Day Trading Watchlist for MONDAY

Summary

TLDRIn this episode, the trader outlines their game plan for a holiday-shortened week, focusing on high-volume, news-driven stocks. With the market closed for Christmas Day and lighter volume expected, they plan to trade early, build a cushion, and focus on stocks in the $5-$10 range. The trader emphasizes scanning for stocks with strong catalysts, avoiding light-volume stocks, and being cautious about speculative trades. They also encourage new traders to join their community with a New Year promotion, promising daily trading insights and strategies to maximize profits even in a quieter market.

Takeaways

- 😀 The upcoming week is expected to be lighter due to market holidays on Wednesday for Christmas Day and next Wednesday for New Year's Day.

- 😀 The market has been strong recently, with traders focusing on stocks with clear momentum and follow-through potential.

- 😀 The trader had a solid week, finishing with a $99,000 profit on Friday, despite slower action later in the day.

- 😀 A major trade last week was on MVNI, which was a Blue Sky setup with big gains despite initial losses earlier in the day.

- 😀 Despite several stocks closing strong, none of the top gainers from Friday’s session look promising for Monday morning trades.

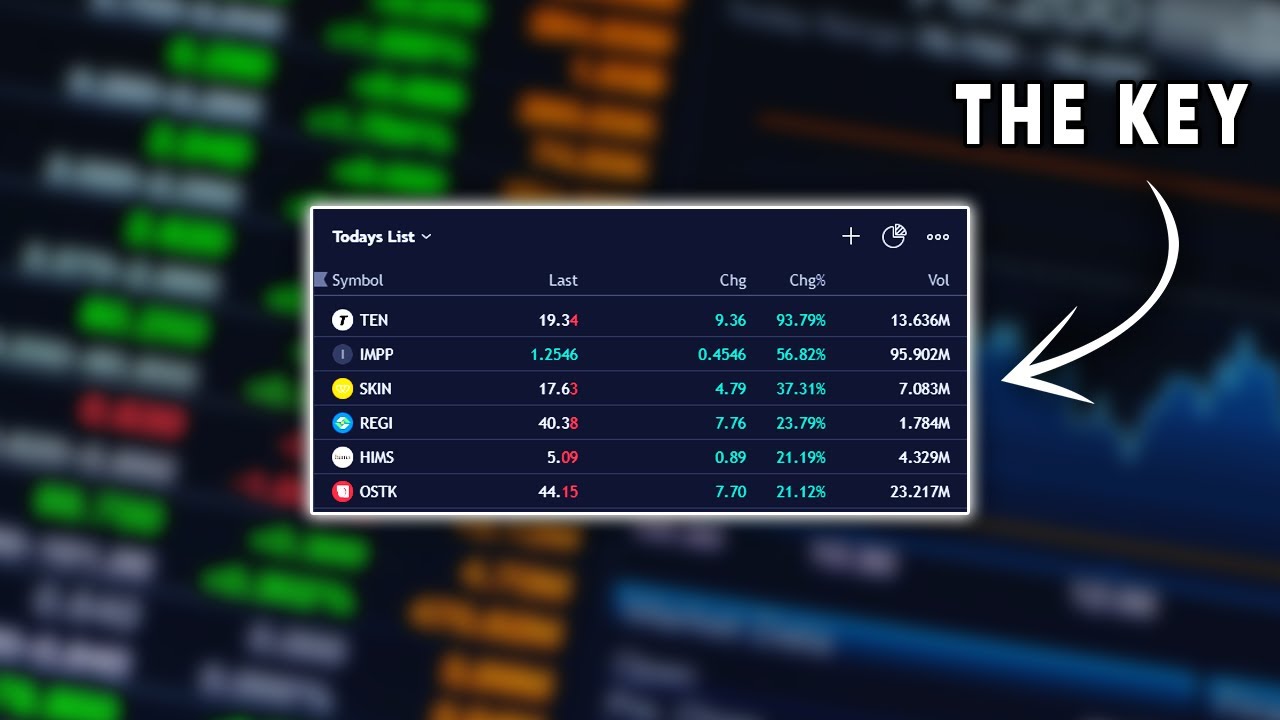

- 😀 The trader plans to focus on fresh stocks with volume and obvious catalysts to guide Monday’s trades.

- 😀 International stocks might be in focus for early morning trades, especially those with breaking news released outside of U.S. market hours.

- 😀 The trader plans to be aggressive early in the day, building a cushion and sizing up quickly to maximize profits during the first trading hours.

- 😀 The market may experience lighter volume this week due to holiday travel and fewer traders in action, so caution is advised when trading.

- 😀 The trader emphasizes managing risk carefully, especially during days with choppy or parabolic price movements that can lead to quick reversals.

- 😀 The trader is offering a two-week trial for new users, with access to scanners, news feeds, and live trading broadcasts, aiming to build a community of traders during the holidays.

Q & A

What is the user's general plan for the upcoming week?

-The user plans to focus on trading early in the day to build a cushion of profit. They will monitor top gainers and stocks with news catalysts, especially in the morning, before the market closes for Christmas on Wednesday. The user expects lighter volume around the holidays but will stay aggressive if there are good opportunities.

How did the user perform in the previous week?

-The user had a solid performance in the past couple of weeks, with some big green days and consistent profits. On Friday, they made $99,000 from several trades, including a final trade on MVNI, which was a blue sky setup.

What does the user think about MVNI's future performance?

-The user is unsure about MVNI's future performance. While it had a big rally on Thursday and Friday, they are uncertain about what to expect next. The stock is in a blue sky setup, meaning it has potential for significant movement, but its after-hours price decline makes them cautious.

What is the importance of the market holiday on Wednesday?

-The market holiday on Wednesday for Christmas Day will lead to lighter trading volumes and fewer opportunities for the week. The user notes that the market might be slower, with some traders taking time off or trading less seriously.

How does the user typically approach trading on lighter volume days like Christmas Eve?

-On lighter volume days like Christmas Eve, the user will take a more cautious approach, focusing on trades that show clear momentum and volume. They will still be active but expect fewer opportunities and more volatility.

What does the user mean by a 'blue sky setup'?

-A 'blue sky setup' refers to a stock that has no significant resistance ahead, meaning it can potentially keep rising because it is hitting new all-time highs. This can create opportunities for big price movements, but the user is cautious about these setups, as they can be unpredictable.

How does the user manage risk when trading high-priced stocks like NUKK?

-The user avoids trading high-priced stocks like NUKK due to their large price spreads, which make managing risk difficult. They prefer stocks in the $5 to $10 range, as these provide more manageable risk while still offering potential for significant profits.

What are the user's thoughts on trading stocks with no news catalysts?

-The user prefers trading stocks with clear news catalysts, as they provide a reason for the stock's price movement. While some stocks with no news have experienced large price movements, these trades are riskier and harder to manage, especially when there is no obvious reason for the rally.

How does the user plan to approach the market after Christmas and into the New Year?

-The user expects the market to be slow right after Christmas but anticipates more momentum as the New Year approaches. They believe that as the market transitions into 2024, there will be increased activity and opportunities for profitable trades.

What is the user's strategy for scanning for trading opportunities?

-The user plans to sit down early in the morning, around 6:45 AM, to review the top gainers scanner and assess which stocks are showing the most promise based on volume and price. They will focus on stocks with strong volume and clear catalysts, then evaluate the technical setup using charts and level two data.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

5.0 / 5 (0 votes)