比特幣暴漲的真正原因居然是… #btc #降息 #美元

Summary

TLDRThe video script discusses the potential for a cryptocurrency market boom driven by Trump's support and his likely presidency. It highlights Trump's embrace of crypto, his campaign strategy to win crypto voters, and the role of crypto as a new 'reservoir' for excess money, replacing traditional assets like gold and stocks.

Takeaways

- 😀 The speaker believes the cryptocurrency market is warming up and will experience a significant boom in the second half of the year.

- 🇺🇸 The first reason for the expected boom is the support of Donald Trump for cryptocurrencies, and the likelihood of his presidency.

- 🔑 The second, less obvious reason for the market optimism is related to the U.S. dollar's hegemony and its need for a 'reservoir' to absorb excess liquidity.

- 🔑🔫 Trump's near-assassination incident is mentioned as a pivotal event that, paradoxically, boosted Bitcoin's price due to his resilient image and subsequent support from figures like Elon Musk.

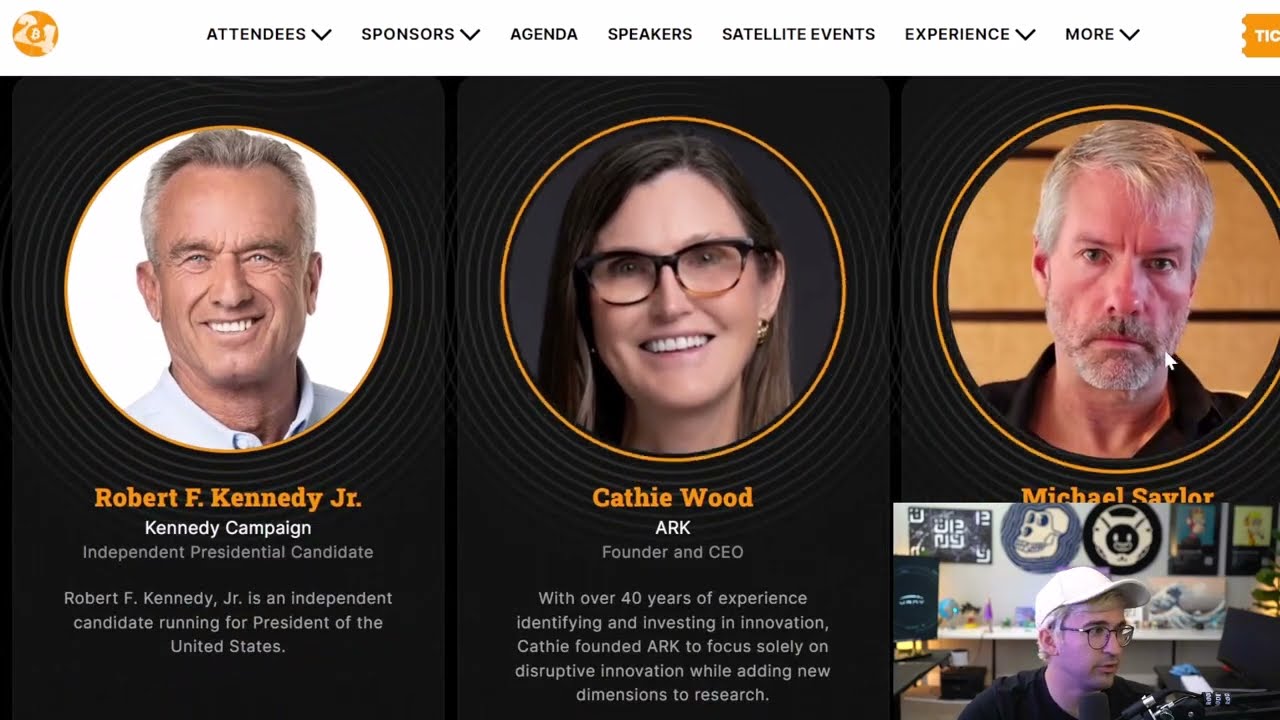

- 💡 Trump's campaign strategy includes actively embracing the crypto community, promising to keep crypto development in the U.S., and accepting crypto donations for his campaign.

