Business Regulatory Framework: Module 3.1

Summary

TLDRThis educational lecture provides a comprehensive introduction to negotiable instruments, specifically focusing on the Bills of Exchange Act, 1881, and related concepts. It covers key topics such as the legal definitions, characteristics, and types of negotiable instruments, including promissory notes and bills of exchange. The speaker emphasizes their importance in business transactions and the legal framework established by the Indian Contract Act, 1872. Detailed explanations on the features of negotiable instruments, such as unconditional promises, writing requirements, and transferability, make this session crucial for students seeking to understand business law and legal documentation in India.

Takeaways

- 😀 The Negotiable Instruments Act, 1881, regulates financial instruments like Bills of Exchange and Promissory Notes in India.

- 😀 A **Promissory Note** is a written, unconditional promise by one party to pay a specified sum of money to another party.

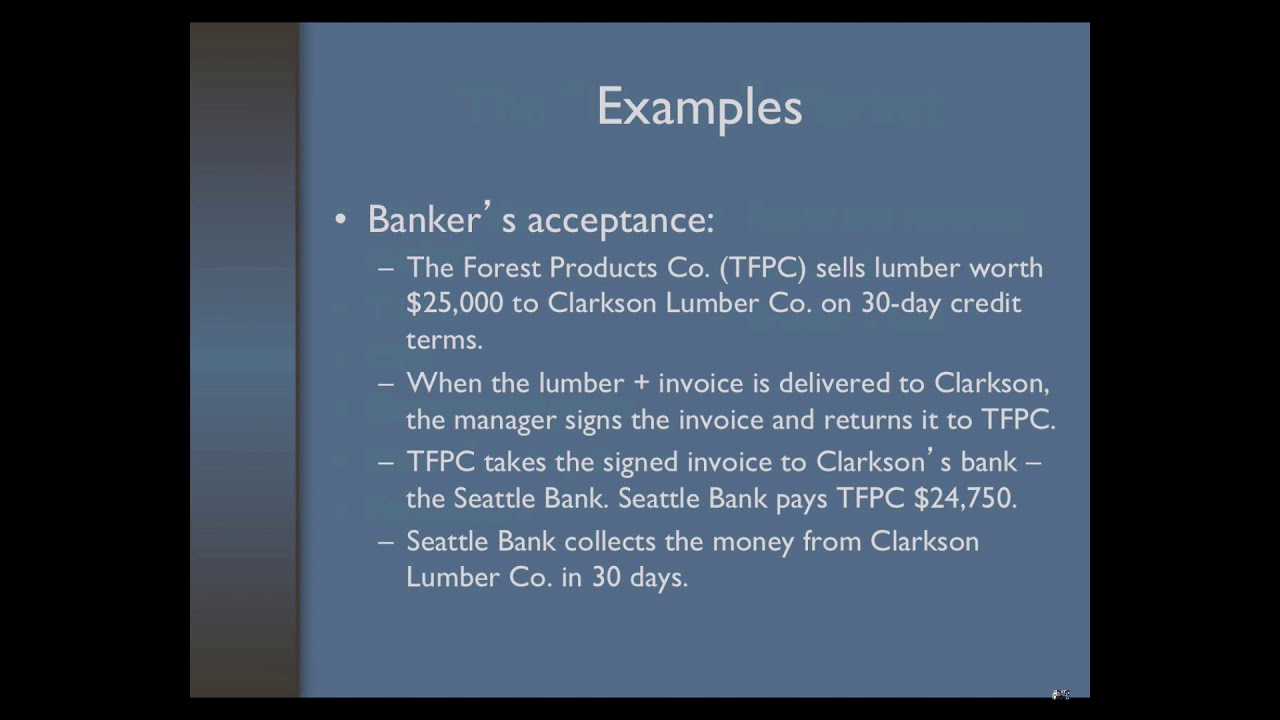

- 😀 **Bills of Exchange** are formal orders for payment and differ from Promissory Notes in terms of issuance and transfer.

- 😀 Key features of negotiable instruments include being **written**, **transferable**, and representing a **fixed amount** of money.

