America’s Grand Strategy: Repo, China, Jensen Huang, & Bitcoin’s Next Move

Summary

TLDRIn this video, Nick Batia explores key macroeconomic trends shaping the financial landscape, focusing on the US's capital expenditure (capex) boom, the impact of credit creation, and the future of Bitcoin. Batia discusses the re-industrialization efforts in the US, strategic moves away from Chinese supply chains, and the role of Bitcoin as a passive recipient of liquidity. He also touches on the volatility in Bitcoin's price, forecasting a widening range as uncertainty grows. The video emphasizes the long-term optimism surrounding these shifts and their implications for asset markets, including Bitcoin.

Takeaways

- 😀 The US is experiencing a capex boom, which is a major driver of future economic growth and will have a significant impact on financial markets.

- 📉 The 10-year Treasury yield is dropping, signaling slower economic growth and inflation expectations, but it doesn’t necessarily point to a recession.

- ⚠️ Private credit losses are rising, drawing parallels with the subprime debt crisis, though the overall economy isn’t showing signs of contraction yet.

- 💡 The capex boom in the US is fueled by both existing savings and fresh credit creation, leading to greater inflationary pressure due to increased demand for goods and commodities.

- 🔮 The bond market expects inflation to stay moderate at around 2%, but the credit expansion from the capex boom could lead to higher inflation, potentially ranging from 2% to 5%.

- 📊 Bitcoin is seen as a passive flow asset, benefiting from credit creation as investors seek scarce assets like Bitcoin and gold during inflationary periods.

- 💵 TBL liquidity index measures the relationship between credit creation and asset prices, particularly Bitcoin and stocks, both of which do well when liquidity is high.

- 🏭 The US is focusing on re-industrializing its economy and reducing reliance on China by bringing back domestic supply chains, which will fuel the capex boom and economic growth.

- 🚀 Nvidia's recent announcement of manufacturing advanced AI chips in the US marks a pivotal moment in the re-industrialization of America, spurred by government tariffs.

- 🌍 The US is working on diversifying its rare earth mineral supply chain to reduce reliance on China, with recent deals like the one with Australia securing future access to crucial resources.

Q & A

What is the main thesis of the speaker regarding the future of the US economy?

-The speaker believes that the US is heading into a capital expenditure (capex) boom, which will be primarily driven by a strategic push to re-industrialize and reduce dependence on China. This boom will be financed by credit creation, leading to inflationary pressures and increased liquidity in the market.

How does the speaker explain the relationship between credit creation and inflation?

-The speaker explains that as credit is created, the dollar is diluted, leading to higher demand for scarce goods and materials. This creates inflationary pressures in the economy. The speaker emphasizes that while inflation expectations are not extremely high, the capex boom will still contribute to a sustained inflationary environment.

What role does Bitcoin play in this economic environment, according to the speaker?

-Bitcoin is viewed as a passive beneficiary of the liquidity created by credit expansion. As credit is created and flows into the market, a portion of this capital flows into Bitcoin, due to its status as a scarce digital commodity. The speaker suggests that Bitcoin will see inflows from institutional and retail investors seeking a store of value amidst inflationary pressures.

What is the TBL Liquidity Index, and how is it relevant to the current economic outlook?

-The TBL Liquidity Index measures the ease with which banks can create credit and the stability of treasury collateral. The speaker connects this index to the performance of Bitcoin and stocks, explaining that when liquidity conditions are favorable (i.e., credit creation is high), both Bitcoin and stock markets perform well.

How does the speaker view the US response to China’s rise, and why is it important?

-The speaker sees the US response to China as central to the capex boom. The shift away from outsourcing to China and the push for re-industrialization within the US are seen as key drivers of economic growth. The US aims to bring manufacturing and key industries back domestically to reduce dependency on China, which will fuel investment and economic expansion.

What role did Trump’s tariffs play in the acceleration of chip production in the US?

-The speaker highlights that Nvidia’s CEO, Jensen Huang, credited Trump’s tariffs as playing a pivotal role in speeding up chip manufacturing in the US. The tariffs were seen as a catalyst that encouraged companies to ramp up production in America, which is now contributing to the capex boom in industries like semiconductors and AI.

Why does the speaker think the capex boom could lead to a higher demand for certain materials and resources?

-The capex boom, especially in manufacturing and technology sectors, will drive up the demand for raw materials, including critical materials like rare earths. As the US re-industrializes, there will be increased demand for infrastructure, energy, and materials, which will be inflationary in nature.

How does the speaker assess the current state of the US dollar and its impact on the economy?

