Hindari MONEY MISTAKES ini Agar Bebas Finansial di 2025!

Summary

TLDRIn this video, Dodi shares the importance of saving money, arguing that it's not about how much you earn but about your saving habits and discipline. He discusses how many people, like Mike Tyson and Johnny Depp, have lost fortunes due to uncontrolled lifestyles, while others, like Andrew Helm and Pak Samuel Rey, have achieved financial freedom through consistent saving. Dodi emphasizes that saving allows for financial security, more time for personal pursuits, and the ability to handle unexpected financial situations. He concludes by urging viewers to adopt saving habits for long-term success.

Takeaways

- 😀 Saving rate, or the percentage of income saved each month, is the key factor in achieving financial independence quickly.

- 😀 Living simply and avoiding flashy displays of wealth is a smart financial strategy that leads to real wealth, not just appearances.

- 😀 Money should not be a tool for showing off success or status; it should be used to buy time and reduce stress.

- 😀 A solid emergency fund is crucial to avoid financial stress when unexpected expenses arise. It provides security and peace of mind.

- 😀 Having a proper emergency fund means protecting yourself from financial surprises and preventing debt accumulation.

- 😀 Time is the most valuable asset you can have. Saving and investing money can give you more time for the things that truly matter in life.

- 😀 Money, when managed wisely, works for you over time. Saving and investing allow your wealth to grow passively, freeing up more time.

- 😀 Financial independence doesn't come from high income alone but from smart saving and disciplined habits.

- 😀 Small habits, like saving a little each day, can lead to significant financial growth over time, just like a snowball effect.

- 😀 The importance of patience, prioritization, and independence in personal finances can be learned through consistent saving habits.

Q & A

Why is saving more important than earning a higher income?

-Saving is crucial because, regardless of how much you earn, without the habit of saving, your money will still disappear quickly. A high saving rate determines how quickly you can achieve financial freedom.

What is the concept of saving rate, and why is it important?

-The saving rate is the percentage of your income that you save. It is important because a higher saving rate accelerates the journey toward financial independence. For example, saving 50% of your income could lead to financial freedom in just 17 years.

How can living simply contribute to building wealth?

-Living simply allows you to avoid unnecessary expenses, thereby saving more money for investments. Many wealthy people prioritize growing their wealth rather than displaying it through luxury items, which helps them build real financial security.

What mistake do many people make when trying to look wealthy?

-Many people fall into the trap of spending excessively on luxury items or showing off their wealth. This lifestyle can lead to financial ruin, as seen with figures like Mike Tyson and Johnny Depp. True wealth is built on simple living and wise saving habits.

Why is it important to understand your relationship with money?

-Understanding your relationship with money helps shape how you use it. If you view money as a way to prove success or seek revenge on past hardships, you may end up spending recklessly, leading to stress. Instead, money should be viewed as a tool to buy time and freedom.

How does money serve as a tool for buying time?

-Money can buy time by allowing you to reduce work hours or hire services, giving you more time for meaningful activities, such as spending time with family or pursuing hobbies. It's not about buying material goods, but gaining the freedom to live life on your terms.

What is an emergency fund, and why is it essential?

-An emergency fund is money set aside to cover unexpected expenses, such as health issues or urgent repairs. Having one provides financial security and reduces stress, preventing you from going into debt when surprises arise.

How much should you set aside for an emergency fund?

-It is recommended to save 3 to 6 months' worth of expenses for singles, and 6 to 12 months for those with families. This fund should be kept in safe, accessible accounts to avoid financial strain during emergencies.

What are some safe places to store an emergency fund?

-An emergency fund should be stored in safe and stable instruments like savings accounts or low-risk investments. Avoid putting it into high-risk options like stocks or cryptocurrencies, as they may lose value when you need the funds most.

How can small daily habits, like saving, lead to big financial changes?

-Small habits, such as saving just a little every day, can compound over time. For example, saving a small amount daily can result in significant growth over the years. It also helps develop patience, prioritization, and financial independence.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

12 Tanda Kamu Diam Diam Mulai Kaya!

How To Become So Self-Disciplined It Feels Illegal

How To Actually Become Disciplined WITHOUT willpower… | The Leading Behaviour Expert Chase Hughes

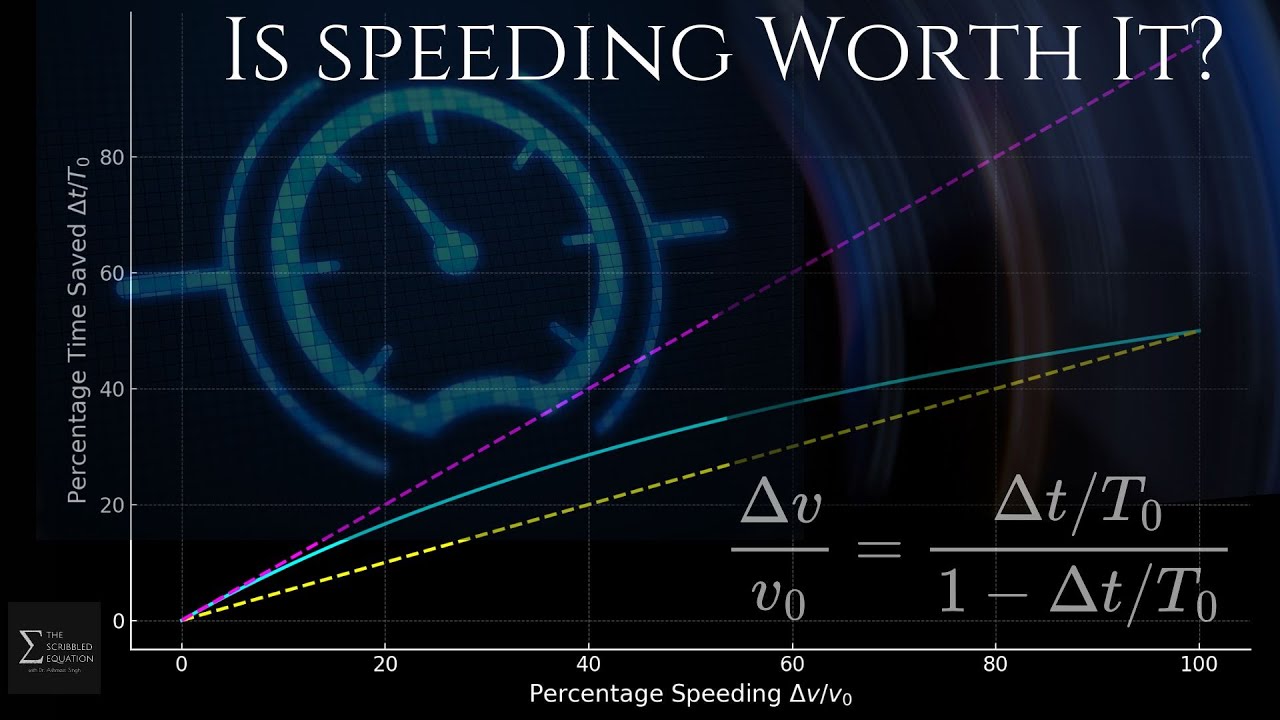

The Math Behind Speeding: More is Less

Lima Tips Kami Untuk Mengatur Cashflow Bulanan

FIQUE RICO INVESTINDO NA POUPANÇA!

5.0 / 5 (0 votes)