credit card से इन 10 चीजों की पेमेंट ना करें | 10 places Where you should not use your credit card

Summary

TLDRIn this video, the creator outlines 10 key situations where using a credit card should be avoided. These include withdrawing cash from ATMs, paying commercial bills, making payments on government websites, loading wallets, and paying at local shops where extra fees may apply. The video also advises on maintaining a credit utilization of no more than 30%, avoiding bill payments just for reward points, and being mindful of international transaction fees. The creator suggests using debit cards or cash in many of these cases to save on charges and fees.

Takeaways

- 😀 Avoid withdrawing cash from ATMs using your credit card due to high charges (3.5%) and monthly finance fees up to 40%.

- 😀 Do not use your personal credit card to pay commercial bills (e.g., factory or showroom bills). Use a business credit card instead.

- 😀 When booking tickets or making payments on IRCTC or government websites, prefer debit cards to avoid extra charges.

- 😀 Avoid loading digital wallets with credit cards as it incurs an additional fee (2-3%). Use a debit card to prevent this.

- 😀 Many small stores charge extra fees (1-3%) for credit card payments. Paying in cash can help you avoid these charges.

- 😀 Be cautious when paying for fuel with a credit card; if there is no fuel surcharge benefit, you may pay an extra 1-2% in fees.

- 😀 Keep your credit card utilization below 30% to maintain a healthy credit score and avoid financial strain.

- 😀 Don’t use your credit card to pay utility bills for others or make multiple payments for reward points, as it can lead to your card being canceled.

- 😀 Never use your personal credit card for business expenses. Apply for a business credit card to keep personal and business finances separate.

- 😀 International transactions and cash advances on credit cards come with extra fees (1-3%). Use a card with minimal or no international transaction charges.

Q & A

Why is it not recommended to withdraw cash using a credit card at ATMs?

-Withdrawing cash using a credit card incurs high fees, typically around 3.5%. Additional finance charges begin from the day of withdrawal, and the interest can go up to 40% annually, making it an expensive option.

What happens if you use your personal credit card for commercial transactions?

-Using a personal credit card for commercial transactions can result in your bank canceling your credit card or withdrawing some of the services you receive. It's better to use a business credit card for such payments.

Are there any charges for using a credit card on government websites like IRCTC?

-Yes, payments made using a credit card on government websites like IRCTC may incur a fee of 1% plus GST or a flat ₹10 fee. Debit cards generally do not have such charges.

Why is it advised to avoid adding money to digital wallets using a credit card?

-When using a credit card to load money into a digital wallet, you may incur additional charges (2-3%). Using a debit card can help you avoid these extra fees.

How can small local shops charge extra when you pay by credit card?

-Many local shops charge extra for credit card payments to cover the transaction fees that banks impose on them. In such cases, paying in cash is a better option to avoid extra charges.

What is the fuel surcharge for credit card payments, and how can it be avoided?

-When you pay for fuel with a credit card, you may be charged an additional 1-3% surcharge, depending on whether your card offers a fuel surcharge benefit. Paying in cash can help avoid these extra charges.

Why should you keep your credit card utilization below 30%?

-Maintaining credit card utilization below 30% is crucial for a good credit score. High utilization can negatively impact your credit score and financial health.

What are the risks of paying multiple bills using a credit card to earn reward points?

-Paying multiple bills to earn reward points may lead to your credit card being canceled by the bank. It’s recommended to use your card wisely and not for excessive bill payments to avoid any issues.

What is the issue with using a personal credit card for business-related transactions?

-Using a personal credit card for business expenses can lead to the bank closing your credit card account. For business transactions, it’s better to use a business credit card to avoid complications.

What fees are involved in international credit card transactions, and how can they be minimized?

-International credit card transactions can incur a fee of 1-3%. If you're frequently making international payments, it's best to get a credit card with low or no international transaction fees.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

I Compared & Ranked Trust Cashback Card for Overseas Spending (you’d be surprised…)

Capítulo 7 - Estruturas de seleção encadeada II

10 Websites That Accept Debit Or Credit Card Without OTP Verification (2024 UPDATED)

My NEW 2025 Credit Card Strategy (& 2024 Recap)

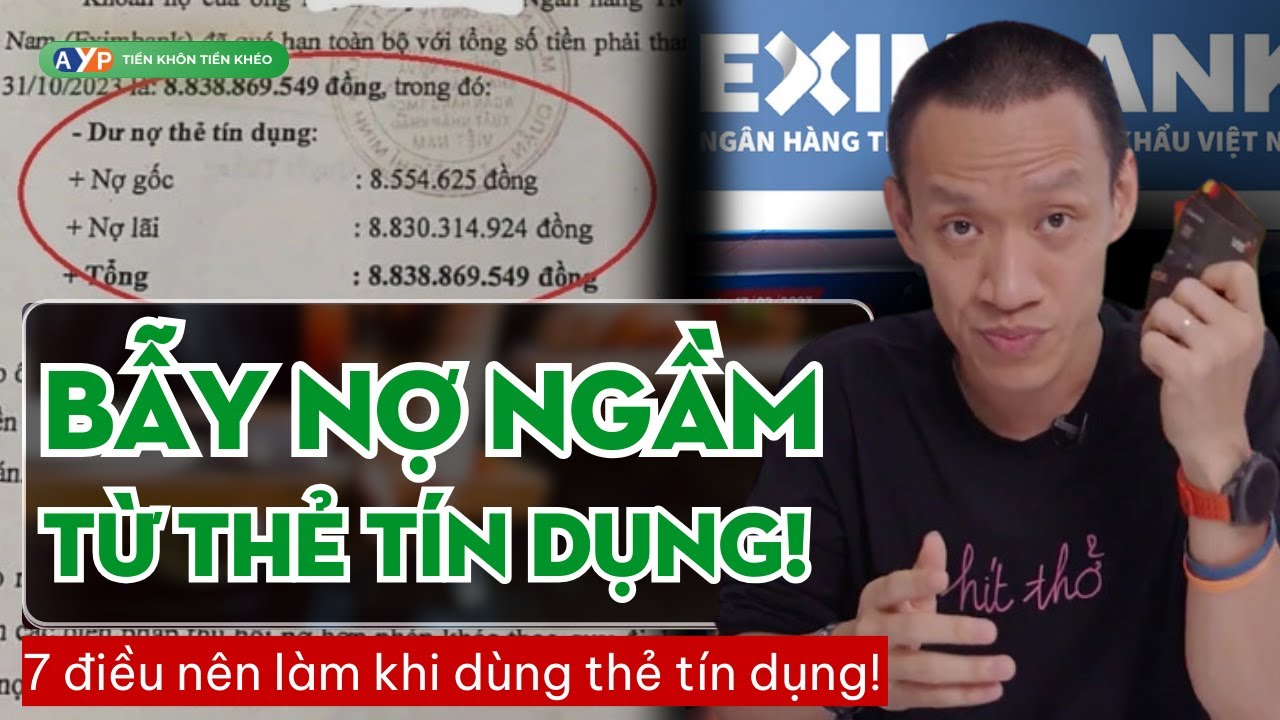

Sau vụ nợ từ 8,5 triệu thành 8,8 tỷ: NÊN và KHÔNG NÊN làm gì khi xài THẺ TÍN DỤNG!| Nguyễn Hữu Trí

Is Cash Back King? (How Travel Cards Are Getting Worse)

5.0 / 5 (0 votes)