The most powerful way to think about money | Paula Pant

Summary

TLDRPaula Pant from the 'Afford Anything Podcast' emphasizes the importance of critical thinking in personal finance, advocating for financial independence through smarter money management. She explains that choices involve trade-offs and encourages viewers to align their financial strategies with their values and life philosophy. Pant outlines three steps to financial independence: grow the income-spend gap, invest the gap, and repeat the process. She also highlights the psychological comfort of saving and the freedom that financial independence provides to pursue various life choices.

Takeaways

- 🔑 Every decision involves trade-offs, emphasizing the importance of critical thinking in financial choices.

- 💰 Money is a tool that teaches you about priorities and the limits of what you can have.

- 🏠 Valuing something doesn't guarantee endless acquisition; choices must be made between different desires.

- ⏰ Time, focus, energy, and attention are all limited resources, just like money, and should be managed wisely.

- 💡 Life itself is a limited resource, making the management of money akin to managing life effectively.

- 📢 Paula Pant, host of the 'Afford Anything Podcast,' aims to guide people towards financial independence through smart money decisions.

- 🌱 The common mistake in personal finance is focusing on products or tactics without understanding the underlying principles.

- 🌳 First-principles thinking involves understanding the foundational values and philosophy that guide financial decisions.

- 🎯 Financial independence (FI) is defined as having passive income cover basic living expenses, leading to freedom and choice.

- 🌐 The three steps to achieve financial independence are: grow the income-spend gap, invest the gap, and repeat the process.

- 💼 Increasing income or reducing spending are the primary methods to grow the income-spend gap, depending on individual circumstances.

- 💹 A minimum savings and investment goal of 20% of income is suggested, with incremental increases if necessary.

- 🔄 Financial management is a lifelong practice, not a quick fix, requiring consistent effort and adaptation.

Q & A

What is the main idea behind the statement 'Money is an invitation to critical thinking.'?

-The statement suggests that managing money requires one to think critically about their choices, trade-offs, and values, as financial decisions often involve complex considerations of what is truly important to an individual.

What does Paula Pant mean by 'You can afford anything, but not everything.'?

-Paula Pant is emphasizing that while one may have the financial means to buy any single item or experience, it's impossible to afford all desires simultaneously due to the finite nature of resources like time, money, and energy.

How does the concept of 'endless series of ands' relate to financial management?

-The 'endless series of ands' illustrates the idea that one cannot pursue every desire or goal at the same time. It encourages prioritization and understanding the limitations of resources, which is a key aspect of financial management.

What is the significance of the 'tree' analogy used by Paula Pant?

-The 'tree' analogy is used to explain the hierarchy of financial planning, where the roots represent values, the trunk is the philosophy of life, the branches are strategies, and the leaves are tactics and products. It suggests a bottom-up approach to financial planning, starting with core values.

What is the definition of 'first-principles thinking' as mentioned in the script?

-First-principles thinking is the process of breaking down a problem to its most fundamental elements or truths and reasoning from there. In the context of the script, it means focusing on the foundational values and principles that guide financial decisions.

How does financial independence (FI) differ from the traditional concept of delayed gratification?

-Financial independence is reframed as a path to freedom, opportunity, and choice, rather than simply delaying gratification until old age. It's about having enough passive income to cover basic needs, which allows for a wide range of life choices without financial stress.

What is the point of achieving financial independence according to the script?

-Achieving financial independence means reaching a state where one's passive income can cover basic living expenses, providing the freedom to pursue various life choices without worrying about meeting financial obligations.

What are the three steps to achieving financial independence as outlined in the script?