- 🌱 The vice-presidential candidate, referred to as 'Old Leeks', has a history of supporting cryptocurrency, including holding Bitcoin and engaging in crypto-friendly legal battles.

- 💰 The speaker suggests that the U.S. is positioning cryptocurrency as the next 'reservoir' for excess dollars, following the limitations of the U.S. Treasury and stock markets.

- 📉 The U.S. Treasury and stock markets are viewed as unsustainable reservoirs for the printed dollars due to their size and potential for collapse.

- 🚀 The script implies that if Trump is elected, the crypto industry will flourish under his administration, as he and his team are perceived as crypto-friendly.

- 💡 The script also highlights the actions of industry leaders, such as A16Z and the Winklevoss twins, who are supporting Trump, indicating a belief in a pro-crypto political environment.

- 📈 The speaker forecasts that the market will be driven by Trump's rhetoric pre-election and then by the Federal Reserve's monetary policy post-election, leading to an influx of funds into the crypto market.

Q & A

What is the main reason suggested for the potential rise in cryptocurrency prices in the second half of the year?

-The main reason suggested is the support from Donald Trump, who is likely to become president, and his positive stance towards cryptocurrencies.

How does the script suggest Trump's support for cryptocurrencies is demonstrated?

-It is demonstrated through his campaign strategy to embrace crypto voters, his acceptance of cryptocurrency donations, and his past actions such as issuing his own NFTs.

What significant event is mentioned in the script that influenced Bitcoin's price positively?

-The assassination attempt on Trump, which he survived, is mentioned as an event that positively influenced Bitcoin's price due to his perceived resilience and the subsequent public support.

What is the role of the U.S. dollar in global trade and how does it relate to the script's discussion on cryptocurrency?

-The U.S. dollar is the primary currency used for global trade due to its historical stability and the U.S.'s economic strength. The script suggests that cryptocurrencies could become a new 'pool' for the excess dollars, similar to how U.S. Treasuries and stocks have served as 'reservoirs' in the past.

Why is the script suggesting that the U.S. might favor cryptocurrencies as a new 'reservoir' for excess money?

-The script suggests that traditional reservoirs like U.S. Treasuries and stocks might be reaching their limits, and cryptocurrencies could serve as a new, flexible, and controllable reservoir that can absorb excess money without directly impacting the U.S. economy.

What is the significance of the U.S. Treasury's role as a 'reservoir' according to the script?

-The U.S. Treasury has historically served as a 'reservoir' to absorb excess money, preventing inflation. However, the script suggests that the current size of the U.S. debt might be nearing a critical point, making cryptocurrencies a more attractive alternative.

How does the script describe the potential impact of Trump's presidency on the cryptocurrency industry?

-The script describes a scenario where Trump's presidency would be highly favorable to the cryptocurrency industry, with policies that support and regulate the industry in a way that could lead to significant growth.

What are the two main reasons provided in the script for the optimism about the cryptocurrency market?

-The two main reasons are Trump's support and potential presidency, and the need for a new 'reservoir' for the U.S. dollar, which cryptocurrencies could fulfill.

What is the significance of the script's mention of the U.S. stock market as a 'reservoir'?

-The U.S. stock market has traditionally been a place where excess money is invested, helping to stabilize the currency. However, the script suggests that the cryptocurrency market could become a new, more flexible 'reservoir'.

How does the script suggest the cryptocurrency market could benefit from the actions of major players like A16Z and the Winklevoss twins?

-The script suggests that the support and investments from major players like A16Z and the Winklevoss twins could boost the credibility and stability of the cryptocurrency market, potentially leading to increased investment and growth.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

🌍 CHUTES CRYPTOS : L'impact de la GUERRE économique de TRUMP (IMPORTANT)

BIZ ADDA | ट्रंप की जीत से बाजार को क्या फायदा? | BIZ Tak

2025 01 21 16 07 58

THIS WEEK IS HUGE FOR CRYPTO

UNFASSBAR! DIESE SACHE IST ABSOLUT ENTSCHEIDEND!!! [Macht Trump DAS wirklich???!]

A Once in a Lifetime Financial Event Is Here

5.0 / 5 (0 votes)