Super Easy ICT Trading Strategy 5m

Summary

TLDRThis video outlines a simple trading strategy focusing on the first available trade post 7:00 a.m. UTC, emphasizing risk management. It details the importance of identifying fair value gaps coinciding with support or resistance levels for entry points, aiming for a 2:1 risk-reward ratio, and adjusting stops to break-even upon reaching a 1:1 risk. The presenter advises against trading post 5:00 p.m. UTC due to reduced liquidity and shares examples to illustrate the strategy's application, while cautioning about the influence of news on price movements.

Takeaways

- 📈 Trading involves risk and most traders lose money, so it's crucial to have good risk management in place.

- ⏰ The strategy focuses on taking the first available trade after 7:00 a.m. UTC plus one time and avoiding subsequent opportunities to maintain higher odds of success.

- 📊 To identify potential trades, plot the previous daily high and low on the chart, either manually or using an indicator.

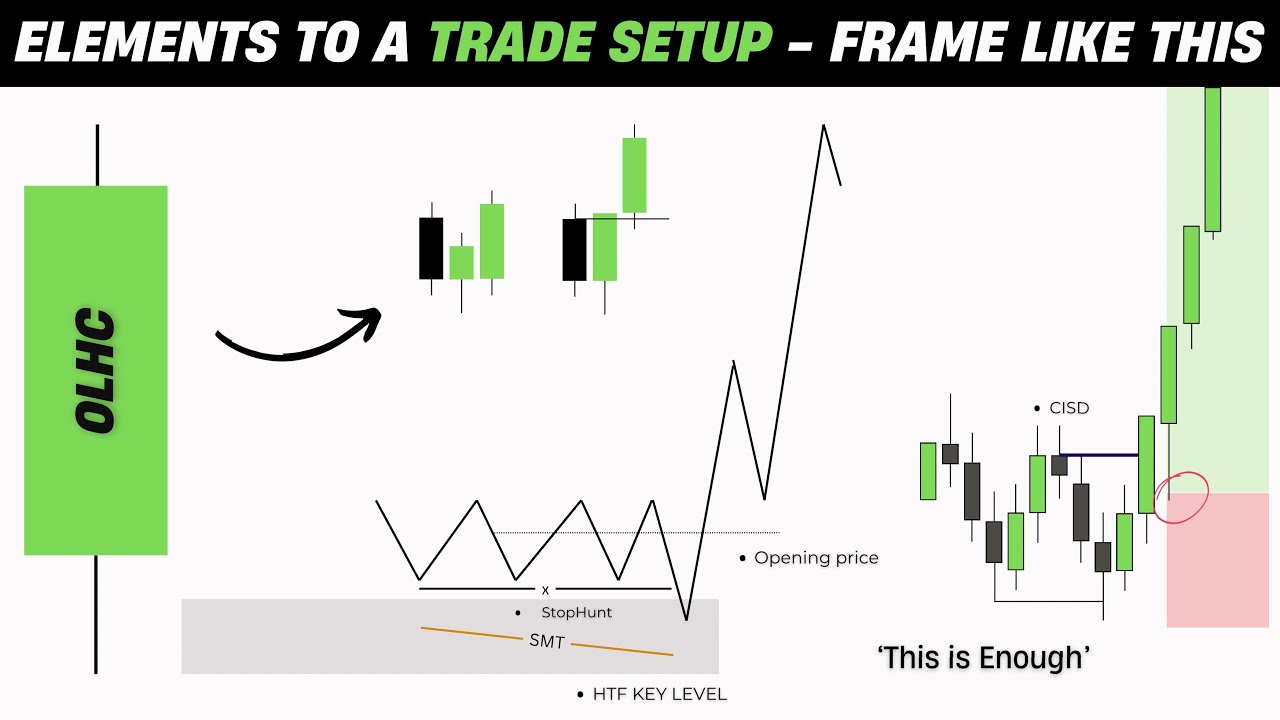

- 🔍 Look for a 'fair value gap' which occurs when there is no overlap between the top of one candle and the bottom of the next, indicating a potential area for price action.