- 😀 The **Negotiable Instruments Act** governs the **transfer** of these instruments, ensuring that ownership passes to the holder upon endorsement.

- 😀 For a Promissory Note to be valid, it must be **signed** by the maker and specify a **clear date** and **amount**.

- 😀 A negotiable instrument must be **unconditional**; if there are conditions attached, it is not valid under the act.

- 😀 The instrument must be **endorsed** (signed by the holder) for it to be transferred legally.

- 😀 The **Promissory Note** must specify the **payee**, which can be a person or their order, and the payment amount must be fixed.

- 😀 Various **legal provisions** ensure that negotiable instruments are enforceable, including those related to disputes, endorsements, and maturity dates.

Q & A

What is the *Negotiable Instruments Act, 1881*, and why is it important in commerce?

-The *Negotiable Instruments Act, 1881* governs negotiable instruments in India, such as promissory notes, bills of exchange, and cheques. It is essential in commerce because it provides a legal framework for the transfer and payment of these instruments, ensuring their validity and enforceability.

What are negotiable instruments, and what makes them legally significant?

-Negotiable instruments are written documents that promise or order the payment of a specific amount of money to a specified person or bearer. They are legally significant because they can be transferred from one person to another, thereby transferring ownership and rights to the money mentioned in the instrument.

What is a *promissory note*, and what are its key features?

-A *promissory note* is a written promise by the maker to pay a specific sum of money to a person or their order at a predetermined date. Key features include it being written, signed by the maker, containing an unconditional promise to pay, and specifying the amount to be paid.

How does the *Negotiable Instruments Act, 1881* apply across India?

-The *Negotiable Instruments Act, 1881* applies throughout India, including Jammu and Kashmir. It sets out the legal requirements for creating, transferring, and enforcing negotiable instruments in commercial transactions.

What are the legal provisions related to the *Negotiable Instruments Act, 1881*?

-The Act contains several sections defining the terms, characteristics, and transferability of negotiable instruments. Notably, Section 13A and Section 118 deal with the specific definitions and provisions regarding negotiable instruments and their transfer.

What does it mean that negotiable instruments are transferable?

-Transferability means that the holder of a negotiable instrument can transfer the ownership and rights to receive payment to another person, typically through endorsement or delivery. This transfer of rights makes the instrument a valuable tool in commerce.

What are the essential characteristics of a *promissory note* under the *Negotiable Instruments Act, 1881*?

-The essential characteristics of a *promissory note* include: it must be in writing, it must contain an unconditional promise to pay a specific amount, it must be signed by the maker, and the amount to be paid must be clearly specified.

What is the difference between a *promissory note* and other negotiable instruments, such as a bill of exchange?

-A *promissory note* involves a direct promise to pay a certain sum, whereas a *bill of exchange* is an order from one party to another to pay a specified sum. In a promissory note, the maker is obligated to pay, while in a bill of exchange, the drawee is required to pay.

Why is a *promissory note* considered an unconditional promise, and how does this affect its validity?

-A *promissory note* is considered an unconditional promise because it does not contain any conditions or contingencies for payment. This ensures that the instrument is legally binding and enforceable without needing to meet any further requirements.

How do the features of a negotiable instrument, like a *promissory note*, support business transactions?

-The features of a negotiable instrument, such as transferability, unconditional promise, and written form, ensure security and liquidity in business transactions. These instruments act as reliable and flexible payment methods, ensuring that money or obligations can be easily transferred between parties.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Global Financial Instruments I

চেকের মামলা | এন আই অ্যাক্টের ১৩৮ ধারার মামলা | Case under section 138 of NI Act | Cheque Dishonour

EKMA4115 Pengantar Akuntansi - Akuntansi Untuk Perusahaan Persekutuan dan Perseroan

Collision and Ionization process |Breakdown of Gas |High Voltage Engineering #highvoltage #viral

Bab 3 Tekanan Hidrostatis | Tekanan Zat Cair IPA part 2 kelas 9 Kurikulum Merdeka #ipakelas7

Contacts

5.0 / 5 (0 votes)