Tariffs, Tech and Transition: Europe and Asia’s Evolving Equity Landscape | The Bid podcast

Summary

TLDRIn this episode of The Bid, experts Helen Juel and Belinda Boa explore how equity markets in Europe and Asia are navigating global challenges like tariffs, geopolitical tensions, and technological disruption. Belinda discusses how Asian companies are adapting to trade dynamics, while Helen highlights Europe's strong domestic-focused sectors and its resilient exporters. Both regions face volatility but also present unique opportunities for investors, especially in AI, defense, infrastructure, and consumer growth. Looking ahead to 2025, they emphasize active stock-picking strategies and the potential for long-term returns in these evolving markets.

Takeaways

- 😀 The global consumer base is rapidly growing, with Asia accounting for 55% of the world's consumers, and countries like China, India, and Indonesia expected to add 830 million consumers by 2030.

- 😀 Rising incomes in Asia will create a large, fast-growing market, offering significant investment opportunities into 2025 and beyond.

- 😀 European equities have performed well due to domestic sectors, especially banks and defense companies, but the focus is now shifting to global exporting companies.

- 😀 40% of European revenues come from within Europe, while 60% come from outside Europe, making globally exposed companies increasingly attractive to investors.

- 😀 Volatility in the market creates opportunities for active stock pickers to target companies that have pulled back but still show strong global exposure and growth potential.

- 😀 Key investment themes in Europe include AI and energy transition, which are expected to drive growth in global exporting companies in the coming years.

- 😀 The companies that have strong exposure to global markets, particularly those involved in emerging sectors like AI, are now trading at attractive valuations, making them appealing for investment.

- 😀 Market volatility is a chance to acquire stocks of companies with solid fundamentals at discounted prices, especially those impacted by tariff concerns but with a bright long-term outlook.

- 😀 European investors are advised to diversify their portfolios and focus on companies that can produce and export globally, capitalizing on trends in technology and sustainability.

- 😀 Asia-Pacific equities, particularly in markets like China, India, and Indonesia, present substantial opportunities for growth, driven by both demographic expansion and rising incomes.

Q & A

What is the significance of Asia in the global consumer market by 2030?

-Asia currently represents 55% of the world's global consumers. By 2030, the combined populations of China, India, and Indonesia are expected to increase by 830 million, leading to a large growth in the consumer base, which presents significant investment opportunities.

How does the growth of rising incomes in Asia impact global markets?

-As incomes rise in countries like China, India, and Indonesia, the consumer market expands, creating more opportunities for businesses and investors. This economic growth leads to increased demand for products and services, particularly in sectors like technology, AI, and energy transition.

What role do global exporting companies play in the performance of European equities?

-Global exporting companies in Europe are essential, as 60% of their revenues come from outside Europe. These companies are likely to perform well in the future due to their exposure to global markets, especially those involved in themes like AI and energy transition.

Why have European equities been performing well, according to the script?

-European equities have performed well largely due to domestic sectors like banks and defense. However, the panel emphasizes that the future growth of these markets will rely more on global exporting companies with diversified international revenue.

What is the investment outlook for companies in Europe with global exposure?

-The investment outlook for companies with global exposure is positive. These companies, especially those connected to AI and energy transition themes, are expected to present opportunities, particularly when their stocks are undervalued during times of market volatility.

What is the importance of stock picking during volatile markets?

-Stock picking becomes crucial during market volatility because it allows active investors to identify undervalued companies with strong growth potential. By focusing on companies with strong fundamentals, especially those exposed to global trends, investors can find profitable opportunities.

What themes should investors focus on when selecting European stocks in 2025 and beyond?

-Investors should focus on global exposure, particularly companies involved in AI and energy transition themes. These sectors are expected to drive growth in the long term, especially as markets continue to evolve.

How can the current market volatility create opportunities for active investors?

-Market volatility can create opportunities by causing temporary pullbacks in stock prices, allowing active investors to purchase undervalued companies that are well-positioned for future growth, particularly in sectors like AI and energy transition.

What are the main global themes driving investment opportunities in Asia?

