Probability Distribution, Statistics - Algorithmic Trading

Summary

TLDRThis video discusses how the probability distribution curve, commonly used by option traders, can also benefit swing and day traders. By leveraging statistical measures like standard deviation, traders can identify high-probability opportunities. The presenter analyzes historical data from Apple stock and demonstrates how trading decisions can be optimized based on the distribution of percentage changes. He highlights the potential for improved returns using these strategies while noting that different stocks may require customized approaches. The video also provides code for viewers to adapt and implement in their own trading strategies.

Takeaways

- 📊 The probability distribution curve is widely used by options traders to calculate deltas and optimize trading strategies but is underutilized by swing and day traders.

- 📈 The advantage of using a probability distribution curve is that it helps to put the odds in a trader's favor by finding statistical edges in the market.

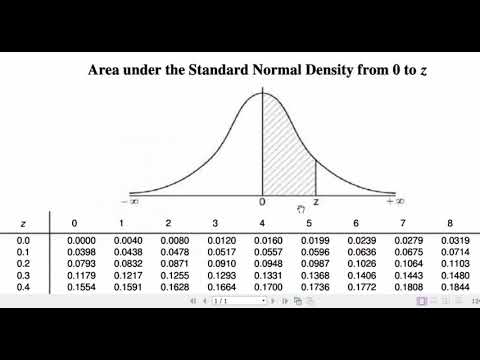

- 👥 The example of human height distribution illustrates the normal distribution curve, where the majority fall within one standard deviation, and extremes lie outside of that range.

- 🍏 The speaker analyzed Apple stock data from 2018 to demonstrate how percentage changes follow a normal distribution curve, with most trades centered around 0% change.

- 🔍 By focusing on extreme values (5% or more), the speaker identifies potential trading opportunities where market movements are rare but statistically favorable.

- 📉 After a 5% market decline, the speaker sees an entry opportunity due to the low probability of further decline and a high chance of a rebound beyond the two standard deviation mark.

- 📈 Trading strategies need to be tailored to each stock, as different stocks (like Apple vs Microsoft) will have varying performance when using a 5% threshold.

- 💡 The speaker recommends using custom strategies that involve statistical measures, rather than random trades, to increase success in swing or day trading.

- 💻 Python and software tools are used to analyze historical data and create strategies, and the speaker offers code for others to tweak for specific stocks.

- 📉 Exit strategies and managing drawdowns are crucial, as the performance of a strategy can vary significantly across different stocks and markets.

Q & A

What is a probability distribution curve, and how is it used in trading?

-A probability distribution curve shows how data points, such as stock prices, are distributed. Option traders use it to calculate deltas and make decisions on buying or selling options based on statistical probabilities, but it's underutilized by swing and day traders.

How can the probability distribution curve give traders a statistical edge?

-By analyzing historical stock price data, traders can identify statistically significant opportunities, such as price movements outside one or two standard deviations. This increases the odds of making profitable trades by trading with the statistical edge in their favor.

Why does the speaker believe swing and day traders are missing out by not using the probability distribution curve?

-The speaker believes swing and day traders miss out because they don't leverage the statistical insights the curve offers, such as identifying trades with a higher probability of success based on historical data. This method provides a clearer statistical advantage.

How is the normal distribution curve applied to stock trading?

-The normal distribution curve can be applied to stock trading by analyzing stock returns over a period. For example, calculating the percentage change in stock prices, identifying averages, and understanding where outlier events (like significant price drops or gains) occur allows traders to predict future moves.

Why does the speaker focus on the 5% threshold for trading strategies?

-The speaker identifies that trades below a 5% decline are rare but offer significant opportunities for gains, as the probability of price recovery after such a decline is statistically higher. This 5% threshold is based on analysis of Apple stock, but it varies between stocks.

What role does coding in TradingView’s Pine Script play in the strategy discussed?

-The speaker uses Pine Script to code a strategy based on entering trades after a 5% decline. This automation allows for testing the strategy and analyzing performance metrics like profitability and drawdown in real-time for different stocks.

Why does the strategy work well with Apple stock but not as well with Microsoft?

-The strategy is based on data from Apple, where a 5% decline represents a statistically significant move outside two standard deviations. However, for Microsoft, the same 5% threshold may not hold the same significance, requiring different thresholds for optimal performance.

What challenges do traders face when applying the probability distribution strategy across different stocks?

-Traders need to manually calculate the appropriate percentage threshold (like 5% for Apple) for each stock, as the standard deviation and volatility vary between stocks. This process can be time-consuming and requires significant data analysis for accuracy.

How does the speaker suggest improving stock-specific strategies?

-The speaker suggests using a derivative of the average true range (ATR) rather than the ATR itself to account for daily price fluctuations and develop more accurate thresholds for different stocks, which results in higher returns with lower drawdowns.

What is the main advantage of option traders using probability and statistics compared to day traders and swing traders?

-Option traders typically have a statistical advantage because they calculate their risks and probabilities using the probability distribution curve, while day and swing traders often trade based on subjective decisions without considering these statistics, leading to less consistent outcomes.

Outlines

此内容仅限付费用户访问。 请升级后访问。

立即升级Mindmap

此内容仅限付费用户访问。 请升级后访问。

立即升级Keywords

此内容仅限付费用户访问。 请升级后访问。

立即升级Highlights

此内容仅限付费用户访问。 请升级后访问。

立即升级Transcripts

此内容仅限付费用户访问。 请升级后访问。

立即升级浏览更多相关视频

The ONLY Way to Trade Reversals and Retracements (That Actually Works)

Aligning Time Frames Is What You Are MISSING

Liquidity Concepts Explained: BEST Strategies Revealed

How Smart Money Moves the Market (And How You Can Follow It)

Peluang Distribusi NORMAL beserta Contoh Soal Pembahasan

How to Use Pivots for Profitable Trading | Day Trading Secrets

5.0 / 5 (0 votes)