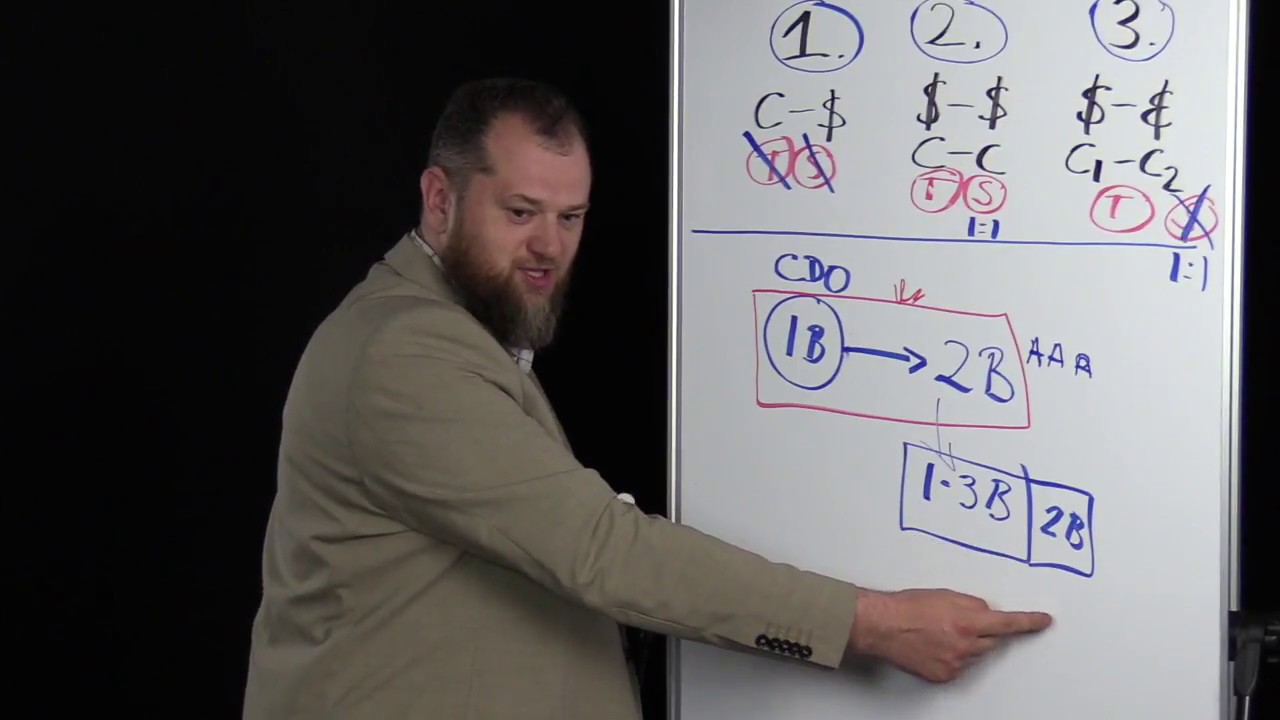

-The three steps are: 1) Grow the gap between earnings and spending, 2) Invest the gap, and 3) Repeat the process. This involves increasing income, reducing spending, saving and investing a significant portion of income, and maintaining these practices over a lifetime.

Why is it suggested to aim for saving and investing at least 20% of one's income?

-Saving and investing at least 20% of income is recommended as a solid target for building wealth and achieving financial independence. It includes not only retirement savings and investments but also paying off debt and building an emergency fund.

How does the script relate historical volatility to the pursuit of financial independence?

-The script suggests that historical volatility, such as pandemics and wars, is a constant in the world's history. Embracing the fear of uncertainty and using it as motivation to make wise financial decisions can lead to a more intentional and joyful life.

What role does fear play in the context of the script when it comes to managing personal finances?

-Fear, when acknowledged and channeled positively, can serve as a powerful motivator for making prudent financial decisions. It can drive individuals to save more and spend wisely, leading to a sense of security and intentional living.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

How Much Money Do You REALLY Need?

O melhor resumo [PAI RICO PAI POBRE] as 5 lições do livro

Wisdom behind Prohibition of Riba (interest) - Case study GFC | Almir Colan

Introduction to Financial Management【Dr. Deric】

#Part-4_Framing Digital Content's Prompts // Chat GPT prompt Engineering in Hindi complete course

One Life-Changing Class You Never Took: Alexa von Tobel at TEDxWallStreet

5.0 / 5 (0 votes)