Binance Sıfırdan Mobil Kaldıraçlı Futures İşlemler Eğitim 2025 | Taktikler Stratejiler

Summary

TLDRThis video tutorial provides an in-depth guide to futures trading, explaining the concept of liquidation price and how to manage risks with leverage. The speaker demonstrates using platform tools to calculate liquidation prices, emphasizing the importance of dividing risk across multiple positions rather than committing to a single trade. By showing how to open and manage different trades simultaneously, the tutorial highlights how futures trading can offer more flexibility and lower risk compared to spot trading. Viewers are encouraged to engage with the community for further insights and support.

Takeaways

- 😀 Leverage allows you to increase your position size, but it also increases the risk of liquidation if the market moves against you.

- 😀 The liquidation price is the price at which your position is automatically closed to prevent further losses.

- 😀 You can calculate your liquidation price using a built-in calculator on trading platforms, which considers leverage, mode (cross or isolated), and position size.

- 😀 The liquidation price can vary depending on the amount of leverage used and the asset you're trading (e.g., Bitcoin, ETH).

- 😀 To manage risk, it's crucial to understand how leverage works and how to divide your total funds into smaller, manageable positions.

- 😀 Using the futures market, you can open multiple positions with different assets, reducing overall risk and avoiding large losses from a single position.

- 😀 On the futures market, the liquidation price is often not visible if you're using a joint margin system, where the total funds are shared between multiple positions.

- 😀 Risk management in futures trading involves balancing multiple assets and ensuring your total exposure is manageable based on your account balance.

- 😀 The spot market only allows you to buy a single asset at a time, but futures let you diversify your risk by opening multiple trades simultaneously.

- 😀 By using the futures market effectively, you can trade with smaller amounts of capital while managing risk through diversified positions and proper liquidation management.

Q & A

What is the purpose of the liquidation price calculator mentioned in the video?

-The liquidation price calculator is used to calculate the price at which a trade will be liquidated based on the leverage, entry price, and the size of the position. This helps traders assess their risk and ensure they don't lose more than they can afford.

How does the speaker use the liquidation price calculator in their trading strategy?

-The speaker uses the liquidation price calculator to assess the risk of each trade before opening it. They input the leverage, trading mode, and transaction size to find out the liquidation price, which helps in making informed decisions about the trade.

What does the speaker mean by using the term 'safe' mode in their trading?

-The 'safe' mode refers to a joint risk management system where the liquidation price is not directly shown. Instead, the overall balance of funds across multiple positions is managed to avoid liquidation by gradually reducing the available funds as losses occur in any single position.

How does the speaker divide their capital in trading to reduce risk?

-The speaker divides their capital by opening multiple positions in different cryptocurrencies. This allows them to manage risk better because if one position loses, the others might offset the loss, reducing the impact on their overall portfolio.

What is the difference between futures trading and spot trading, as explained in the video?

-In futures trading, the speaker can divide their capital across multiple positions in different assets, allowing them to manage risk and reduce the chance of liquidation. In contrast, spot trading only allows one position per asset, limiting the ability to diversify risk.

Why does the speaker prefer futures trading over spot trading?

-The speaker prefers futures trading because it allows them to divide their capital across various assets, which reduces the risk of loss by diversifying their positions. This strategy is not possible in spot trading, where only one asset can be traded at a time.

How does the speaker manage potential losses in multiple positions simultaneously?

-The speaker manages potential losses by using a strategy where they open several positions across different cryptocurrencies, such as Bitcoin, ETH, and BNB. If one position loses, the others might perform better, allowing the speaker to maintain a balanced portfolio and avoid liquidation.

What role does leverage play in the speaker’s trading strategy?

-Leverage allows the speaker to control larger positions with a smaller amount of capital. In the video, they demonstrate using leverage (e.g., 49x) to open larger positions, which can amplify both gains and losses. It’s used as a tool for potentially higher profits while managing risk through diversified positions.

How can using the liquidation price calculator help traders avoid losing money?

