MEIO MILHÃO EM AÇÕES DE DIVIDENDOS E COM CAIXA ROBUSTO! Análise de carteiras

Summary

TLDRIn this YouTube video, the host presents an analysis of a portfolio from a channel member named Fabiano, who has an invested value of R$30,000 with a significant capital gain. The portfolio is focused on a strategy involving only six high-quality, diversified assets, primarily consisting of stocks and direct treasury bonds. The host appreciates the simplicity and effectiveness of the strategy, which aligns with the 'Mariana Previdência' approach. He suggests adding a commodity stock for further diversification, given Fabiano's substantial cash position. The host also reviews the portfolio's performance, noting its potential to generate substantial passive income, and commends Fabiano's methodical buying in small increments to capture different price levels.

Takeaways

- 🎥 The video is a part of a series called 'análise de carteiras' where the host analyzes the investment portfolios of their channel members.

- 📈 The host discusses a portfolio with an asset value of over one million reais, emphasizing that strategy is more important than the size of the portfolio.

- 👤 The portfolio belongs to a person named Fabiano, who has invested R$ 30,000 with a nearly R$ 560 gross balance, showing a capital gain.

- 💼 The portfolio is focused and follows a strategy that the host refers to as 'Estratégia Marceliana Previdenciária', which is based on a set of conservative investment choices.

- 📊 The portfolio consists mainly of stocks and direct treasury bonds, which the host suggests could be considered as a 'cash reserve'.

- 🔢 The portfolio is composed of six high-quality diversified assets, which the host finds appropriate given the size of Fabiano's portfolio.

- 💡 The host suggests adding another asset to the portfolio, possibly a more 'pure' commodity stock like Vale, Gou or Petrobras, depending on Fabiano's risk appetite.

- 📉 The host notes that the portfolio's yield (YC) is quite interesting, with most assets yielding above 6%, and some even above 10%.

- 💰 The host estimates that the portfolio could generate nearly R$ 40,000 by the end of the year, based on current performance and expected dividend announcements.

- 📅 The host mentions that most of the strong dividend announcements for the portfolio are expected towards the end of the year.

- 📝 The host appreciates Fabiano's method of buying in tranches, which helps to average out the purchase price over different levels.

Q & A

What is the main topic of the video?

-The main topic of the video is an analysis of a portfolio belonging to a member named Fabiano, which is part of a series called 'análise de carteiras' on the YouTube channel.

What is the value of Fabiano's investment in his portfolio?

-Fabiano has invested approximately R$ 30,000 in his portfolio, with a nearly R$ 560 balance, indicating a capital gain.

What is the focus of Fabiano's portfolio according to the video?

-Fabiano's portfolio is focused on a strategy, primarily consisting of actions and direct treasury bonds, which the speaker refers to as a 'caixa' or cash reserve.

How many assets does Fabiano's portfolio contain?

-Fabiano's portfolio contains six assets, which are of high quality and well diversified.

What type of assets are included in Fabiano's portfolio?

-The portfolio includes a proportionally larger amount in TAES (Tesouro Direto), exposure to energy companies with TRPL, financial sector with BBAS and BB Seguridade, and insurance companies like Comot and CLBIN.

What is the speaker's suggestion for diversifying Fabiano's portfolio further?

-The speaker suggests adding another company that could be considered a 'commodity purer' such as Vale or Petrobras, depending on Fabiano's risk appetite and the current attractive prices of commodity companies.

What is the speaker's opinion on the number of assets in Fabiano's portfolio?

-The speaker believes that while the portfolio is concentrated with six assets, it could potentially include more, suggesting a range of eight to ten assets, considering the size of Fabiano's portfolio.

What is the speaker's view on the performance of Fabiano's portfolio?

-The speaker finds the portfolio's performance interesting, with most of the assets yielding above 6%, and some like TAESA yielding over 10%.

What does the speaker suggest as a potential addition to Fabiano's portfolio given his current cash position?

-The speaker suggests that Fabiano could add another stock to his portfolio, as he has a significant cash position, and could afford to invest an additional R$ 45,000 without any issues.

What is the speaker's advice for viewers regarding portfolio management?

