The Dragons Don't Understand Uunn's £2.7 Million Evaluation | Dragons' Den

Summary

TLDRGina Dorvand and Hower Budra present their innovative dental tech, Oon, a smartphone app paired with a lens that detects plaque on teeth. They seek £70,000 for a 2.6% share in their business. Despite their technology's promise, they face tough scrutiny from investors, with concerns over their high valuation, limited commercial sense, and competition from traditional products like plaque detection tablets. After multiple rejections, one investor offers £70,000 for 30%, but the duo cannot agree on the terms, ultimately leaving the pitch empty-handed. Their journey highlights both the potential and pitfalls of entering the tech-driven health market.

Takeaways

- 😀 Gina and Hower pitch 'Oon', a dental tech product designed to detect plaque buildup on teeth using a smartphone app and an AI-powered lens.

- 😀 They are seeking £70,000 for a 2.6% equity stake in the company, valuing it at £2.7 million.

- 😀 The product includes an app and accessory that analyzes images of teeth to determine plaque levels and provides notifications for users.

- 😀 Despite 5 years of development, including acquiring patents and technology, the company has limited funds left (around £20k).

- 😀 The valuation of £2.7 million is questioned by the Dragons, who see it as overly optimistic for a pre-revenue business with limited cash reserves.

- 😀 The Dragons express skepticism about the commercial potential of the product, pointing out cheaper alternatives like plaque detection tablets.

- 😀 The revenue model proposed by Gina and Hower includes online sales, with packages ranging from £38 for individuals to £123 for families over six months.

- 😀 Several Dragons, including Deborah Meaden and Ta Lvani, criticize the business model and suggest exploring partnerships with dental professionals or distributors.

- 😀 Tuka Sullyan offers £70,000 for a 30% equity stake, citing his contacts in the dental industry and his ability to help scale the business internationally.

- 😀 Gina and Hower decline Tuka's offer due to the high equity demand, leaving the pitch empty-handed but optimistic about their product's future.

Q & A

What is the main product being pitched by Gina and Hower?

-Gina and Hower are pitching 'Oon', a smartphone app and accessory that helps users detect plaque buildup on their teeth using AI-based image processing.

What is the funding amount Gina and Hower are seeking, and what percentage of equity are they offering?

-They are seeking £70,000 in exchange for 2.6% equity in their business.

What are some of the concerns raised by the Dragons regarding Gina and Hower's business?

-The Dragons are concerned about the high valuation of £2.7 million for a pre-revenue company, the commercial model, the practicality of the product compared to cheaper alternatives, and the entrepreneurs’ cash burn rate.

How does the 'Oon' app work?

-The 'Oon' app works by users taking three photos of their teeth, which are then uploaded into the app. The app uses image processing AI technology to analyze the photos and identify areas with plaque buildup.

What is the pricing model for 'Oon'?

-'Oon' offers three packages: £38 for an individual for 6 months, £65 for a couple, and £123 for a family of four for 6 months of use.

What is the main selling point of 'Oon' according to the entrepreneurs?

-The main selling point is that the app allows users to measure the cleanliness of their teeth at home, providing a more personalized and convenient way to track plaque buildup compared to traditional methods.

What alternative to 'Oon' does Deborah mention during the pitch?

-Deborah mentions the use of cheap plaque-detecting tablets, which are available for around £2 and can last for months, as a simpler and more cost-effective alternative to 'Oon'.

What was the Dragons' main issue with the valuation of the company?

-The Dragons believed the £2.7 million valuation was too high for a pre-revenue company, especially considering the cash that had already been raised and the lack of substantial progress in terms of commercialization.

What kind of partnership did one of the Dragons, Ta Lvani, suggest for the entrepreneurs?

-Ta Lvani suggested that the entrepreneurs should partner with dentists, offering their technology as part of a dental care plan, which could be sold to clients through dental practices.

How did Gina and Hower respond to Ta Lvani's suggestion?