-The speaker notes that the US dollar has been in a declining wedge pattern throughout the year. A rising dollar could be problematic for risk assets like stocks and Bitcoin. The speaker believes that the administration is likely focused on a weaker dollar to make US goods more competitive globally, which could boost exports and support the capex boom.

What is the significance of the widening range in Bitcoin’s volatility?

-The widening of Bitcoin’s volatility range indicates potential for both upward and downward price movements. While this presents opportunities for profit, it also introduces risks. The speaker notes that Bitcoin’s price has been fluctuating more significantly in recent weeks, signaling increased market uncertainty and a potential for larger price swings.

What are some of the key sectors that are expected to drive the US re-industrialization according to the speaker?

-The speaker mentions several key sectors that are critical to the US re-industrialization strategy, including advanced manufacturing, semiconductors, AI, renewable energy, and critical materials like rare earths. JP Morgan is expected to invest heavily in these sectors, providing financing to support the expansion of these industries.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Bitcoin’s Price Floor Just Hit $100,000, and It’s Still Early

The Sector that is Standing Strong! 💪

Collateral Wars: Bitcoin, Chips, & The Next Dollar System

The Fed Quietly Halted QT On Dec 1st - Lyn Alden Warns ‘The Gradual Print’ Begins

Japan’s Historic Election, Yen Defense, & Why Bitcoin Is Still a Liquidity Trade

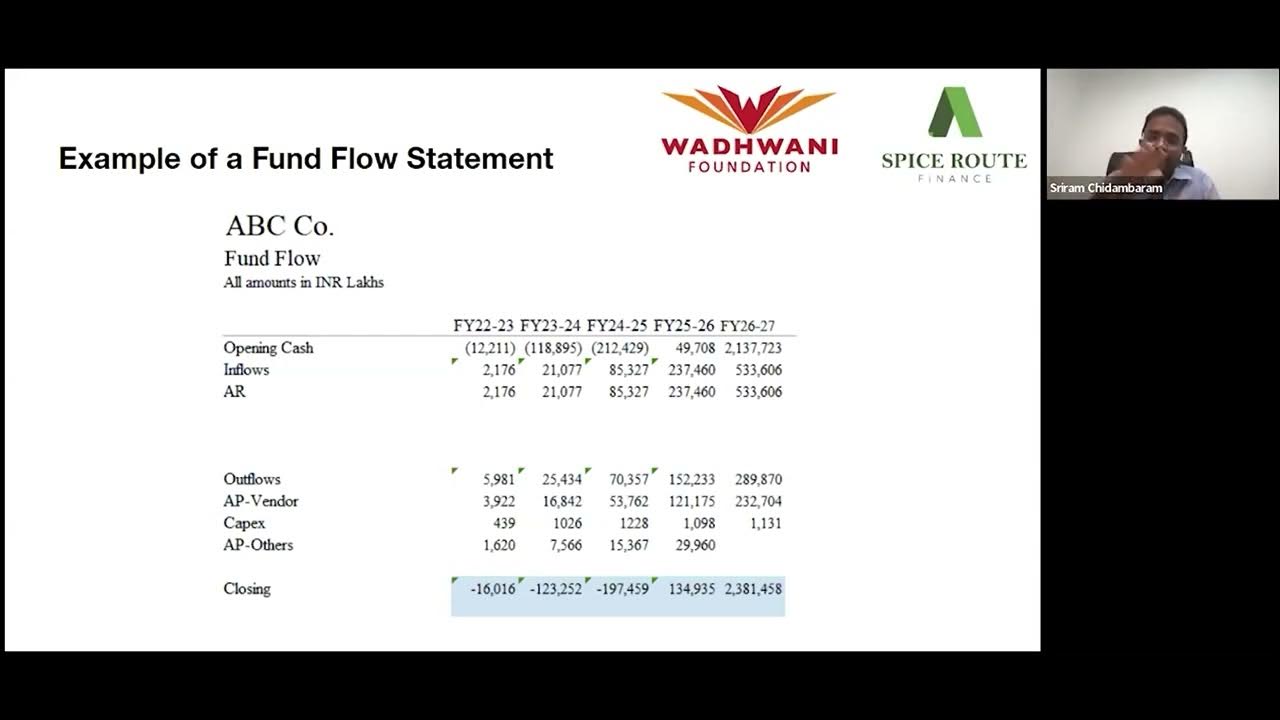

Week 9 Masterclass Sriram Chidambaram Crucial Financial Insights for Startups Success

5.0 / 5 (0 votes)