Candlestick Trading? Tidak Perlu di Hafal!

Summary

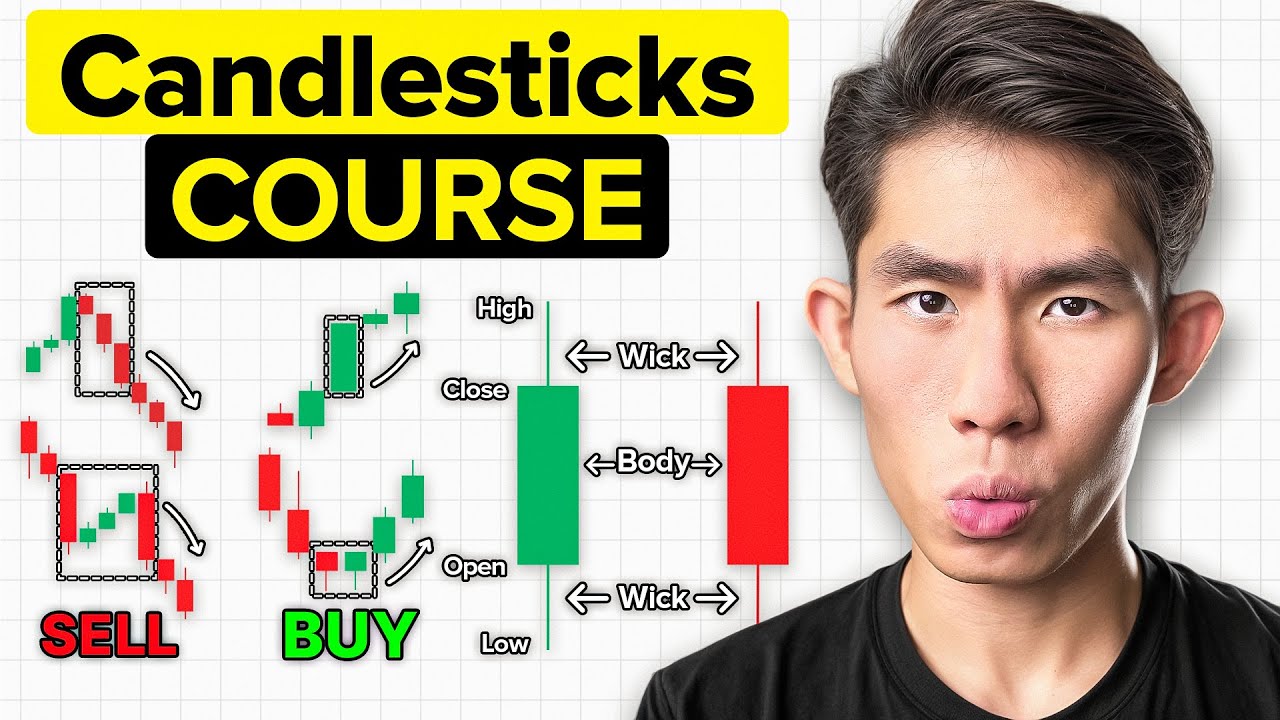

TLDRThis video breaks down the basics of candlestick trading by focusing on understanding the key elements of candlesticks—such as the body, wick, and their relative size—rather than memorizing patterns. The content emphasizes analyzing lower time frames to better interpret candlesticks and make quicker, more informed trading decisions. Through examples of bullish engulfing, hammer candles, and doji patterns, the video illustrates how candlesticks can signal different market conditions. Ultimately, the key message is that understanding candlesticks in context is more effective than rote memorization for successful trading.

Takeaways

- 😀 Candlestick patterns should not be memorized but understood by analyzing their components: body, wick (shadow), and relative sizes.

- 😀 The size of the candlestick body compared to the wick indicates the strength of buyers or sellers in the market.

- 😀 A small wick indicates strong buyer control, while a large wick shows indecision or a conflict between buyers and sellers.

- 😀 Each candlestick is formed from smaller candlesticks on lower timeframes, making it more effective to analyze lower timeframes for a clearer understanding.

- 😀 Candlestick patterns like hammer or bullish engulfing are easier to identify and trade when broken down to lower timeframes, such as H1 or H2.

