MENTZEN O PODATKACH #6: Opodatkowanie kryptowalut

Summary

TLDRThis video script delves into various strategies for dealing with cryptocurrency taxes. It explores countries with favorable tax policies such as Germany, Portugal, and Malta, and offers insights on how to legally avoid or delay taxes. One key strategy involves moving to a tax-friendly country, while another focuses on using stablecoins to defer tax payments. The speaker emphasizes the importance of consulting local tax professionals before making decisions and highlights how these strategies can help crypto traders manage their tax liabilities efficiently.

Takeaways

- 😀 Germany offers favorable tax treatment for cryptocurrency holders, particularly for those living close to the border with Poland.

- 😀 Portugal also provides tax benefits for individuals holding cryptocurrencies for at least 12 months, with no tax on sales during this period.

- 😀 Georgia, Singapore, Monaco, and Malta are other countries that have favorable tax laws for cryptocurrency investors.

- 😀 Before selling cryptocurrencies in any country, it is essential to consult with local tax advisors or legal professionals to ensure compliance with regulations.

- 😀 If moving abroad to avoid cryptocurrency taxes, it's crucial to follow legal procedures and invest in local legal advice from experts familiar with the tax laws in the new country.

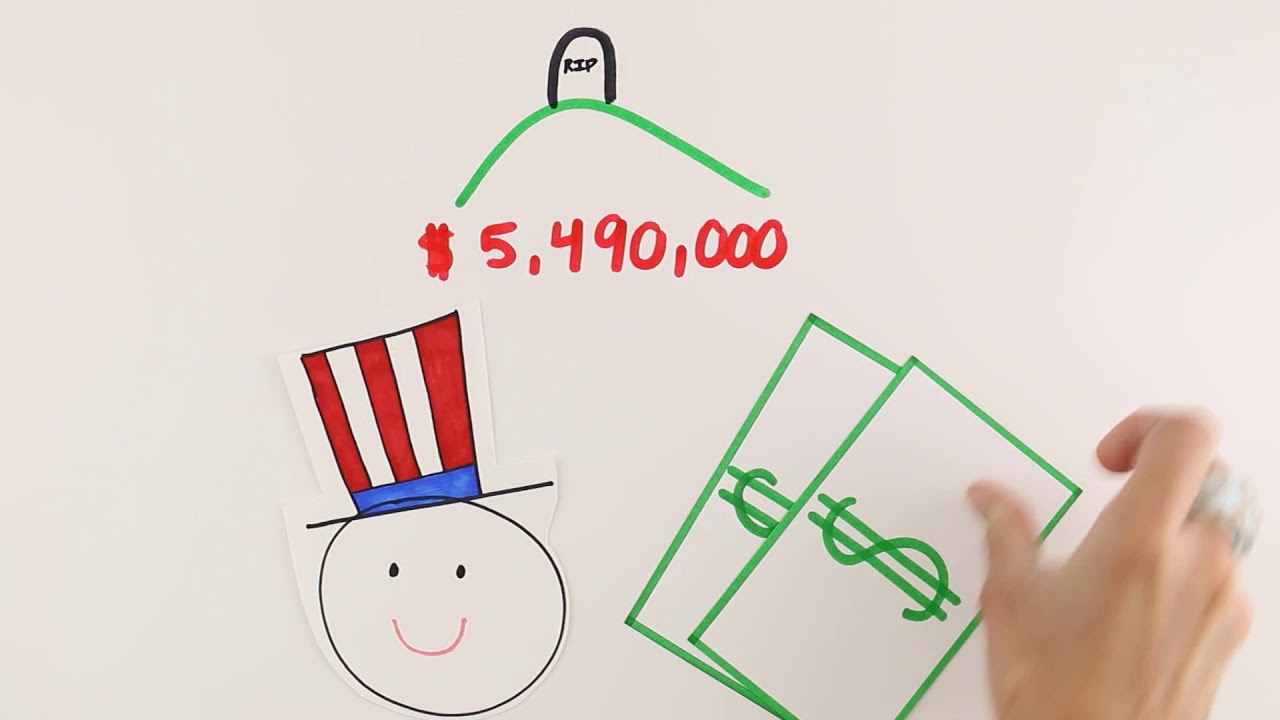

- 😀 In Poland, a tax deferral strategy can be used by buying stablecoins like Tether at the end of the year and selling them at the beginning of the next year, effectively delaying taxes.

