Почему США никогда не погасят свой Госдолг

Summary

TLDRThe U.S. faces a staggering national debt exceeding $34 trillion, with a growing budget deficit and increasing interest payments on that debt. The government relies on issuing bonds to finance its expenditures, but rising interest rates complicate this further. Inflation may be used as a strategy to reduce the real burden of debt, but it carries risks of economic instability. The script discusses the complexities of U.S. economic policies, suggesting that long-term fiscal responsibility and productivity growth are essential for sustainability. The audience is encouraged to reflect on the challenges and potential solutions for the future.

Takeaways

- 😀 The U.S. national debt has reached $34.8 trillion, with each American citizen responsible for over $100,000 of that debt.

- 😀 The U.S. government has been running a budget deficit for years, where spending consistently exceeds revenues.

- 😀 The U.S. covers its budget shortfall by selling Treasury bonds, which are essentially loans taken from both domestic and foreign investors.

- 😀 Investors in U.S. Treasury bonds include countries like China, Japan, and the U.K., and the U.S. promises to repay these loans with interest.

- 😀 As the debt grows, so does the cost of servicing it, which is becoming an increasingly significant part of the federal budget.

- 😀 Higher interest rates are worsening the situation by increasing the amount the U.S. government must pay in interest on its debt.

- 😀 The U.S. is caught in a 'debt spiral,' where it takes on new loans to pay off old debts, leading to greater financial instability.

- 😀 A potential strategy for managing the debt could be using inflation to reduce the real value of the debt, a method used after World War II.

- 😀 While inflation could make debt easier to manage, it can also destabilize the economy and erode purchasing power if uncontrolled.

- 😀 To address the long-term debt issue, the U.S. must either reduce spending, increase revenue, or a combination of both, though political resistance makes this difficult.

- 😀 Without changes, the U.S. risks economic instability, with rising debt, higher interest payments, and potential social unrest due to the effects of inflation.

Q & A

What is the current U.S. national debt, and how does it compare to the population size?

-The U.S. national debt is currently $34.8 trillion, which means that each American citizen's share of the debt is over $100,000, considering the population of approximately 333 million people.

How does the U.S. government manage its national debt?

-The U.S. government manages its debt by issuing Treasury bonds. Investors, including foreign governments like Japan, China, and the UK, purchase these bonds, effectively lending money to the U.S. government in exchange for interest payments.

What role does the Federal Reserve play in the U.S. debt situation?

-The Federal Reserve, the U.S. central bank, can buy Treasury bonds to inject money into the economy. This process is essentially 'printing money' and is used to support government spending without immediate repayment of debt.

What has been the trend in the U.S. budget deficit over the past two decades?

-Since 2001, the U.S. has experienced a growing budget deficit, with government spending exceeding revenue each year. The country has continuously borrowed money to cover the difference, leading to a steadily increasing national debt.

How has the U.S. government been affected by rising interest rates?

-Rising interest rates increase the cost of servicing the national debt, as U.S. bonds that are maturing must be refinanced at higher rates. This exacerbates the deficit and makes it more difficult for the government to manage its obligations.

What is the concept of inflation as a solution to reduce the debt burden?

-Inflation can help reduce the real value of debt. By allowing inflation to increase, the value of money decreases, making it easier to repay debts with less valuable currency. The U.S. used this approach after WWII to manage its debt load.

What are the risks of using inflation to manage U.S. debt?

-While inflation can reduce the real value of debt, it carries significant risks, including economic instability, social unrest, and potentially the collapse of the currency if inflation becomes uncontrolled.

What is the 'debt spiral' described in the transcript?

-The 'debt spiral' refers to the vicious cycle where the U.S. government borrows more money to cover the increasing interest payments on its debt. This creates more debt and higher interest obligations, making it increasingly difficult to break free from the cycle.

What has been the historical approach of the U.S. to manage its national debt after major crises?

-Historically, the U.S. has managed national debt by using inflation to reduce the real value of the debt, especially after major crises like WWII. This approach involves 'printing money' and allowing inflation to erode the debt burden over time.

What is the long-term strategy suggested for reducing U.S. national debt?

