Dari Mana Saja Sumber Pemasukan Negara ?

Summary

TLDRThis video script discusses Indonesia's recent tax regulation reforms, including the Harmonization of Taxation Laws (HPP), which aims to boost state revenue by 130 trillion Rupiah. The script explains key tax components such as Value Added Tax (PPN), Luxury Goods Tax (PPnBM), and Income Tax (PPh), with a focus on how these taxes contribute to national income. The government has increased taxes for high-income earners and redefined tax brackets. Other revenue sources like non-tax income (PNBP) and grants are also mentioned. The video highlights how paying taxes helps contribute to the nation's development and welfare.

Takeaways

- 😀 The Indonesian government passed a new law in October 2021 aiming to increase national revenue by 130 trillion Rupiah through tax reforms.

- 😀 The law focuses on harmonizing tax regulations and introduces new adjustments in income and luxury goods taxes.

- 😀 Taxes contribute to 82.5% of the total national revenue, with Value-Added Tax (VAT) and Income Tax (PPh) being key contributors.

- 😀 VAT of 10% applies to everyday purchases such as food, drinks, and groceries, with clear labels showing VAT included in the price.

- 😀 Luxury Goods Tax (PPNBM) applies to high-end items like luxury homes, cars, airplanes, and yachts, with rates ranging from 10% to 75%.

- 😀 High-value items like luxury homes, weapons, and airplanes are subject to PPNBM at varying rates, with some reaching as high as 75%.

- 😀 Income tax (PPh) is a significant revenue source, with PPh 21 applying to salaries, wages, and other employment-related income.

- 😀 Recent tax reforms increase PPh 21 for the wealthy, raising the rate for individuals earning over 5 billion Rupiah annually from 30% to 35%.

- 😀 The government aims to make the tax system more equitable by adjusting tax brackets, such as raising the threshold for the 5% income tax from 50 million Rupiah to 60 million Rupiah annually.

- 😀 In addition to taxes, non-tax revenues (PNBP) and grants contribute to national income, with PNBP projected at 298.2 trillion Rupiah in 2021 and grants at 900 billion Rupiah.

- 😀 By paying taxes, individuals play an essential role in supporting national development and government programs aimed at improving public welfare.

Q & A

What is the main goal of the recently passed Harmonization of Tax Regulations Law in Indonesia?

-The main goal is to increase the state revenue by approximately 130 trillion Rupiah through the implementation of new tax regulations.

What are the three primary sources of state revenue in Indonesia according to the script?

-The three primary sources of state revenue are taxes, non-tax revenue (PNBP), and grants.

How much of Indonesia's total state revenue comes from taxes?

-Taxes contribute 82.5% of the total state revenue in Indonesia.

What is Value Added Tax (PPN) and what is its general rate in Indonesia?

-Value Added Tax (PPN) is a tax applied to goods and services, generally at a rate of 10% in Indonesia.

How does the tax rate on luxury goods (PPnBM) vary in Indonesia?

-The tax rate for luxury goods (PPnBM) varies between 10% and 200%, depending on the item. For example, luxury homes and yachts are taxed at up to 75%, while goods like firearms and airplanes are taxed at even higher rates.

What change was made to the PPh 21 tax rate for high-income earners under the new law?

-The PPh 21 tax rate for individuals earning over 5 billion Rupiah annually was increased from 30% to 35%.

What was the previous threshold for PPh 21 tax at the lowest rate, and how has it changed?

-Previously, individuals earning 50 million Rupiah per year were subject to the lowest PPh 21 rate of 5%. The new law raises this threshold to 60 million Rupiah per year.

How much did non-tax revenues (PNBP) contribute to Indonesia's budget in 2021?

-Non-tax revenues (PNBP) were projected to contribute 298.2 trillion Rupiah to Indonesia's budget in 2021.

What was the amount of grants that contributed to Indonesia's state revenue in 2021?

-Grants contributed 900 billion Rupiah to Indonesia's state revenue in 2021.

What is the significance of paying taxes for citizens, according to the video?

-Paying taxes is seen as a contribution to building Indonesia and supporting national development for the collective welfare of the country.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

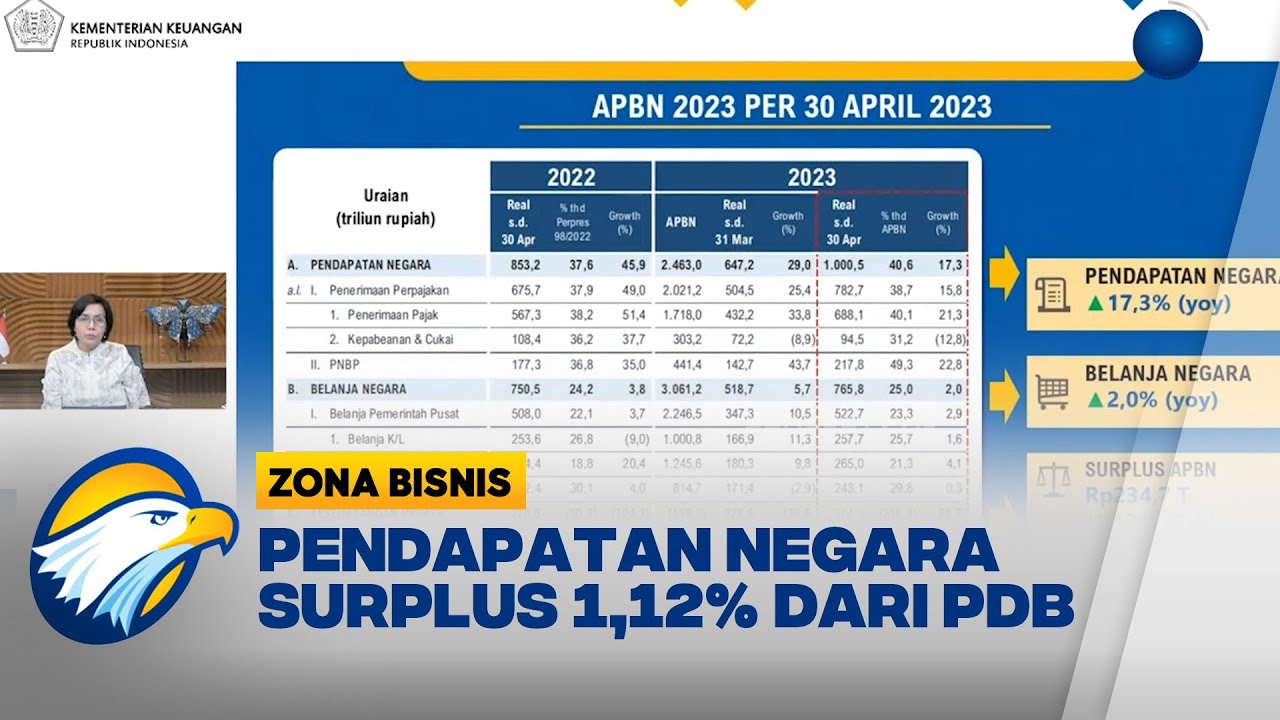

APBN Surplus Rp234,7 Triliun pada 2023

Natura dan Kenikmatan Kena Pajak, Apa Saja Yang Kena dan Tidak kena Pajak?

Pendapatan Negara Semester 1 2024 Tembus 47,1% - [Zona Bisnis]

PPh Pasal 24: Pengertian, Subjek dan Objek, Cara Pelaksanaan Kredit, dan Studi Kasus

Understanding Pakistan's Federal Budget 2024-25

Tepatkah Menerapkan Kenaikan PPN jadi 12 Persen di Awal 2025?

5.0 / 5 (0 votes)