- 🚫 Avoid taking trades that occur too late in the day, specifically after 5:00 UTC plus one, as volume dries up and the chance of hitting the profit target decreases.

- 🔄 The strategy involves taking trades when the price breaks through the previous daily high or low and then comes back within the fair value gap.

- 🎯 Prefer fair value gaps that coincide with additional support or resistance levels, such as the previous daily high or low, for stronger trade setups.

- 💰 Use a 2:1 risk-to-reward ratio for trades, and if the trade reaches a 1:1 risk level, move the stop to break even to secure profits.

- 📉 In cases where the price breaks through a level but doesn't provide a fair value gap, or if the gap is too small or weak, it's safer to avoid the trade.

- 📝 It's important to monitor trades closely and adjust stop-loss orders to break even when the trade is at risk of losing the initial investment.

- 🛑 The presenter emphasizes the importance of sticking to the rules, as no trading strategy has a 100% win rate, and encourages viewers to do their own research and potentially adapt the strategy to their preferences.

Q & A

What is the main topic of the video script?

-The main topic of the video script is a simple trading strategy that can be implemented by viewers, with a focus on risk management and specific rules for identifying trades.

Why does the speaker emphasize the importance of risk management in trading?

-The speaker emphasizes risk management because trading is inherently risky, and most traders lose money. Good risk management is crucial to minimize losses and protect the trader's capital.

What is the first rule of the trading strategy discussed in the script?

-The first rule is to only take the first available trade after 7:00 a.m. UTC plus one time, and not to take subsequent opportunities as the odds of success decrease with each passing opportunity.

How does the speaker define a 'fair value gap' in the context of trading?

-A 'fair value gap' is defined as a gap created between two candles when the top of one candle and the bottom of the next do not overlap, indicating a potential area for price to bounce or reverse.

What is the significance of the previous daily high and low in the trading strategy?

-The previous daily high and low are significant because they serve as reference points for identifying potential trade entries and exits. They also provide additional support or resistance levels that can validate trade setups.

What is the recommended risk-to-reward ratio for this trading strategy?

-The recommended risk-to-reward ratio for this trading strategy is 2:1, meaning for every unit of risk, the trader aims to gain two units of profit.

What should a trader do if the trade reaches a 1:1 risk-to-reward ratio?

-If the trade reaches a 1:1 risk-to-reward ratio, the trader should move their stop-loss order to break-even, ensuring that they will not lose money on the trade if the market moves against them.

Why is it not advisable to take trades after 5:00 UTC plus one time according to the script?

-It is not advisable to take trades after 5:00 UTC plus one time because the volume in the market tends to dry up later in the day, reducing the likelihood of the price reaching the profit target.

What is the importance of the 'retest' in the context of the trading strategy?

-A 'retest' is important because it provides a second opportunity to enter a trade after the price has broken through a significant level (like the previous daily high or low) and then returns to test that level again, potentially offering a safer entry point.

How does the speaker suggest handling trades that result in a loss?

-The speaker suggests sticking to the rules of risk management, such as moving the stop-loss to break-even at a 1:1 risk-to-reward ratio if the trade moves against the trader, and accepting that not all trades will be winners.

What does the speaker mean by 'cherry picking' trades?

-Cherry picking refers to the practice of selectively choosing only the most favorable or successful trades to showcase, often ignoring or not discussing the less successful ones. The speaker clarifies that they did not cherry pick the trades in the script.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

ICT Forex - The ICT New York Killzone

Simple 1 Minute Scalping Strategy To Make $300/Day (Backtesting REAL Results)

How a Simple Candles Strategy Achieved a 90% Win Rate With 7-Year Automated Backtest

ICT Concepts - Elements To A Trade Setup

BEST 5 Minute Crypto Scalping Strategy (Simple)

EASIEST ICT Trading Strategy (77% Win Rate)

5.0 / 5 (0 votes)