FİNANSAL MUHASEBE - Ünite 4 Konu Anlatımı 1

Summary

TLDRThis video focuses on the management of current assets in financial accounting, particularly inventories and their classification. It explains key terms such as stock types, including raw materials and commercial goods, and emphasizes the importance of tracking these assets for a business's financial health. The script outlines the procedures for recording purchases, sales, and inventory adjustments, highlighting the impact of VAT on transactions. It also contrasts continuous and periodic inventory methods, discussing their implications for financial reporting. Overall, the content serves as an essential guide for understanding inventory management within the context of financial accounting.

Takeaways

- 😀 Current assets are essential for a company's financial health, including cash, securities, trade receivables, and inventories.

- 📦 Inventories are classified as raw materials, work-in-progress, finished goods, commercial goods, and other stock types.

- 📊 Accurate tracking of inventories significantly impacts a business's financial position and operational efficiency.

- 💰 VAT (Value Added Tax) is a key factor in purchasing and selling inventories, affecting the overall cost and pricing strategies.

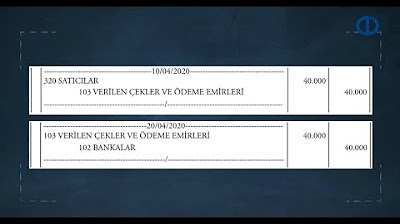

- 📈 Inventory purchases are recorded as debits to the inventory account, while the associated VAT is recorded separately in the VAT account.

- 🧾 When selling inventories, businesses must document revenue in the sales accounts and account for any collected VAT.

- 🔄 Returns of sold goods should reduce sales revenue and be recorded in a separate returns account, reflecting the decrease in income.

- 💵 Discounts offered for early payments are classified as sales discounts and decrease the total recognized revenue.

- 📚 There are two main inventory accounting methods: the continuous system, which records transactions in real-time, and the periodic system, which summarizes transactions at the end of an accounting period.

- ✅ Proper management of inventories and their accounting processes is vital for financial reporting accuracy and compliance with accounting standards.

Q & A

What are current assets, and why are they important in financial accounting?

-Current assets include stocks, cash equivalents, securities, trade receivables, and other receivables. They are crucial because they represent resources that are expected to be converted into cash or consumed within one year, directly affecting a company's financial health.

How are stocks classified in financial accounting?

-Stocks are classified as current assets that are acquired for sale, production, or consumption purposes. They include raw materials, work-in-progress, finished goods, and trading goods that are expected to be used or sold within a year.

What is the significance of inventory tracking for a business?

-Inventory tracking is vital as it directly impacts a business's financial position. Proper management of inventory ensures that a company can meet customer demand while minimizing excess stock and associated holding costs.

What is the role of VAT in inventory transactions?

-Value Added Tax (VAT) is a percentage added to the purchase price of goods and services. During inventory transactions, the VAT paid on purchases is recorded separately, allowing for the deduction of this tax from future sales VAT.

What are the key components of a commercial goods purchase transaction?

-A commercial goods purchase transaction includes the purchase price of goods, VAT incurred, and any additional purchase expenses such as freight or insurance, which are recorded in the accounting books to reflect the total cost.

How is the sale of goods recorded in financial accounts?

-When goods are sold, the sales revenue is recorded in the appropriate sales account, while the cost of goods sold is recorded separately to calculate profit or loss. VAT collected from the buyer is also recorded as a liability.

What happens when a sale is returned?

-When a sale is returned, the corresponding sales revenue must be reduced, and the returned goods are recorded back into inventory. The VAT collected is also adjusted accordingly to reflect the decrease in sales.

What are the two methods for tracking inventory, and how do they differ?

-The two methods for tracking inventory are the perpetual inventory method, which records transactions continuously, and the periodic inventory method, which updates inventory records at the end of a period. The main difference lies in the timing of recording the cost of goods sold.

How is gross profit calculated in relation to sales?

-Gross profit is calculated by subtracting the cost of goods sold from total sales revenue. This figure provides insight into the profitability of a company's core business operations.

What are 'other current assets' and how are they classified?

-Other current assets include items that do not fit neatly into the standard categories of current assets, such as prepaid expenses, advances to suppliers, and miscellaneous receivables. They are recorded separately in the accounting records.

Outlines

此内容仅限付费用户访问。 请升级后访问。

立即升级Mindmap

此内容仅限付费用户访问。 请升级后访问。

立即升级Keywords

此内容仅限付费用户访问。 请升级后访问。

立即升级Highlights

此内容仅限付费用户访问。 请升级后访问。

立即升级Transcripts

此内容仅限付费用户访问。 请升级后访问。

立即升级浏览更多相关视频

FİNANSAL MUHASEBE - Ünite 3 Konu Anlatımı 1

CARA MEMAHAMI PENGERTIAN DAN JENIS AKTIVA || AKUNTANSI DASAR | AKTIVA | HARTA | ASET

AKM I.10. Aset Tidak Berwujud

Calicut University /5th sem Bcom Accounting for management chapter 1/part 1

Property, Plant & Equipment (PPE) in Government Accounting part3 | AFAR

KELOMPOK 4_KARAKTERISTIK DAN TUJUAN SEKTOR PUBLIK_UTS AKUNTANSI SEKTOR PUBLIK

5.0 / 5 (0 votes)