How This Stay At Home Mom Made 122% Returns

Summary

TLDRIn this insightful interview, the speaker shares their evolution as a trader, discussing how they've adapted to market conditions and risk management. They describe their shift toward taking losses, relying on mental stops rather than stop orders, and managing large positions in liquid S&P stocks. The conversation highlights their confidence in navigating macroeconomic changes and their approach to balancing risk, particularly regarding undefined upside risk. Despite their expertise, they continue to learn and grow, keeping a portion of their capital in play. Their story serves as an inspiration, especially for women in the trading world.

Takeaways

- 😀 The trader used to avoid taking losses but now accepts them, particularly when macro conditions change.

- 😀 They rely on mental stops rather than placing physical stop orders in their trades.

- 😀 In the face of large macroeconomic shifts, such as tariffs, they would rather close a position than try to adjust it with other trades like selling a call spread.

- 😀 Currently, the trader is using 95% of their capital, focusing on large liquid S&P stocks.

- 😀 They accelerate trades by combining stock positions with options to increase returns.

- 😀 The recent market downturn (early April-May) has been particularly favorable for their style of trading.

- 😀 The trader is considering taking profits soon but plans to keep some core positions active to remain engaged in the market.

- 😀 They believe it’s essential to keep something on in the market to avoid becoming overly cautious or 'crazy.'

- 😀 The trader expresses a concern about undefined upside risk, which is more emotional than logical, reflecting the difficulty of fully controlling market outcomes.

- 😀 They feel comfortable with their knowledge of trading and can always refer back to videos and other resources for clarification when needed.

- 😀 The interview highlights the need for more women in the trading field, with the trader's success story seen as an inspiration.

Q & A

What was Emily’s initial experience with trading options?

-Emily's initial experience with trading options was in 2019, when she had no prior background in finance. She was introduced to Tasty Trade by her father, who was an options trader in retirement. Despite having no interest in financial markets before, she found the platform relatable and started learning by watching videos and taking notes.

What was the reason Emily started trading options in the first place?

-Emily started trading options as a way to pass the time after an injury to her wrist in 2019, which prevented her from continuing her jewelry-making business. Her father suggested she try options trading, and she decided to give it a shot.

Why did Emily choose to trade Apple options initially?

-Emily chose to trade Apple options, specifically bull put spreads, because the strategy allowed her to limit potential losses. She liked the backup option of taking the stock if the trade didn't go as planned, and this helped her gain confidence in her trading.

How did Emily handle the market downturn during the early days of the COVID-19 pandemic?

-During the early stages of the COVID-19 pandemic, Emily experienced a significant market crash. However, she was careful with margin management, and instead of panicking, she rolled out her put positions into longer durations (leaps), waiting for a recovery. When the market began easing, she reinvested her cash and bought back in.

How did Emily's husband react to her success in options trading?

-Emily's husband was supportive of her trading journey. As she made consistent profits, he kept depositing more money into her trading account without much discussion. Eventually, he retired because of the financial success Emily achieved, showing his full trust in her trading abilities.

What changes did Emily make to her trading strategy in 2022, and how did it affect her returns?

-In 2022, Emily experienced a tougher market due to a significant sell-off. To manage risk, she began rolling her positions wider to still collect premium, but this strategy resulted in lower returns compared to previous years. Despite this, she stuck to her risk management strategies and adjusted as needed.

What is Emily’s preferred method of selecting stocks for trading?

-Emily focuses on large, liquid stocks in the S&P 500, particularly those with strong momentum and profitability. She watches a small handful of stocks closely and uses a strategy that typically involves selling put spreads on these stocks.

What was Emily's approach to trading during volatile market conditions, such as in April 2025?

-During volatile conditions like the market sell-off in April 2025, Emily adapted by purchasing long-term leaps (call options) on stocks she believed were undervalued, such as Palantir and Nvidia. She then traded shorter-term positions with her freed-up cash. This strategy allowed her to ride out the volatility while protecting her portfolio.

How does Emily manage risk when trading options?

