Gestão Financeira, Você, o Dinheiro e a Empresa (Parte 1)

Summary

TLDRThis video script offers valuable insights into effective financial management for businesses. It emphasizes the importance of understanding financial challenges as a mindset issue, rather than just monetary problems. Key advice includes the need for professional financial teams, setting appropriate prices, and maintaining disciplined financial practices. The script also highlights the significance of organizing finances, reviewing them regularly, and being proactive in managing cash flow. With a clear financial strategy and expert help, businesses can overcome financial struggles and ensure long-term success. The message encourages business owners to commit to structured financial management and continuous improvement.

Takeaways

- 😀 Financial problems often stem from mismanagement or lack of knowledge, not from the financial situation itself.

- 😀 It's essential for business owners to distinguish between personal finances and company finances, with clear boundaries.

- 😀 Pro-labore, the salary of the business owner, is crucial for managing personal expenses and ensuring financial discipline within the business.

- 😀 Pricing products or services incorrectly can lead to significant losses, even if the business is generating a lot of sales.

- 😀 Financial management should be data-driven, not based on guesswork or assumptions, to avoid costly mistakes.

- 😀 Discipline and organization in managing finances are vital for running a successful business.

- 😀 A lack of focus or poor management often leads to financial difficulties; having a clear strategy is crucial.

- 😀 Having a professional team in place is essential for successful financial management, ensuring better decision-making and risk management.

- 😀 Business owners must be proactive about financial decisions, not waiting for a crisis to force action.

- 😀 Correct pricing must reflect the true cost structure of the business, including all fixed and variable expenses.

- 😀 The importance of being organized and having systems in place for financial tracking and decision-making cannot be overstated.

Q & A

What is the primary issue with financial management in companies according to the speaker?

-The primary issue is not financial problems themselves, but mental or psychological barriers that prevent proper financial management. Companies often neglect financial planning and face consequences later on.

Why is it important to have a professional team managing the finances of a company?

-Having a team of professionals ensures that the financial decisions made are informed, helping the company avoid risks and optimize its operations for growth. A lack of professional input can lead to severe financial problems.

What is meant by the phrase 'no financial problems, only mental problems' in the context of financial management?

-This phrase suggests that many financial challenges faced by companies are often due to poor decision-making or lack of focus, rather than actual financial hardship. Mental obstacles like procrastination and denial often prevent business owners from addressing issues in a timely manner.

What role does focus play in managing a business's finances?

-Focus is crucial for financial management because it helps prioritize tasks, allocate resources properly, and ensure that the company remains on track financially. A lack of focus leads to poor decisions that can damage the business.

What is 'pró-labore' and why is it important for business owners?

-'Pró-labore' is the salary paid to business owners or partners. It is essential because it provides a fixed income that covers personal expenses, and helps separate personal finances from business finances, which is key for proper financial management.

What risks arise from setting the wrong price for a product or service?

-Setting the wrong price can lead to a loss of customers and reduced profits. If the price is too high, customers may not buy the product, and if it’s too low, the business may not cover its expenses, leading to financial losses.

How does understanding the cost structure of a company help in pricing decisions?

-By knowing the exact costs involved in producing and delivering a product or service, a business can set a price that ensures profitability. It also helps avoid underpricing, which can negatively impact the company’s sustainability.

Why should business owners track their finances regularly?

-Regular tracking helps identify issues early, manage cash flow, and ensure that expenses are under control. It allows business owners to make informed decisions and avoid financial crises.

What are the essential qualities for managing a business's finances effectively?

-The essential qualities include discipline, organization, focus, and the ability to document and analyze financial information. These help ensure that financial decisions are made based on reliable data and not on assumptions or guesswork.

What does the speaker mean by 'there is no middle ground in financial management'?

-The speaker emphasizes that in financial management, there is no room for half-hearted efforts. Businesses must either be fully committed to managing their finances effectively or risk failure. Financial management requires dedication and clear, informed decision-making.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

