Why The U.S. Won’t Pay Down Its Debt

Summary

TLDRAs of early September 2023, the US national debt reached nearly $33 trillion, with about $25.7 trillion held by the public. The national debt serves as an accounting record of government economic activity. While debt can be useful for emergencies and investments, concerns arise when it's used for immediate consumption without long-term benefits. The debt-to-GDP ratio, nearing 100%, indicates the economy's ability to service the debt. The Federal Reserve's interest rate hikes affect debt servicing costs, with the government paying $475 billion in interest in 2022. The script discusses the balance between the benefits of debt for initiatives and crises response versus the potential burden on future generations.

Takeaways

- 💼 As of early September 2023, the US national debt was nearly $33 trillion.

- 🔄 Of this amount, approximately $7 trillion was intragovernmental debt, meaning the government owes it to itself.

- 🌐 The majority, about $25.7 trillion, was public debt held by entities outside the government.

- 💡 The national debt is an accounting record that tracks the government's financial transactions with the broader economy.

- 🚨 The national debt increased by nearly 90% since the beginning of the pandemic, highlighting its use in emergencies.

- 📈 Many warn that the expanding national debt can harm the economy if not managed properly.

- 💹 The US economy has the resources to reduce the debt or halt its increase, but it requires political will.

- 💵 The US issues government securities like Treasury bonds, notes, and bills when it borrows money.

- 🌍 US Treasury debt is considered a safe asset, attracting global investors due to the US dollar's status as the world's reserve currency.

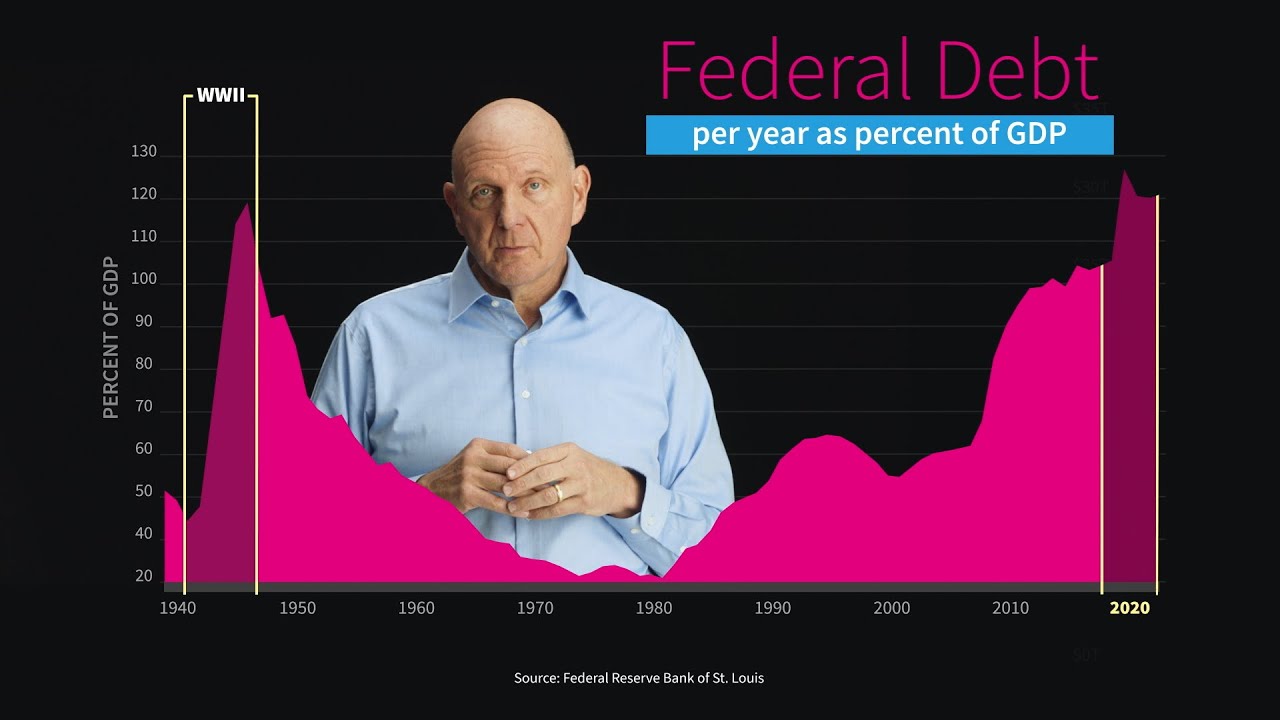

- 📊 The debt-to-GDP ratio is crucial as it indicates the economy's ability to service the debt; the US is nearing 100%, which is higher than the stability threshold of around 70%.