-The main global themes driving investment opportunities in Asia include the rising consumer base, increasing incomes, and the rapid expansion of sectors like technology, AI, and energy transition, which are supported by the growing middle class in countries like China, India, and Indonesia.

Why is it important for European companies to have strong global exposure?

-It is important for European companies to have strong global exposure because it helps them diversify their revenue streams and reduce dependence on the European market, which has limited growth potential compared to global markets. Companies with international exposure are better positioned to capitalize on global trends and growth opportunities.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

2025 Outlook: Europe’s economies brace for more political upheaval

Is time on China's side in Trump's trade war? | DW News

1 MIN AGO: Trump MELTS DOWN as Boeing SHUTS DOWN U.S. Production — Trump's Reaction SAYS It All

My Thoughts On the Global Stock Market Meltdown

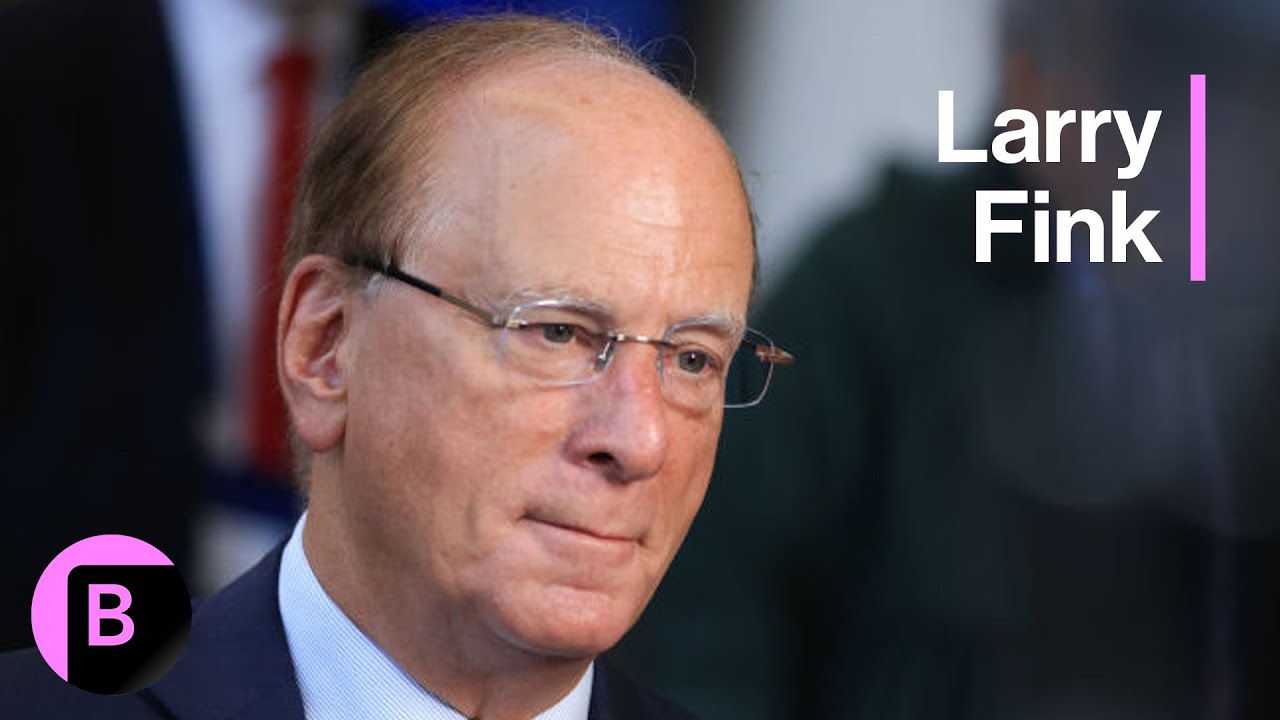

BlackRock CEO Larry Fink on US Economy, Trump Vs. Harris, Geopolitical Risks (Full Interview)

Can Trump win a trade war with China? - The Global Story podcast, BBC World Service

5.0 / 5 (0 votes)