Learn ICT Market Maker Models in 12 Minutes

Summary

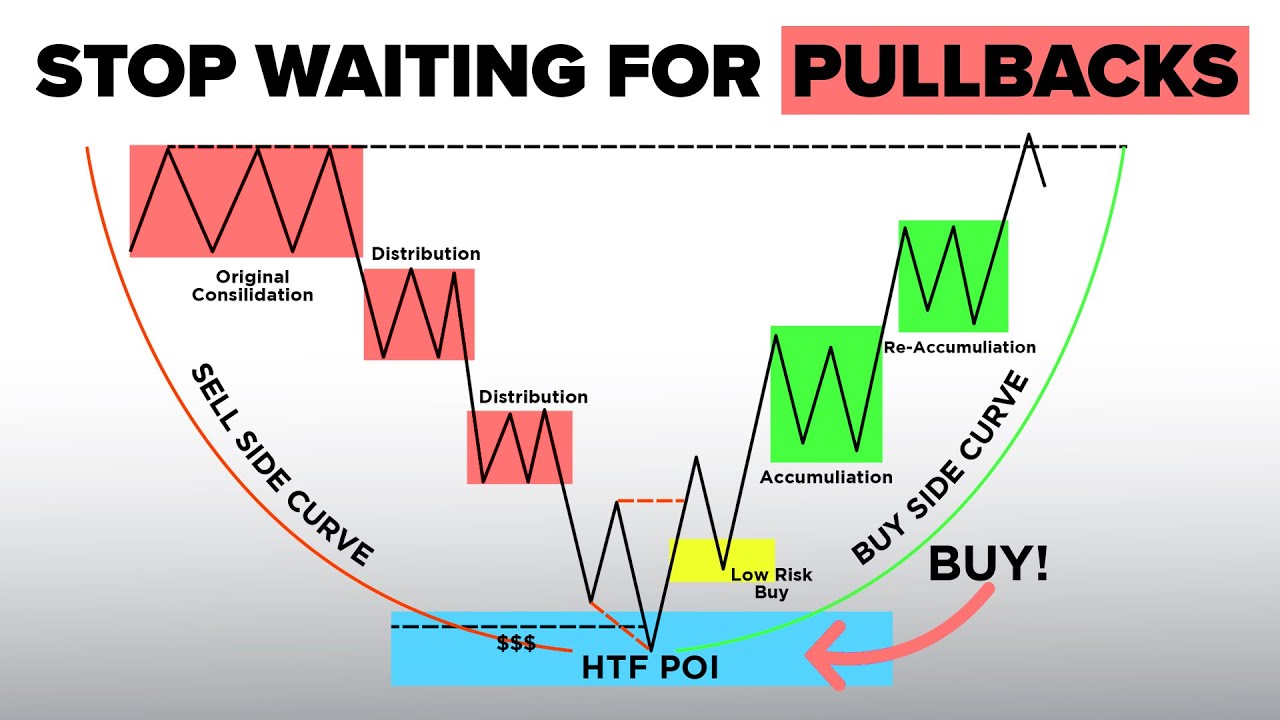

TLDRIn this video, the speaker explains how Market Maker Models can significantly improve trading success. Drawing from personal experience, they highlight how mastering these models helped them become consistently profitable. The video breaks down how Market Maker Models simplify market bias, pinpoint trade entries, and clarify when to trade. It emphasizes the importance of understanding the market's overall direction, identifying key levels, and utilizing lower time frames for confirmation. The speaker also discusses risk management and conviction, aiming to guide traders to make confident, strategic decisions.

Takeaways

- 😀 Market maker models simplify the process of identifying daily market bias and trade entries, allowing for more effective trading.

- 😀 Understanding market maker models is key to avoiding confusion and inconsistency in trading by focusing on essential patterns and concepts.

- 😀 Market maker models apply to both reversal and continuation trades, as they provide insight into the overall market flow.

- 😀 A fair value gap (FVG) is a three-candle formation where a gap exists between the wicks of two candles, representing potential entry or exit points.

- 😀 The market typically moves between two key levels: IRL (initial reversal level) and ERL (extended reversal level), which can be used to predict market direction.

- 😀 Understanding market maker models helps simplify trading by focusing on a singular market direction, avoiding overcomplication with multiple ICT concepts.