-Gina and Hower were open to the idea of working with dentists, mentioning that they already have a dentist on their board and are looking to explore such partnerships.

What offer did Ta Lvani make to Gina and Hower?

-Ta Lvani offered £70,000 for a 30% equity stake in the business, citing the value he could bring through his contacts in the dental industry.

Why did Gina and Hower reject Ta Lvani's offer?

-Gina and Hower rejected Ta Lvani's offer because they were unwilling to give up 30% equity, feeling that it was too high given their valuation and previous fundraising efforts.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

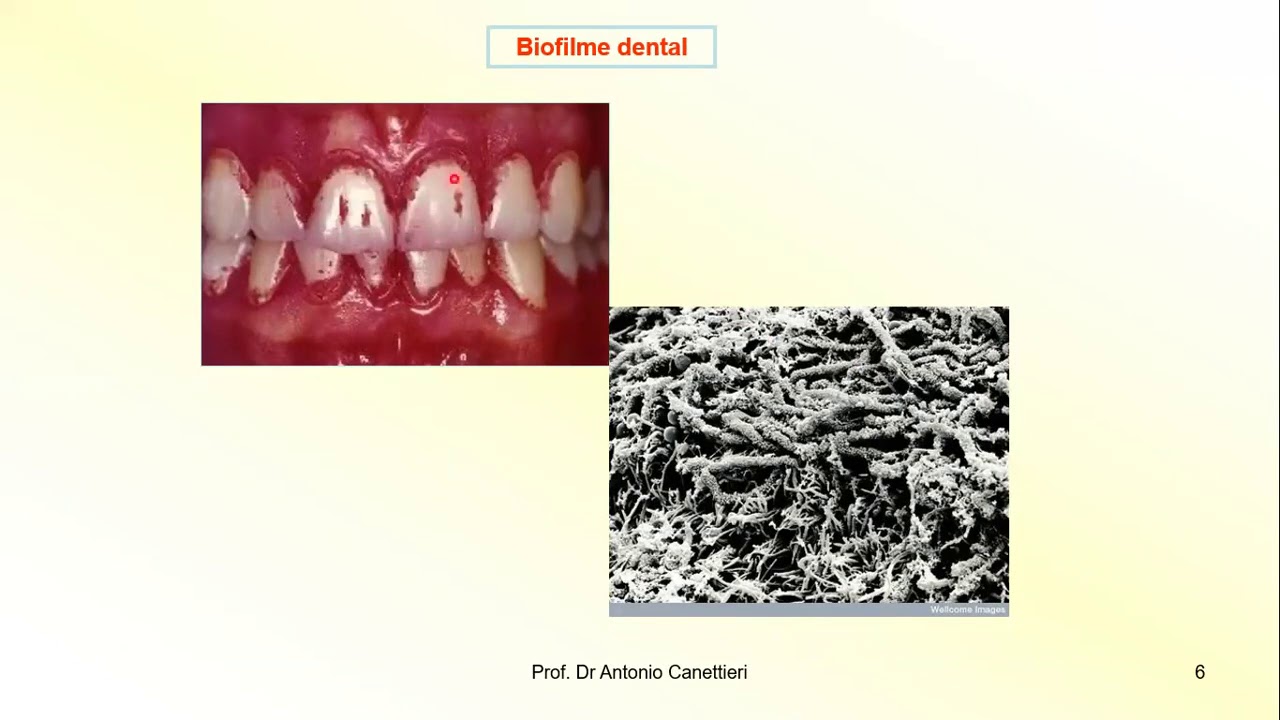

MICROBIOLOGIA BUCAL- Biofilme dental

Insights at 45, mistakes, joy of life, cholesterol, supplements, preventive examination, dental f...

Dentist Reviews Philips Sonicare Power Flosser! A Water Flosser Like Waterpik

The #1 Top Remedy for Dental Plaque

The #1 BEST Remedy for Dental Plaque (TARTAR)

Dental Hygiene | Teaching Dental Care to Kids

5.0 / 5 (0 votes)