-Emily manages risk by being cautious with margin and always keeping a reserve of capital. She also uses a mental stop approach to close positions when she believes the macroeconomic conditions have changed significantly, such as during events like trade tariffs. She avoids using stop orders but is careful about taking losses when necessary.

What does Emily consider her primary trading goal, and how is she tracking her performance in 2025?

-Emily’s primary trading goal is to beat the S&P 500 each year. In 2025, she is currently ahead with a 12% return, while the S&P 500 is at approximately 2%. She remains focused on this goal and continues to monitor her performance to ensure she remains on track.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

+$23,952.98 Momentum Trading Stocks with NO NEWS 😱

How To Predict The ICT Market Maker Model LIVE

Michael Saylor on Bitcoin, the Red Wave, Capital vs. Currency & a Digital Assets Renaissance

5 things i stopped doing to become a profitable trader

This change allowed him to finally achieve consistency: Bara on over $5,000 in payouts

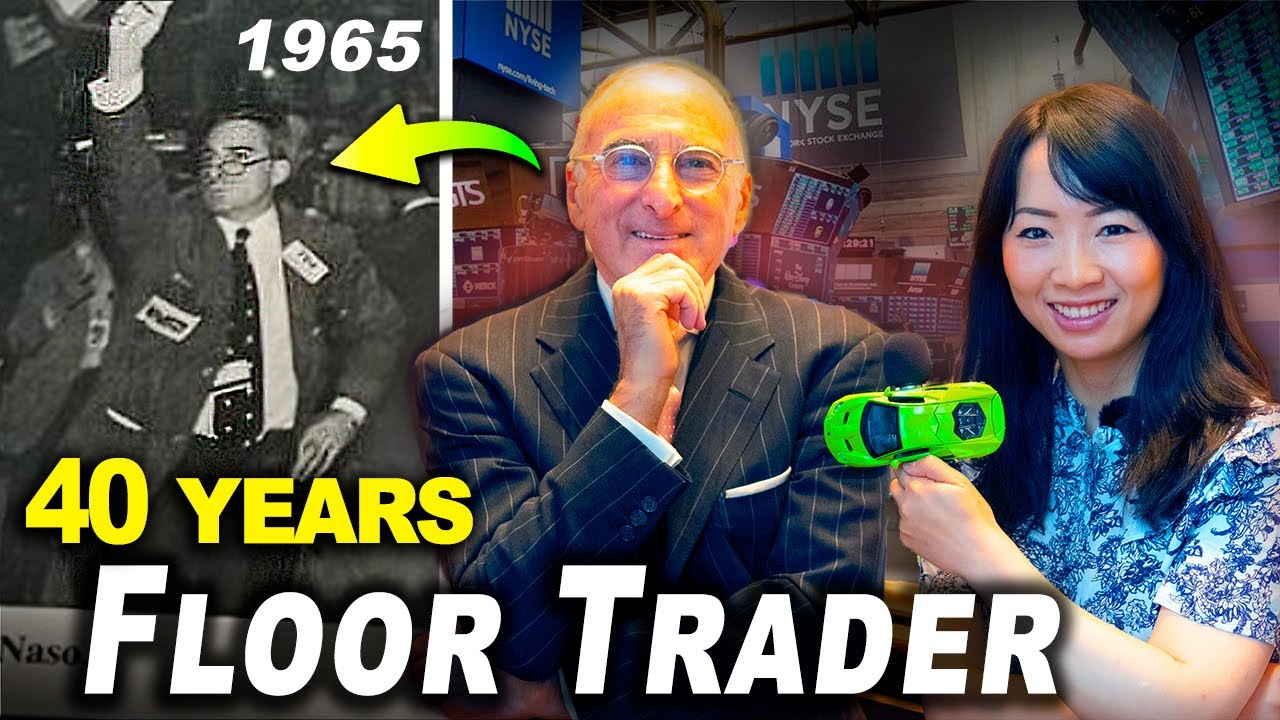

Veteran Wall Street Trader Reveals Strategies Used At Stock Exchanges

5.0 / 5 (0 votes)