-By calculating the liquidation price, traders can understand the price at which their position will be forced to close due to insufficient margin. Knowing this in advance allows traders to set up risk management strategies to prevent reaching that point, such as adjusting their position size or using stop-loss orders.

What is the benefit of not seeing a liquidation price in the speaker’s trading approach?

-Not seeing a liquidation price is part of the speaker's risk management strategy, as it allows them to focus on managing their total available funds across multiple positions. This approach reduces the emotional stress of managing individual positions and helps them maintain better control over their overall portfolio.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

BITCOIN TRAPS LONG TRADERS - BTC DUMP EXPLAINED | CRYPTO FUTURES TIPS | MARKET UPDATE

1722681018149453

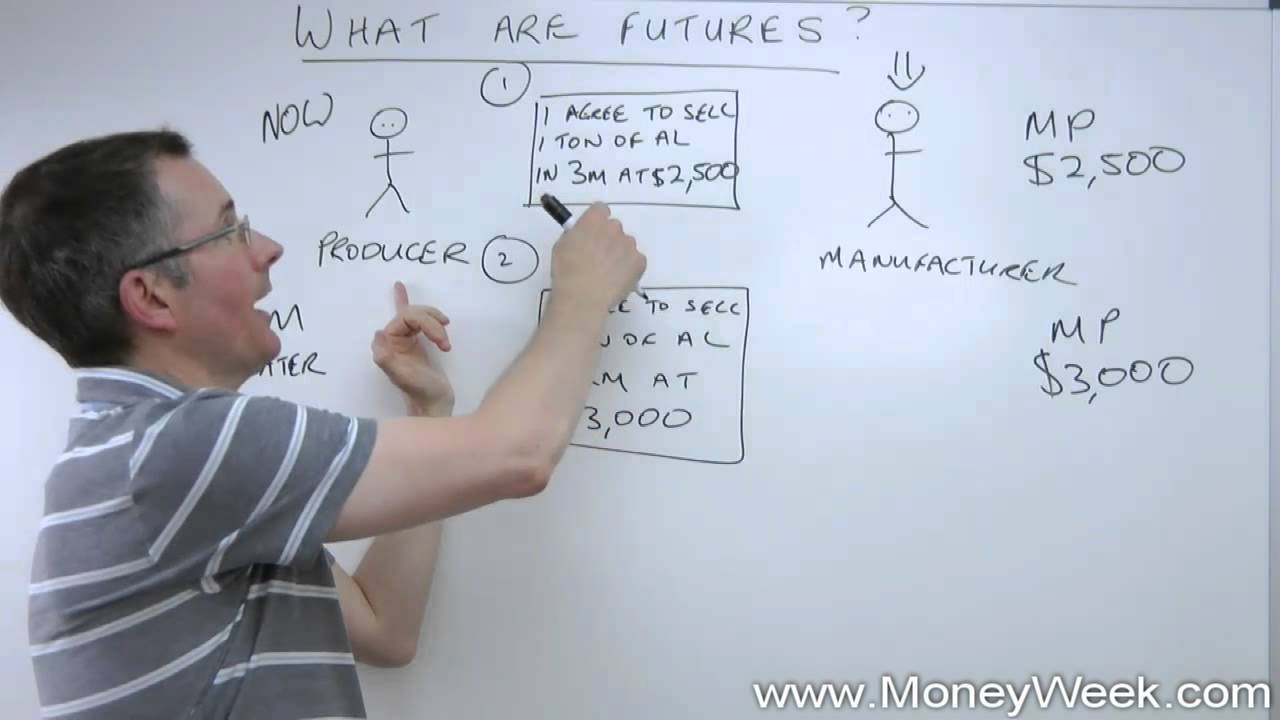

What are futures? - MoneyWeek Investment Tutorials

BITCOIN TURUN DRASTIS SENTUH ANGKA 95.5K ! APAKAH YANG DILAKUKAN PARA BANDAR CRYPTO ? ONCHAIN DATA

How to NOT Get Liquidated With Crypto Leverage Trading – Bitcoin Trading Strategy

How to create a Binance futures demo account | trade crypto on a Binance demo account

5.0 / 5 (0 votes)