Investimentos para não herdeiros (sem cursos caros, coach ou fórmula mágica)

Summary

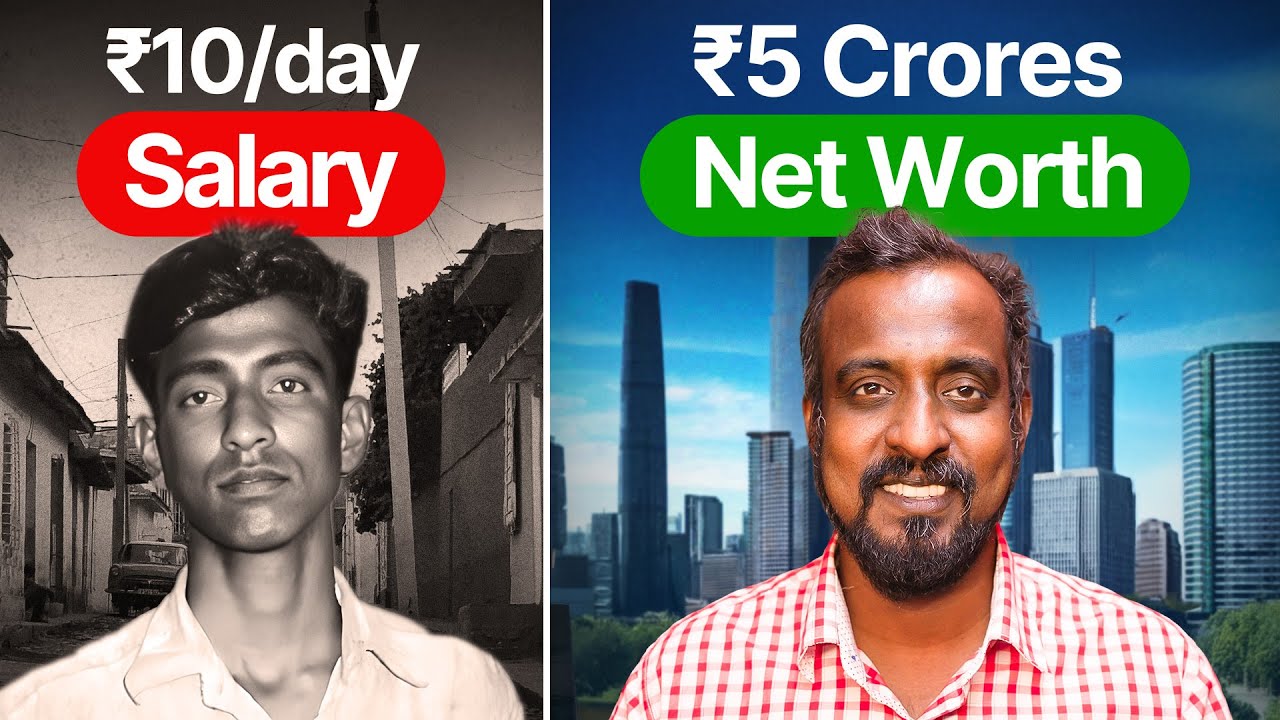

TLDRIn this video, Diego shares his journey to saving R$ 100,000 by the age of 24, despite starting with a low salary and feeling discouraged. He provides five essential tips for building wealth, starting with simple and effective investments. Diego explains the power of compound interest and how small, consistent investments can accumulate over time. He also emphasizes the importance of increasing income, maintaining a modest lifestyle, and investing regularly. Additionally, he recommends platforms like Nubank, Nômade, and Binance for safe and reliable investments. This practical guide offers insights on how anyone can start building wealth today, regardless of their financial background.

Takeaways

- 😀 Start with the basics: Focus on simple, practical steps to build a financial foundation before attempting more complicated strategies.

- 😀 Don't focus solely on saving: It's not just about saving money, but about making your money work for you through wise investments.