- 😀 The hammer pattern, a sign of bullish reversal, can be constructed from different candlestick combinations in lower timeframes, such as a large bearish candle followed by a bullish one.

- 😀 Doji candlesticks do not always indicate a trend reversal; they show the formation of support or resistance levels on lower timeframes.

- 😀 A doji that breaks below support signals a continuation of the downtrend, while one that breaks above resistance suggests an uptrend reversal.

- 😀 By focusing on lower timeframes, traders can quickly identify key price actions and entry points, leading to faster and more profitable trades.

- 😀 Memorizing patterns like doji or bullish engulfing is unnecessary; understanding the price action behind them is more effective for successful trading.

Q & A

What are the three key components of a candlestick that traders should focus on?

-The three key components of a candlestick are the body, the wick (or shadow), and the size of the body relative to the wick. These components can help determine the strength and sentiment of the market.

Why is it important to consider the size of the candlestick's body and wick?

-The size of the body and wick provides insight into market sentiment. A small body with a long wick might suggest indecision, while a large body with a small wick indicates strong control by one side (buyers or sellers).

How do candlestick colors (such as green or red) affect their interpretation?

-Candlestick colors can indicate whether the market is bullish (green) or bearish (red), but the interpretation depends on the body and wick size. For example, a green candle with a small wick suggests strong buying pressure, while a red candle with a long wick indicates resistance from sellers.

What is the significance of a 'Doji' candlestick?

-A Doji is a candlestick with a very small body and long wicks, indicating indecision in the market. It often appears at key turning points, but traders should look at the lower timeframes to confirm whether it signals a trend reversal.

How can two candles of the same color, like green, mean different things?

-Two green candles can mean different things depending on the relationship between the body and the wick. A green candle with a small wick suggests strong control by buyers, while a green candle with a long wick indicates that sellers pushed the price down but were overcome by buyers.

Why is it useful to check lower timeframes when analyzing candlestick patterns?

-Checking lower timeframes helps confirm the strength and context of a candlestick pattern. Lower timeframes reveal additional price action that may explain why a pattern formed, offering more accurate and timely entry signals.

What is the process for confirming a 'Bullish Engulfing' pattern in trading?

-To confirm a Bullish Engulfing pattern, you should first identify a key support level on a higher timeframe, such as the daily chart. When the Bullish Engulfing appears at this level, you can enter a buy position. Confirming the pattern on lower timeframes, like the H1, can offer more precise entry points.

How do you differentiate between a real reversal and a false Doji signal?

-While a Doji can indicate a potential reversal, it’s important to confirm its significance by looking at lower timeframes. If a Doji is followed by a break of support or resistance, it may signal a real reversal. Otherwise, it might be a false signal if the price continues in the original direction.

What does the 'Hammer' candlestick pattern signify in trading?

-The Hammer is a candlestick with a small body near the top of the price range and a long lower wick. It typically signifies a potential reversal to the upside, often occurring after a downtrend. It shows that sellers initially drove the price lower but were overpowered by buyers by the end of the trading period.

Why is it not necessary to memorize candlestick patterns to succeed in trading?

-Memorizing candlestick patterns is not essential because patterns can form from different combinations of smaller candles in lower timeframes. Instead of memorizing individual patterns, it's more effective to understand the principles of candlestick behavior and analyze the context in which they appear.

Outlines

此内容仅限付费用户访问。 请升级后访问。

立即升级Mindmap

此内容仅限付费用户访问。 请升级后访问。

立即升级Keywords

此内容仅限付费用户访问。 请升级后访问。

立即升级Highlights

此内容仅限付费用户访问。 请升级后访问。

立即升级Transcripts

此内容仅限付费用户访问。 请升级后访问。

立即升级浏览更多相关视频

الدرس ٥: أسهل طريقة لقراءة الشموع اليابانية

ULTIMATE Candlestick Patterns Trading Guide *EXPERT INSTANTLY*

The ONLY Candlestick Video You’ll EVER Need (Step By Step Guide)

Panduan Candlestick untuk pemula lengkap dan simple

Boot Camp Day 2: Candlesticks

Trading Transformation Day 4: Candlesticks and Timeframes

5.0 / 5 (0 votes)