Unlocking the Power of Ainstein AI for Finance 🚀

Summary

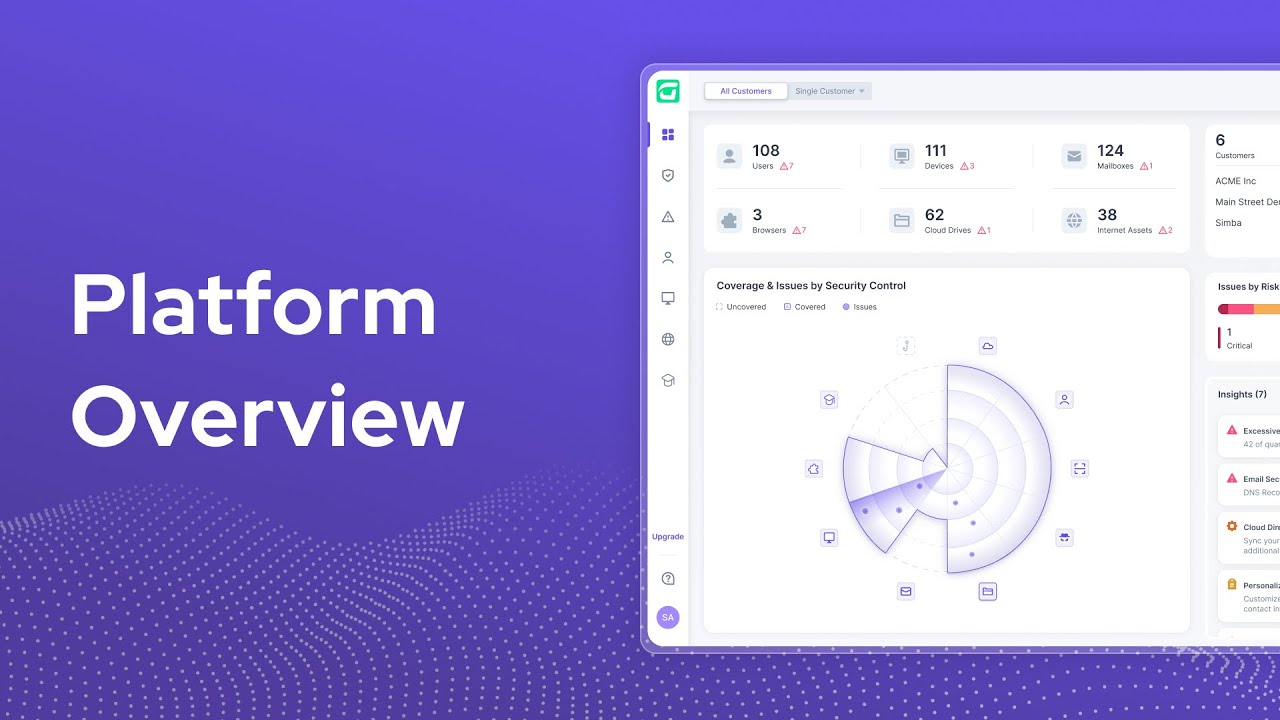

TLDREinstein AI Advisor is an advanced, fully autonomous AI platform tailored for finance, offering customizable tools for portfolio risk management, investment analysis, and research. It utilizes a specialized Small Language Model (SLM) to provide real-time analytics and integrates with enterprise LLMs like Claude and GPT for voice-based interactions. Advisors and investors can use the system to monitor portfolios, receive risk insights, and explore investment opportunities through voice-driven commands. It enhances productivity, especially for buy-side, sell-side analysts, and self-directed investors, while ensuring human oversight in the decision-making process.

Takeaways

- 😀 Einstein AI is an autonomous, customizable AI platform specifically designed for the finance sector, with 10 years of development involving a team from MIT.

- 😀 The platform uses its own Small Language Model (SLM) and integrates with Claude and GPT Mini for voice interactions, ensuring compartmentalized data and accurate analytics.