-The speaker advises viewers to focus on the 'obvious' investments, as demonstrated by Fabiano's portfolio, regardless of the size of their wealth, and to use Fabiano's portfolio as a mirror for their own investment strategy.

What is the estimated potential passive income from Fabiano's portfolio by the end of the year?

-The speaker estimates that Fabiano's portfolio could generate nearly R$ 40,000 or slightly more by the end of the year, considering upcoming dividend announcements.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

ÓTIMA EXPOSIÇÃO INTERNACIONAL, ALÉM DE BOAS ESCOLHAS DE DIVIDENDOS! Análise de carteiras

Assisted Living Facility, Million Dollar Assisted Living Business with Entrepreneur Tomika Turner

B Inggris 9 Unit 3 Teks Naratif

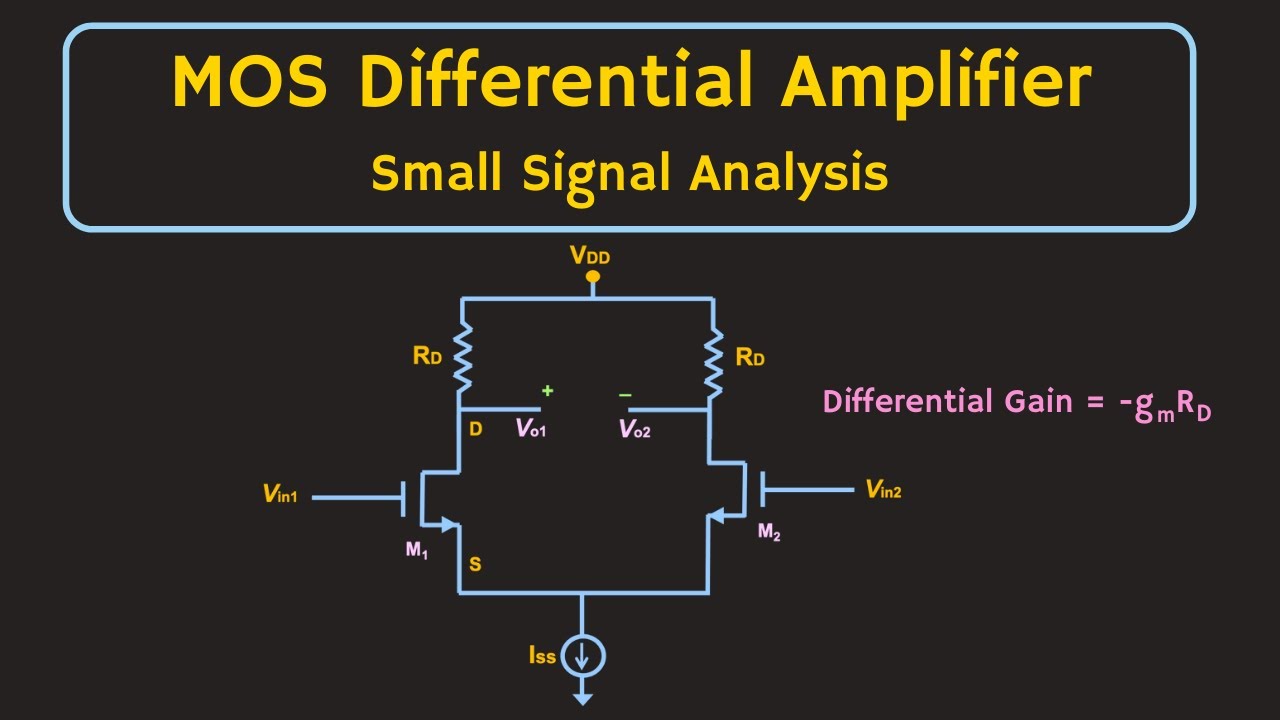

MOSFET - Differential Amplifier (Small Signal Analysis)

Best Growth Stock to Buy for 2025 and Beyond: The Trade Desk or Roku? | TTD Stock | ROKU Stock

Fundamentals of Stock Analysis | A step-by-step process to analyse stocks #StockMarket

5.0 / 5 (0 votes)