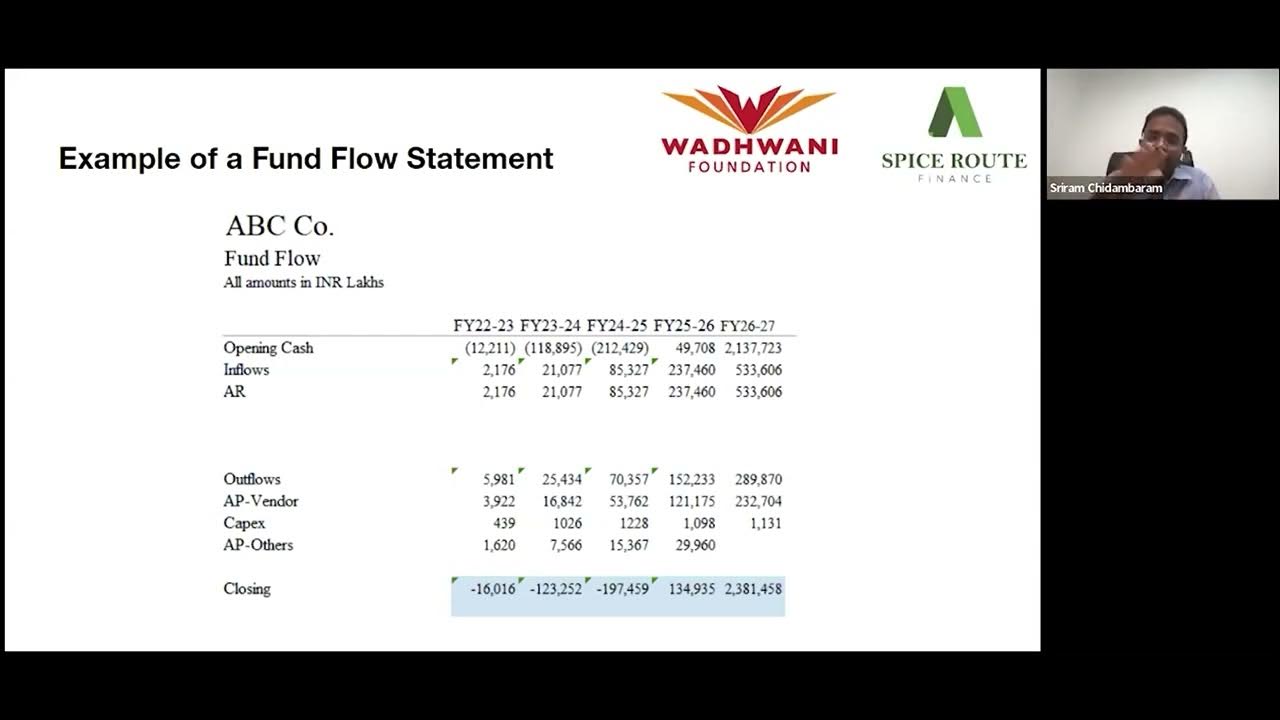

Week 9 Masterclass Sriram Chidambaram Crucial Financial Insights for Startups Success

Video-2 Mengenal Pencatatan Keuangan | Program CAMELIA

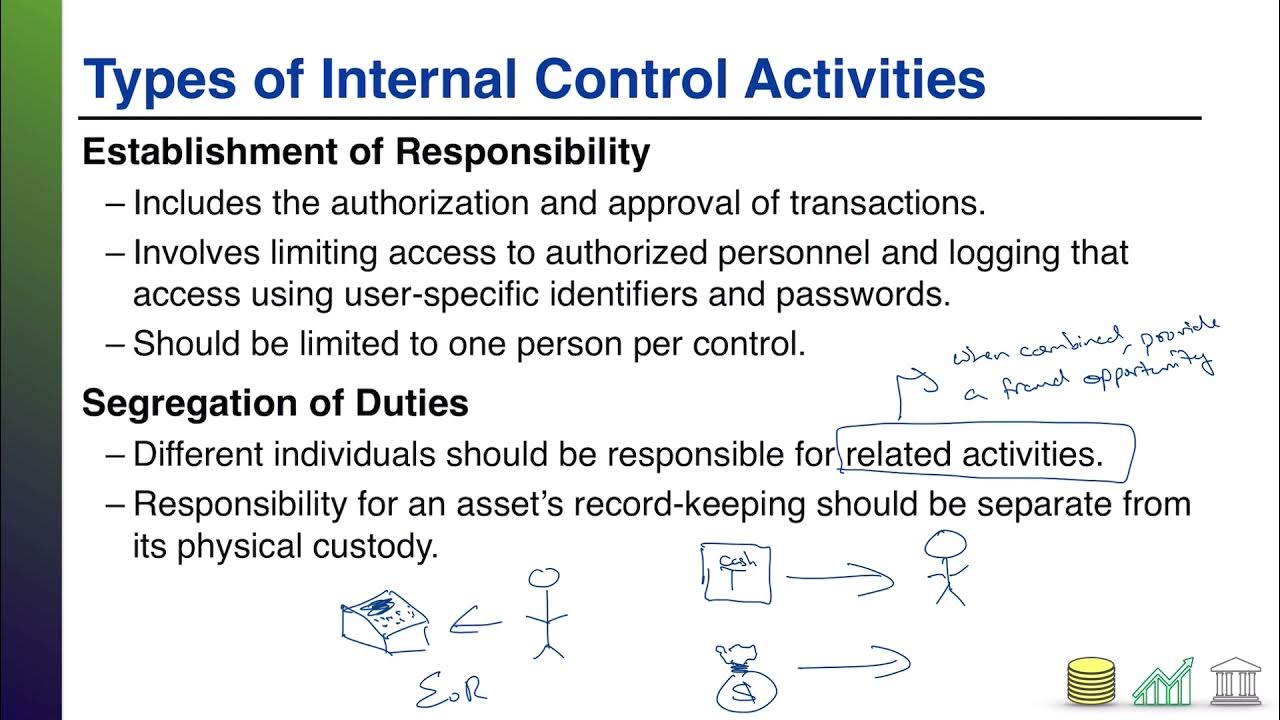

Types of Internal Control Activities

Entrepreneurship New Ventures and Business Ownership Dr George Mochocki

After I Read 40 Books on Business - Here’s What Will Make You Rich

ISO 14001 Aspects & Impacts Simplified

5.0 / 5 (0 votes)