- 😀 One of the key features is the portfolio risk checkup screen, which helps advisers monitor and manage client portfolios by identifying and addressing any risk issues in the background.

- 😀 The platform's cube tool provides a 3D, customizable decision-making environment, enabling advisers to analyze portfolios based on their unique preferences and risk ratings.

- 😀 Voice interactivity allows advisers to engage with the system, ask questions, and receive feedback, although all actions still require human initiation, keeping the adviser in control.

- 😀 The system allows advisers to manage multiple portfolios for a single client through a householding function, enabling an overall view of a client's financial situation.

- 😀 The platform includes a quintile-based risk rating system, but users can incorporate their own customizable factors for portfolio analysis, providing flexibility in asset management.

- 😀 The AI agent suggests buy and sell actions but never takes action autonomously; human approval is required for all transactions, ensuring that advisers maintain full control.

- 😀 A range of analytical tools is available for security analysis, including detailed ETF and mutual fund modules, allowing advisers to perform deep research on individual securities.

- 😀 For portfolio managers and securities analysts, the platform integrates various data sources, such as earnings reports, trading ranges, and valuation metrics, to create comprehensive research reports efficiently.

- 😀 The platform supports real-time analysis across 30,000 global securities and offers a customizable engine that adapts to different investment methodologies, allowing for continuous, up-to-date research and insights.

Q & A

What is Einstein AI's platform primarily designed for?

-Einstein AI's platform is designed for various applications within the finance vertical, offering customizable and autonomous tools for portfolio management, risk assessment, and research, mainly aimed at financial advisors, self-directed investors, and analysts.

How does Einstein AI differentiate itself from other platforms in the market?

-Einstein AI differentiates itself by using a specialized small language model (SLM) built for finance, integrating with enterprise LLMs like Claude and GPT mini, and compartmentalizing client data and analytics to avoid internet-based hallucinations, ensuring secure and accurate insights.

What is the primary function of the 'portfolio risk checkup screen'?

-The portfolio risk checkup screen allows advisors to view and assess the risk levels of client portfolios. The platform continuously analyzes the portfolios in the background, alerting the advisor of any potential issues that need attention.

How does the 'cube' tool work within the platform?

-The 'cube' is a three-dimensional decision-making tool that aggregates key factors of a portfolio based on the advisor's preferences. It provides visual and voice-interactive insights, allowing advisors to review portfolio risk and performance and make data-driven decisions.

Can the Einstein AI platform take actions automatically on behalf of the advisor?

-No, the platform is designed to provide insights and suggestions autonomously, but it always requires the advisor to initiate any actual actions. The system is autonomous in analysis but requires a human in the loop for decision-making.

What role does voice interaction play in the Einstein AI platform?

-Voice interaction is a key feature that allows the advisor to communicate directly with the platform. The system can respond verbally, ask questions, and provide feedback on portfolio performance, helping advisors make informed decisions without needing to manually navigate the system.

How does the platform handle portfolios with multiple accounts for a client?

-Einstein AI includes a householding function that aggregates various client portfolios (e.g., IRA, trust, or 529 accounts) into a single view, making it easier for advisors to track and manage all of a client's assets in one place.

What customizable options are available for risk and stock rating in the platform?

-The platform includes a default quintile-based rating system, but it is fully customizable. Advisors can integrate their own factors, weight them as needed, and tailor the system to their specific portfolio management and investment strategies.

What is the process for rebalancing a portfolio on the platform?

-To rebalance a portfolio, the advisor can sell underperforming securities (e.g., D-rated stocks) and consider new, higher-rated ETFs or stocks. The platform generates a new cube to reflect the changes and provides insights into the updated portfolio's risk and performance.

How does the platform support securities research for analysts?

-Einstein AI provides an advanced research module for securities analysts, offering real-time data, predictive analytics, and customizable report generation. It covers 30,000 securities worldwide, integrating different data sources for comprehensive analysis, helping analysts create detailed reports efficiently.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade Now5.0 / 5 (0 votes)