-The long-term strategy for reducing U.S. national debt involves focusing on increasing productivity and cutting unnecessary government spending to create a balanced budget and reduce the need for borrowing.

Outlines

此内容仅限付费用户访问。 请升级后访问。

立即升级Mindmap

此内容仅限付费用户访问。 请升级后访问。

立即升级Keywords

此内容仅限付费用户访问。 请升级后访问。

立即升级Highlights

此内容仅限付费用户访问。 请升级后访问。

立即升级Transcripts

此内容仅限付费用户访问。 请升级后访问。

立即升级浏览更多相关视频

Apresiasi Usai Timnas Juara Piala AFF U-19 2024 - iNews Pagi 01/08

How would you go about solving this? Limit of x/sqrt(x^2+1) as x goes to infinity. Reddit inf/inf

Embedded Linux | Introduction To U-Boot | Beginners

How to Diagnose and Replace Universal Joints (ULTIMATE Guide)

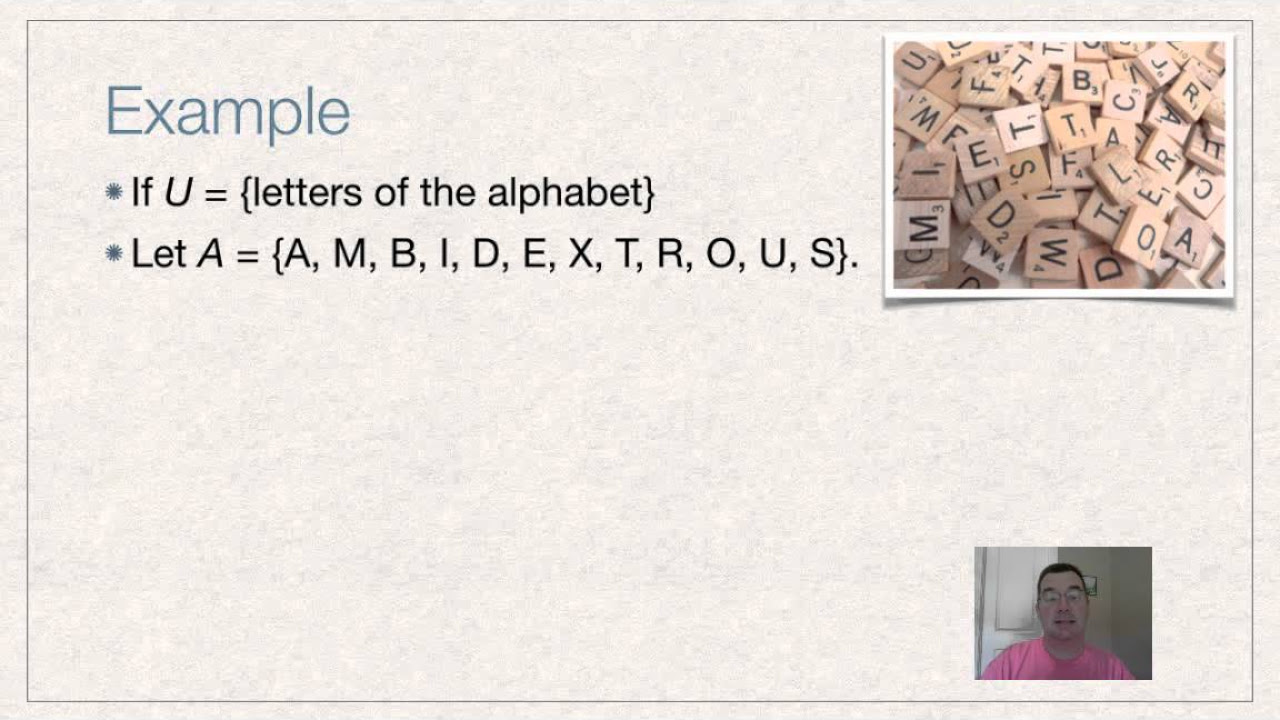

Complements of Sets

Kalah 6-0 dari Korea Utara, Timnas Indonesia U17 Gagal ke Semifinal Piala Asia

TIMNAS INDONESIA U17 KALAH SEGALANYA DARI KORUT DAN TERSINGKIR DARI PIALA ASIA!

5.0 / 5 (0 votes)