Overview of the forthcoming IFRS Accounting Standard—IFRS 18

Summary

TLDRThis webcast introduces IFRS 18, an upcoming standard for financial reporting, focusing on improved communication and comparability. It will introduce new subtotals, require disclosure of management-defined performance measures, and enhance guidance on information grouping. Aimed at better decision-making, it will be effective from January 2027, with early adoption possible. The IASB will provide resources and webcasts for stakeholders to prepare.

Takeaways

- 📊 IFRS 18 is a forthcoming accounting standard aimed at improving financial reporting through better presentation and disclosure in financial statements.

- 🚁 The standard addresses investors' demands for clearer information on companies' financial performance to facilitate better decision-making.

- 🔑 It introduces three main sets of new requirements to enhance the comparability, transparency, and usefulness of financial information.

- 📈 The first requirement standardizes the structure of the statement of profit or loss by defining new subtotals such as 'operating profit' and 'profit before financing and income taxes'.

- 📝 The second requirement mandates the disclosure of non-GAAP measures, termed as 'management-defined performance measures' (MPMs), in a single note to the financial statements.

- 🏦 For entities with specified main business activities like banks and insurers, IFRS 18 includes specific guidance on classifying income and expenses in the operating category.

- 🔗 MPMs must be reconciled to the most directly comparable subtotal or total defined by IFRS Accounting Standards, enhancing investor understanding.

- 📋 The third requirement focuses on aggregation and disaggregation, ensuring that material information is not obscured and is presented in a structured manner.

- 🗓️ IFRS 18 is set to be launched in April 2024, with an effective date of January 1, 2027, allowing companies ample time to prepare for the transition.

- 📘 The IASB will replace IAS 1 with IFRS 18, which includes new presentation and disclosure requirements without altering the recognition and measurement of financial statement items.

- 🛠️ Tools and resources, including webcasts and social media updates, will be made available to stakeholders to assist with the preparation for the new standard.

Q & A

What is the main purpose of IFRS 18?

-IFRS 18 aims to improve financial reporting by providing better information for decision-making, enhancing the communication of financial performance, and making it easier for investors to analyze and compare companies' performance.

Who are the primary stakeholders affected by IFRS 18?

-All stakeholders in the IFRS Accounting Standards ecosystem will be affected by IFRS 18, including investors, companies, auditors, and regulators.

What are the three key sets of new requirements introduced by IFRS 18?

-The three key sets of new requirements are: 1) structuring the statement of profit or loss with new defined subtotals, 2) disclosure of management-defined performance measures in a single note to the financial statements, and 3) enhanced guidance on aggregation and disaggregation of information in financial statements.

What is the effective date for IFRS 18?

-The effective date for IFRS 18 is January 1, 2027, with an option for companies to apply it earlier.

What is the significance of the operating profit subtotal in the context of IFRS 18?

-The operating profit subtotal, as defined by IFRS 18, will provide a consistent and comprehensive starting point for investors' analysis, making it easier to compare performance between companies.

How does IFRS 18 address the use of non-GAAP measures by companies?

-IFRS 18 requires companies to disclose information about certain non-GAAP measures, known as management-defined performance measures (MPMs), in a single note to the financial statements, subjecting them to audit and increasing transparency.

What are the categories defined in the statement of profit or loss under IFRS 18?

-IFRS 18 defines three new categories in the statement of profit or loss: operating, investing, and financing, along with two new required subtotals: operating profit and profit before financing and income taxes.

How does IFRS 18 handle companies with specified main business activities like banks and insurers?

-For companies with specified main business activities, IFRS 18 includes requirements to classify income and expenses in the operating category that would otherwise be classified in the investing or financing categories, ensuring a clear presentation of key performance metrics.

What are the key disclosures required for management-defined performance measures under IFRS 18?

-Key disclosures for MPMs include reconciliation to the most directly comparable subtotal or total defined in IFRS Accounting Standards, explanations of why each MPM is reported, how it is calculated, and any changes reported must be explained.

What guidance does IFRS 18 provide regarding the grouping of information in financial statements?