- 🏦 The Federal Reserve's interest rate hikes since March 2022 affect the cost of servicing the national debt, with the government paying $475 billion in interest in 2022 alone.

Q & A

What was the US national debt as of early September 2023?

-The US national debt was nearly $33 trillion as of early September 2023.

What is the difference between intragovernmental debt and public debt?

-Intragovernmental debt refers to the portion of the national debt that the government owes to itself, which was about $7 trillion. Public debt, on the other hand, is the majority of the debt, approximately $25.7 trillion, held by entities outside the government, such as individuals, corporations, and foreign governments.

Why is there no need for the national debt to be zero?

-Debt serves useful purposes, such as financing emergencies, and it is not necessary for it to be zero. The national debt is an accounting record of the government's financial transactions with the broader economy.

How did the national debt increase during the pandemic?

-The national debt increased by nearly 90% since the beginning of the pandemic, likely due to government spending to support the economy and citizens during the crisis.

What factors should be considered when evaluating the sustainability of national debt?

-The sustainability of national debt should be evaluated based on the interest rate on borrowing and the growth rate of the economy. If the economic growth rate is faster than the interest rate, the debt is more sustainable.

Why is the US dollar considered a reserve currency, and what does this mean for US treasuries?

-The US dollar is considered a reserve currency because of its stability and widespread use in global trade and finance. This means that many entities around the world want to own US treasuries, which are seen as safe and secure investments.

What is the significance of the debt to GDP ratio, and what is the current ratio for the US?

-The debt to GDP ratio is significant because it shows the ability of an economy to service its debt. The US is almost at a 100% debt to GDP ratio, which is higher than the stability threshold of around 70%.

How does an increase in interest rates affect the cost of servicing the national debt?

-As interest rates rise, the cost of servicing the national debt increases because the government has to pay more interest on its past debt. This can lead to higher net interest payments.

What are the potential consequences of borrowing for immediate consumption without long-term benefits?

-Borrowing for immediate consumption without long-term benefits can deteriorate the financial or fiscal future of a borrower, whether it's an individual, business, or government, as it does not contribute to long-term growth or stability.

How does the federal government's approach to debt differ from that of a household budget?

-The federal government's budget does not work like a household budget because the government can create money and has the ability to tax, which means it is not constrained in the same way a household is when it comes to managing debt.

What is the role of debt in financing large initiatives and crises, and how should it be managed?

-Debt can be used to finance large initiatives like infrastructure and to address crises such as pandemics. However, it should be managed carefully by monitoring the debt to GDP ratio to ensure that the debt is serviceable and does not jeopardize the economy's stability.

Outlines

此内容仅限付费用户访问。 请升级后访问。

立即升级Mindmap

此内容仅限付费用户访问。 请升级后访问。

立即升级Keywords

此内容仅限付费用户访问。 请升级后访问。

立即升级Highlights

此内容仅限付费用户访问。 请升级后访问。

立即升级Transcripts

此内容仅限付费用户访问。 请升级后访问。

立即升级浏览更多相关视频

Mengapa Pemerintah Ga Cetak Uang Sendiri Buat Bayar Utang?

Membedah Utang Negara Indonesia

Defisit APBN Melebar Per-Agustus 2024 - [Metro Siang]

Hutang Pemerintah Terhitung Naik Per Juli 2024 - [Zona Bisnis]

Just the Facts About the US Federal Budget: Steve Ballmer Talks Through the Numbers

🚨 URGENT: JAPAN TO SELL U.S. BONDS SOON?!?

5.0 / 5 (0 votes)