Why I Completely Changed My Nvidia 2025 Prediction..¨- Tom Lee

Summary

TLDRIn this conversation, Tom Lee, managing partner at Fundstrat, discusses the historic post-election market rally, attributing it to both drisking into the election and optimism over deregulation and pro-business policies. He highlights Tesla's undervaluation due to its AI and intellectual property and introduces Fundstrat's new thematic ETF, the Granny Shots ETF. Lee also touches on Nvidia's growth prospects amid rising hyperscaler demand. Additionally, concerns are raised over the slowing pace of generative AI progress, which could impact future technological advancements and stock valuations in the sector.

Takeaways

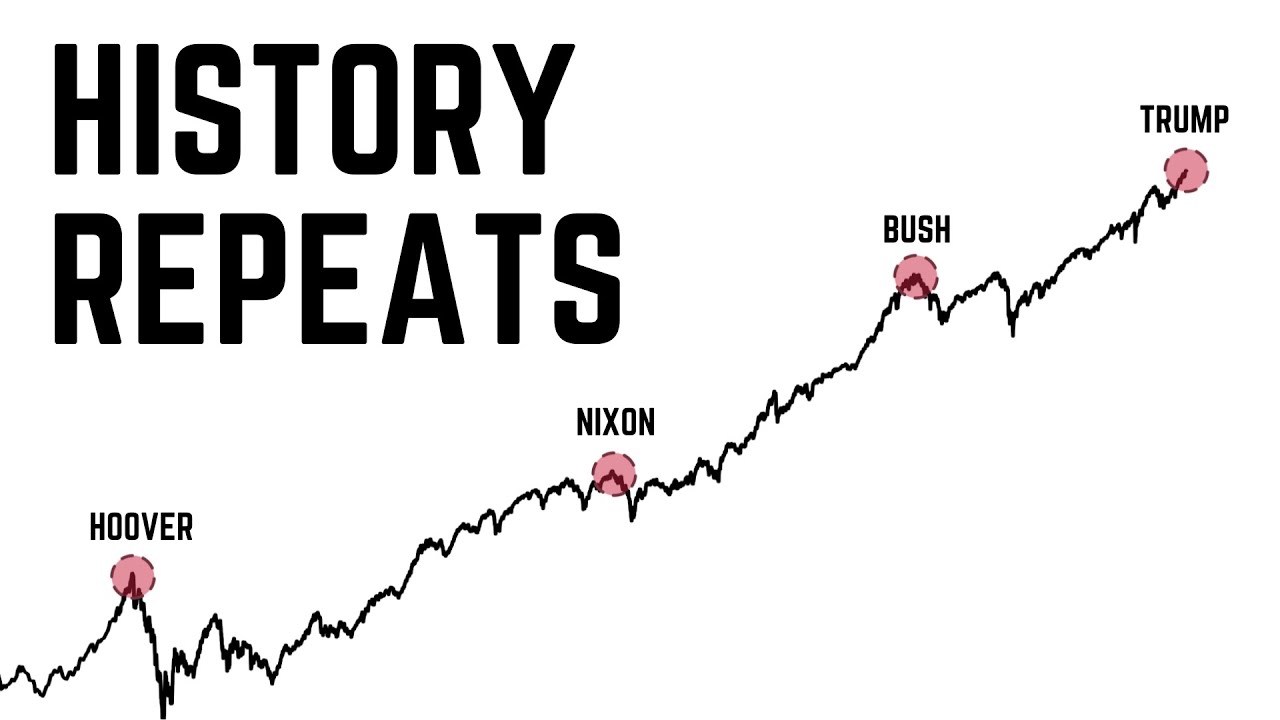

- 😀 The post-election rally saw a 3% increase, marking the best post-election move in history, reflecting investor optimism and a pro-business environment.

- 😀 De-risking into the election played a key role in the market surge, with many investors reducing exposure leading up to election day.

- 😀 The drop in the VIX, a volatility index, signals a major shift toward risk-taking in the market, with volatility now at much lower levels.

- 😀 There is still significant upside potential (5-10%) for the market heading into the end of the year, despite the rally.

- 😀 Tom Lee sees the market top not being caused by a recession or P/E problems but rather by exhausted market fuel or unhinged expectations.

- 😀 Investor sentiment, while improving, isn't overly extreme, suggesting that the market still has room to grow.

- 😀 The Granny Shots ETF, created by Fundstrat, focuses on large-cap stocks tied to key market themes such as AI, millennials, and deregulation.