-IFRS 18 enhances requirements for grouping information, including presenting and disclosing operating expenses, determining whether information should be presented in the primary financial statements or disclosed in the notes, and providing meaningful labels and disclosures for items labelled as 'other'.

What resources will be available for stakeholders to prepare for IFRS 18?

-Once IFRS 18 is released, the standard and accompanying material will be published on the IASB's website, along with a series of webcasts that delve deeper into the key new requirements, and updates will be shared through social media channels.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Implementing IFRS 19—Insights from global preparers

Hans Hoogervorst: IFRS Standards as enlightened self-interest

Conceptual Framework for Financial Reporting 2018 (IFRS Framework) - still applies in 2024

Accounting Intermediate - Kieso : Chapter 1 (Financial Reporting & Accounting Standards)

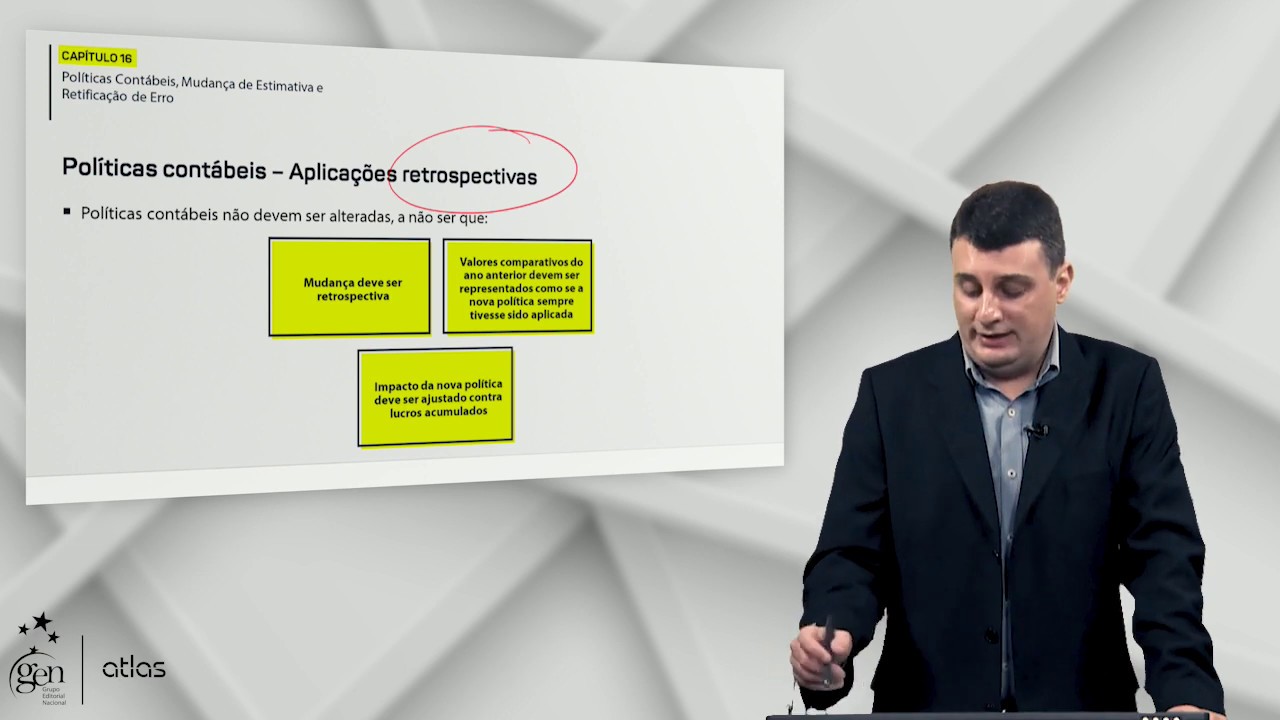

Políticas Contábeis, Mudança de Estimativa e Retificação de Erro | Contabilidade Avançada | 2ª ed.

IAS 7 Statement of Cash Flows: Summary - applies in 2025

5.0 / 5 (0 votes)