- 😀 Leverage compound interest: Investing with compound interest can significantly accelerate your savings compared to simply saving money.

- 😀 Avoid poor investments: Be cautious with traditional options like savings accounts or private pensions, as they may offer poor returns.

- 😀 Gradually build investment knowledge: Start with simple investments, such as the Nubank 'caixinha', before diversifying into more complex assets like stocks and crypto.

- 😀 Consistency is key: Make it a habit to invest regularly, no matter how small the amount. This helps build a strong financial discipline.

- 😀 Realistic goals: Start by saving a small, manageable percentage of your income, such as 5-10%, and increase gradually over time.

- 😀 Increase your income: If you're struggling to save, consider ways to boost your income, such as learning new skills or improving your job performance.

- 😀 Keep your lifestyle in check: As your income increases, maintain your current lifestyle and use the extra money for savings and investments.

- 😀 Choose trustworthy platforms: When investing, make sure to use reliable platforms like Nubank, Nômade, and Binance to avoid risky or unknown investments.

Q & A

How did the speaker manage to save R$ 100,000 at the age of 24?

-The speaker managed to save R$ 100,000 by initially having a low-paying job, but through disciplined saving, smart investing, and using the power of compound interest. He emphasizes the importance of starting early and investing wisely.

What is the significance of compound interest in the speaker’s strategy?

-Compound interest played a crucial role in the speaker’s ability to grow his savings faster. Even with modest returns, the accumulation of interest over time significantly shortened the time required to reach R$ 100,000.

Why does the speaker discourage using certain traditional savings methods like FGTS and savings accounts?

-The speaker believes that methods like FGTS (which yields only 3% per year) and savings accounts (which are even worse) are poor options for growing wealth due to their low returns, and that better alternatives exist for anyone looking to save and invest.

What is the key difference between saving and investing according to the speaker?

-The speaker stresses that saving alone, especially at low interest rates, takes far too long to accumulate significant wealth. Investing, on the other hand, allows money to grow at a faster pace through higher returns, particularly when using compound interest.

What is the first investment the speaker recommends for beginners?

-The speaker recommends starting with a simple and accessible investment, such as the 'caixinha' feature on Nubank, which provides a return significantly better than a traditional savings account, with minimal complexity.

What analogy does the speaker use to explain the importance of starting with the basics in investing?

-The speaker uses the analogy of starting a fitness regimen. Just as one cannot expect to become fit by working out only once, you cannot expect to get rich quickly without investing regularly and consistently over time.

How does the speaker suggest managing your income when starting to invest?

-The speaker advises to start by saving a small percentage of your income, even if it's just 5% or 10%. The key is to develop a habit of saving and investing, and gradually increase the amount as your income and investment knowledge grow.

Why does the speaker suggest that increasing your income is crucial for achieving financial goals?

-The speaker emphasizes that if you are not earning enough to save and invest, the solution is to increase your income. By improving skills and offering value at work, you can unlock higher earning potential, making it easier to save and invest.

What does the speaker recommend regarding lifestyle when your income starts to increase?

-The speaker advises maintaining the same lifestyle as your income increases. By not increasing your spending along with your income, you can save and invest more, accelerating your path toward financial goals.

What are the investment platforms the speaker trusts and uses?

-The speaker trusts platforms like Nubank for fixed income investments, Nômade for international investments in U.S. dollars, and Binance for cryptocurrency. He also mentions that he has partnerships with these platforms but recommends them because they offer good returns and are reliable.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

How I became a Millionaire by 31 on a Low-Medium Salary (Copy & Paste My Lazy Strategy)

How I Make $100,000/Year Working in Singapore at 30

How He Retired With 5 CRORES in Chennai?

tenho um salário de R$42.264,67 com 21 anos

How I Saved $100k in 5 Years

DO ZERO A 100 MIL REAIS OU FICO CARECA | Desafio Dropshipping

5.0 / 5 (0 votes)