- 😀 Tesla's role in the Granny Shots ETF is based on its undervalued AI capabilities and intellectual property, beyond its electric vehicle business.

- 😀 Despite being viewed primarily as a car maker, Tesla is considered undervalued due to its AI and robotics potential, including robotaxis and other innovations.

- 😀 Nvidia is considered a key stock, with its rapid growth driven by advancements in AI and chips like the Blackwell chip, making it a standout in the tech sector.

- 😀 The slowing progress in AI models, particularly with OpenAI, raises questions about the future trajectory of AI technology, potentially impacting Nvidia and similar companies.

Q & A

What was Tom Lee's perspective on the market's post-election rally?

-Tom Lee views the 3% move post-election as historically significant, calling it the best post-election rally. He believes this reflects investor optimism driven by potential deregulation, mergers, and a pro-business environment. He suggests the market could see 5-10% more upside through the end of the year.

What factors does Tom Lee believe contributed to the market's strong post-election performance?

-Tom Lee attributes the market's strong post-election performance to two key factors: first, the market had experienced a significant amount of 'drisking' (reducing risk) into the election, and second, there was a sense of optimism or 'animal spirits' unleashed by expectations of deregulation and a pro-business environment.

What is Tom Lee's take on the potential for a market top in the next 6 months?

-Lee acknowledges the possibility of a market top in the next 6 months, but he doesn't foresee it being caused by recession or issues with price-to-earnings ratios. Instead, he believes the top could come when either 'firepower is exhausted' or market expectations become unrealistic.

How does Tom Lee assess investor sentiment and the market's risk at the moment?

-Tom Lee believes investor sentiment is not at extreme levels, indicating that the market isn't overly risky. The VIX (Volatility Index) has collapsed, signaling reduced uncertainty. He feels that while the market is not in an extreme phase, investors should still remain cautious.

What is the 'Granny Shots' ETF and how is it constructed?

-The 'Granny Shots' ETF is based on Fundstrat’s research model and targets stocks correlated with key market themes, such as AI, Millennials, Fed easing, and improving PMIs. It focuses on stocks that appear frequently across these themes, and the ETF is named after Rick Barry’s unique style of shooting free throws.

Why is Tesla included in the Granny Shots ETF?

-Tesla is included in the Granny Shots ETF because it aligns with Fundstrat's research model, particularly due to its potential hidden assets like AI and intellectual property. Tom Lee believes Tesla is undervalued, viewing it not just as a carmaker but as a company with significant growth opportunities in areas like robotaxis and robotics.

What is Tom Lee's outlook on Tesla's value and growth prospects?

-Tom Lee believes Tesla is undervalued because its potential extends beyond being just a carmaker. He points to its AI capabilities and intellectual property, as well as new ventures like robotaxis and robotics, as reasons for its continued growth. Lee sees Tesla as a stock that will likely perform well in the long term.

How does Tom Lee compare Nvidia and Apple in terms of market performance?

-Tom Lee compares Nvidia and Apple by noting that while Nvidia's market cap is growing, it still has smaller revenues compared to Apple. However, Nvidia’s rapid growth, especially in the AI sector, makes it a more attractive stock for investors looking at future potential, despite its higher valuation.

What concerns does Tom Lee raise about the future of generative AI?

-Tom Lee refers to concerns that the progress of large language models (LLMs), particularly at OpenAI, may be slowing. He highlights that improvements from one model to the next are becoming smaller, which could have significant implications for the future of AI development and its potential impact on the economy.

How does Mark Andreessen view America's economic growth potential, and how does this relate to technology like AI?

-Mark Andreessen believes that America is an 'economic coiled spring' and that the country should be growing at 4-6% GDP annually. He suggests that AI and robotics could play a major role in driving this growth, but Lee also points out the challenge of achieving such growth without adequate labor, hinting that technology, particularly AI, might be the solution.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Tom Lee Said Market Will Explode On 2 January | Fundstrat's Stock Market Prediction

Tom Lee Just ENDED The Stock Market | URGENT

Tom Lee on Why There Is “Dry Powder” for a V-Shaped Stock Rally and $TSLA Is Exhibit A for This Move

It’s Happening Again.

Tom Lee: 7 Stocks to Buy BEFORE the Election

S&P 500 +2%, TESLA +14%: LA RISPOSTA del MERCATO alla VITTORIA di TRUMP!

5.0 / 5 (0 votes)