- 😀 This deferral strategy can be repeated over multiple years, potentially reducing the impact of inflation on the tax burden or making the tax problem disappear over time.

- 😀 Stablecoins can be used as a tool to postpone taxes on cryptocurrency gains, as their value remains stable and can help manage tax timing.

- 😀 It’s crucial to ensure that the appropriate legal documentation and declarations are submitted when deferring taxes to avoid any potential issues with tax authorities.

- 😀 The speaker emphasizes that while tax laws around cryptocurrency are becoming stricter, there are still legal methods available to reduce or defer taxes if planned carefully.

Q & A

What are some countries with favorable tax regulations for cryptocurrency holders?

-Some countries with favorable tax regulations for cryptocurrency holders include Germany, Portugal, Georgia, Singapore, Monaco, and Malta. These countries either have no taxes on cryptocurrency or provide favorable tax treatments for long-term holders.

How does the tax treatment of cryptocurrencies differ in Germany compared to Poland?

-In Germany, there is a tax advantage for long-term holders. If you hold cryptocurrencies for over 12 months, you do not pay taxes on the gains. In contrast, Poland taxes cryptocurrency profits unless a tax deferral strategy is used, such as buying stablecoins to delay the tax liability.

What tax advantages does Portugal offer for cryptocurrency holders?

-Portugal follows similar tax rules as Germany. If cryptocurrencies are held for at least 12 months, there are no taxes on the profits when they are sold.

Why is Georgia considered a good country for cryptocurrency taxation?

-Georgia has favorable tax laws for cryptocurrencies. It is a tax-friendly jurisdiction where cryptocurrencies are not heavily taxed, making it an attractive option for crypto traders and investors.

What is the strategy suggested to avoid paying taxes on cryptocurrency in Poland?

-The suggested strategy involves deferring the tax payment by buying a stablecoin (such as Tether) at the end of the year and selling it in the next year. This allows you to delay the tax payment to the following year, reducing the immediate tax burden.

How can one use stablecoins to delay cryptocurrency taxes?

-To delay taxes, you can buy stablecoins at the end of the year, sell them at the beginning of the next year, and report no gains. By doing this repeatedly, you can defer taxes for years while the value of your taxable amount may decrease due to inflation.

What is the significance of consulting a local tax lawyer when changing tax residency for cryptocurrency transactions?

-Consulting a local tax lawyer is crucial when changing tax residency to ensure compliance with the tax laws of the new country. A lawyer specializing in cryptocurrency taxation can help you navigate local regulations and ensure that all formalities are properly followed.

What are the potential long-term effects of using stablecoins to defer taxes?

-By using stablecoins to defer taxes, you can extend the period before paying taxes on your gains, potentially for many years. However, inflation may reduce the value of your taxable amount over time, and the tax liability may eventually be significantly reduced or eliminated.

What is the importance of formal tax planning when dealing with cryptocurrency investments?

-Formal tax planning is important because it ensures that you comply with tax regulations while taking advantage of legal methods to minimize or defer taxes. Without proper planning, you may face penalties or unexpected tax liabilities, which can be avoided by consulting with tax professionals.

What are the risks of trying to avoid cryptocurrency taxes without professional advice?

-The risks of avoiding cryptocurrency taxes without professional advice include the possibility of non-compliance with local tax laws, which can result in legal penalties, fines, and retroactive tax assessments. It is important to consult with tax professionals to ensure you are taking legal and proper steps.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

3 Simple Crypto Tax Hacks The IRS Want You To Ignore

Types of Taxes in the United States

Videoaula 2.1.1 - Unidade 2 - Direito Aplicado à Gestão de Negócios - Prof. Aldemir Berwig

Administrasi Pajak Kelas 11 Akuntasi - Fungsi dan Jenis-jenis Pajak - SMK Doa Bangsa | Mauly N.

How This Crypto Trader Just Made a Million (In Bear Market)

Don't Lose Your CRYPTO Gains! TOP TIPS When Exiting!!

5.0 / 5 (0 votes)