Interest Rates Are Soaring... How High Will They Go?!

Summary

TLDRIn this analysis of rising interest rates and inflation, the speaker argues that long-term rates are primarily driven by growth and inflation expectations rather than the supply of treasuries. Examining historical trends from 1980 to today, he suggests that while recent inflation spikes can be attributed to monetary supply increases during the pandemic, future inflation is likely to remain subdued. He predicts that the 10-year treasury yield may drop below 3% in the coming year, reflecting lower growth and inflation expectations. The discussion emphasizes the complexity of economic dynamics, particularly in the context of government spending and banking credit.

Takeaways

- 📈 Interest rates are rising, with mortgage rates exceeding 7% and treasury yields increasing significantly.

- 📊 The surge in mortgage rates equates to a 6% rise in home prices from a monthly payment perspective.

- 🔍 Two main factors drive long-term interest rates: the supply of treasuries and growth/inflation expectations, with the latter being more influential.

- 📉 Historical data shows that 10-year treasury rates closely follow growth and inflation expectations rather than treasury supply.

- 💵 U.S. federal government debt has increased dramatically from under $1 trillion in 1980 to around $35 trillion today.

- 📅 From 1980 to 2020, inflation has generally decreased even as government debt has increased.

- 📉 Recent consumer price inflation (2020-2024) was influenced by factors like increased M2 money supply and government spending.

- 💳 Bank credit saw a significant increase during the pandemic, which contributed to the rise in consumer price inflation.

- 📉 Recessions typically lead to disinflation, suggesting that government measures may counteract inflation rather than exacerbate it.

- 📉 Overall, the prediction is that 10-year treasury yields may drop to 3% or lower in the next year due to reduced growth and inflation expectations.

Q & A

What recent trends have been observed in interest rates and mortgage rates?

-Interest rates have risen significantly, with mortgage rates surpassing 7%, equivalent to a substantial increase in home prices from a monthly payment perspective.

What are the two schools of thought regarding what drives interest rates?

-The two schools of thought are: one that attributes interest rate changes to the supply of treasuries, and the other that ties them to growth and inflation expectations.

How does historical data support the relationship between interest rates and inflation?

-Historical data shows that 10-year treasury rates closely follow growth and inflation expectations rather than the supply of treasuries issued.

What factors contributed to the consumer price inflation observed from 2020 to today?

-Key factors include the significant increase in M2 money supply during the pandemic and the government's stimulus measures, which led to more currency chasing goods and services.

Why does the speaker argue against the idea that increased government spending leads to inflation?

-The speaker points out that despite rising government debt and deficits, consumer price inflation decreased over the decades, indicating that spending does not necessarily trigger inflation.

What is the potential impact of a recession on future inflation and interest rates?

-The speaker believes that if a recession occurs, central banks may resort to quantitative easing, which could offset a decrease in bank credit but is unlikely to lead to a re-acceleration of inflation.

What role does bank credit play in the overall economy and inflation?

-Bank credit is crucial as it represents the currency units available in the economy; if bank credit contracts, it limits the amount of currency available for spending, impacting inflation.

How might political factors, such as tariffs or energy policies, influence inflation?

-While tariffs and energy policies can affect specific prices, the speaker argues that without an increase in bank credit or lending, such price increases would merely shift economic burdens rather than create overall inflation.

What is the speaker's prediction for the 10-year treasury yield over the next year?

-The speaker predicts that although there might be short-term increases, the 10-year treasury yield will likely trend towards 3% or lower over the next year due to lower growth and inflation expectations.

What does Milton Friedman’s perspective on inflation suggest about its causes?

-Milton Friedman stated that inflation is primarily a monetary phenomenon, implying that without banks creating more credit, sustained consumer price inflation is unlikely, regardless of other economic factors.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

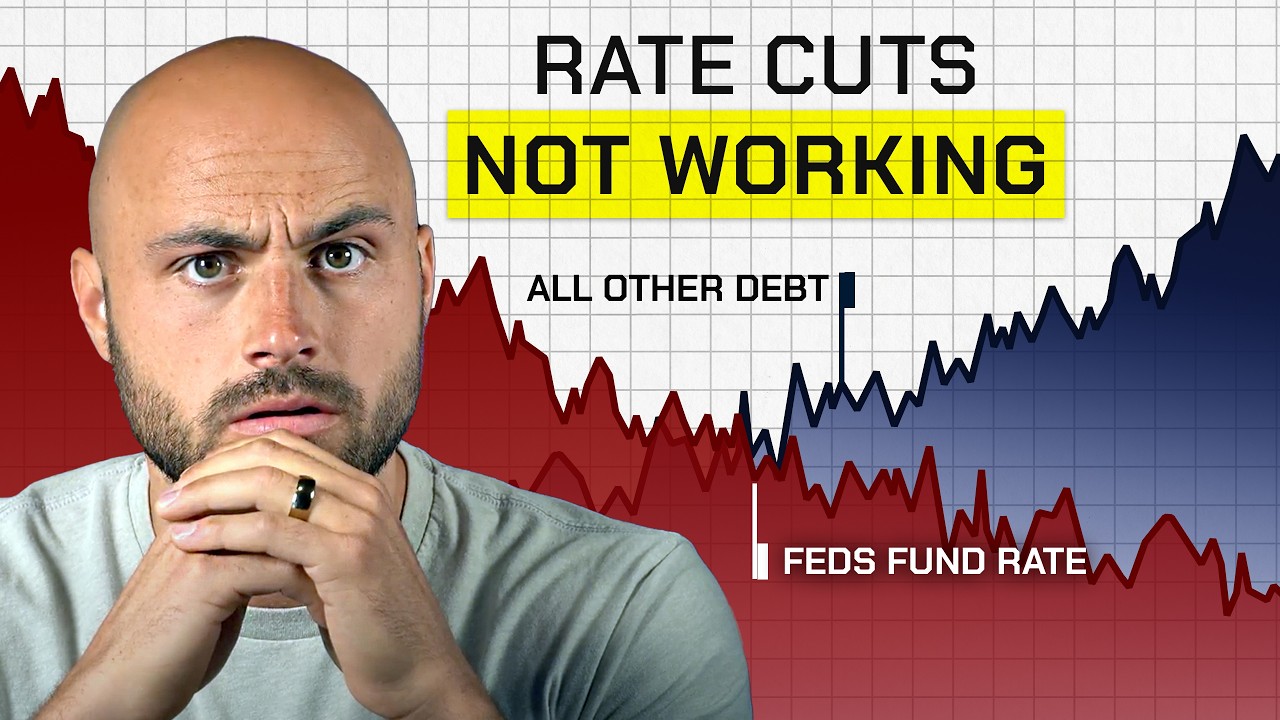

Why the Fed Cuts are Causing Interest Rates to RISE Instead

The FED can Play with Rates, until Modern Monetary Theory Collapses (MMT)

Como funciona a economia?

L'INIZIO del CROLLO dei Mercati: è il Colpo di Grazia (FED+Blackout) ?

Inflasi Mulai Tinggi, Ini Dampaknya ke Konsumsi & Suku Bunga

What Will happen to UK House Prices in 2025

5.0 / 5 (0 votes)