- 😀 Timeframe alignment is crucial. Start with a higher timeframe to understand the market flow, then zoom in on lower timeframes for precise entries.

- 😀 A key to success is conviction in your market direction. Once you're confident in your bias, you're less likely to be shaken by short-term losses.

- 😀 Don’t focus solely on catching the top or bottom of the market. Instead, understand the context of the market flow for consistent opportunities.

- 😀 Using market maker models helps identify multiple opportunities to trade, as they reveal key levels and patterns for both long and short positions.

- 😀 In addition to fair value gaps, other tools like market structure shifts and inverted fair value gaps can be used as entry signals at key market levels.

Q & A

What are Market Maker models, and why should traders use them?

-Market Maker models are a trading concept that helps simplify the understanding of market movements. They highlight the flow of the market through consolidations and key levels, such as fair value gaps and highs or lows (IRL/ERL). Traders should use them because they provide clarity in determining daily bias, helping to make more informed and consistent trading decisions, as well as offering an understanding of both reversals and continuations.

How do Market Maker models help with identifying daily bias?

-Market Maker models help simplify the process of identifying daily bias by focusing on key levels, like fair value gaps, instead of trying to use multiple ICT concepts. This allows traders to avoid overcomplicating their analysis, leading to a more straightforward approach and greater consistency in predicting market trends.

What is the significance of fair value gaps in Market Maker models?

-A fair value gap is a price range between three candles where there's a noticeable gap between the wicks, indicating an imbalance in the market. These gaps represent areas of liquidity, where the market tends to move towards or away from, depending on the trend. Recognizing and understanding fair value gaps is crucial for identifying key levels and potential entry points in the market.

What role do IRL (Important Reversal Level) and ERL (Expansive Reversal Level) play in Market Maker models?

-IRL and ERL represent key levels in the market, with IRL being a low or fair value gap and ERL being a high. The market moves between these levels, and understanding how to identify and use them is essential in forming a Market Maker model. They help define the market's potential path and serve as key reference points for trade entries.

What is the primary pattern in Market Maker models?

-The primary pattern in Market Maker models involves two or more consolidations leading into a key level, such as a fair value gap or a high/low. This pattern helps traders understand market behavior and potential reversals or continuations at key points, making it easier to decide when to take a trade.

How can a trader recognize when a Market Maker model is about to fail?

-A Market Maker model can fail when the expected price movement doesn’t follow through after a key level is reached. This failure can be identified by a lack of follow-up movement in the direction anticipated after a consolidation pattern. Understanding these failures is part of the learning process and helps traders avoid false signals.

How does time frame alignment affect the use of Market Maker models?

-Time frame alignment is critical when using Market Maker models, as different time frames provide different insights into the market. Higher time frames (such as weekly or 4-hour) offer broader market context and bias, while lower time frames (such as 1-minute or 15-minute) help confirm entry points. This alignment ensures that traders are operating with the correct market context and timing.

How do you determine when to enter a trade using Market Maker models?

-Once the overall market bias is determined using higher time frames, traders can enter a trade when they identify key reversals or fair value gaps on lower time frames. This can include using price action such as market structure shifts, inverted fair value gaps, or breaking key lows/highs. Entry confirmation can be based on bullish or bearish price action following a consolidation or key level test.

What is the importance of conviction in trading with Market Maker models?

-Conviction is crucial in trading because it helps traders remain confident in their bias even when they encounter losses. Understanding the flow of the market and having confidence in the model's predictions allows traders to manage risk better and avoid being shaken out of a trade too early. This leads to better decision-making and ultimately greater profitability.

How do Market Maker models differ from retail trading strategies?

-Market Maker models differ from retail trading strategies by focusing on the market's flow and key levels (such as fair value gaps and liquidity points), rather than relying on patterns or indicators commonly used by retail traders. Market Maker models emphasize understanding the market's intent and using that insight to make more informed trades, rather than just trading based on patterns or trends.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

The Market Maker Model You Were Never Taught

Market Maker X Model For BEGINNERS

Stop Waiting for Pullbacks, Use Market Maker Models Instead (ICT Concepts)

4HR PO3 | MMXM | Standard Deviations | ICT Concepts

Why you STILL don't UNDERSTAND ICT Market Maker Models

ICT Market Maker Models simplified in 9 Minutes

5.0 / 5 (0 votes)