07- Análisis Horizontal y Vertical dentro de los Estados Financieros

Summary

TLDRIn this finance course session, the instructor explores the significance of financial statement analysis, focusing on horizontal and vertical methods. Key financial statements are reviewed, including the balance sheet and income statement, highlighting how these tools help assess a company's financial health. Through an example spanning three years, the instructor demonstrates how to analyze trends in sales, costs, and profitability. By examining cost structures and operational expenses, participants learn to identify areas for improvement, empowering them to make informed decisions that enhance organizational performance.

Takeaways

- 📊 Understanding financial performance is essential for informed decision-making in organizations.

- 📈 The four main financial statements are the balance sheet, income statement, statement of changes in equity, and cash flow statement.

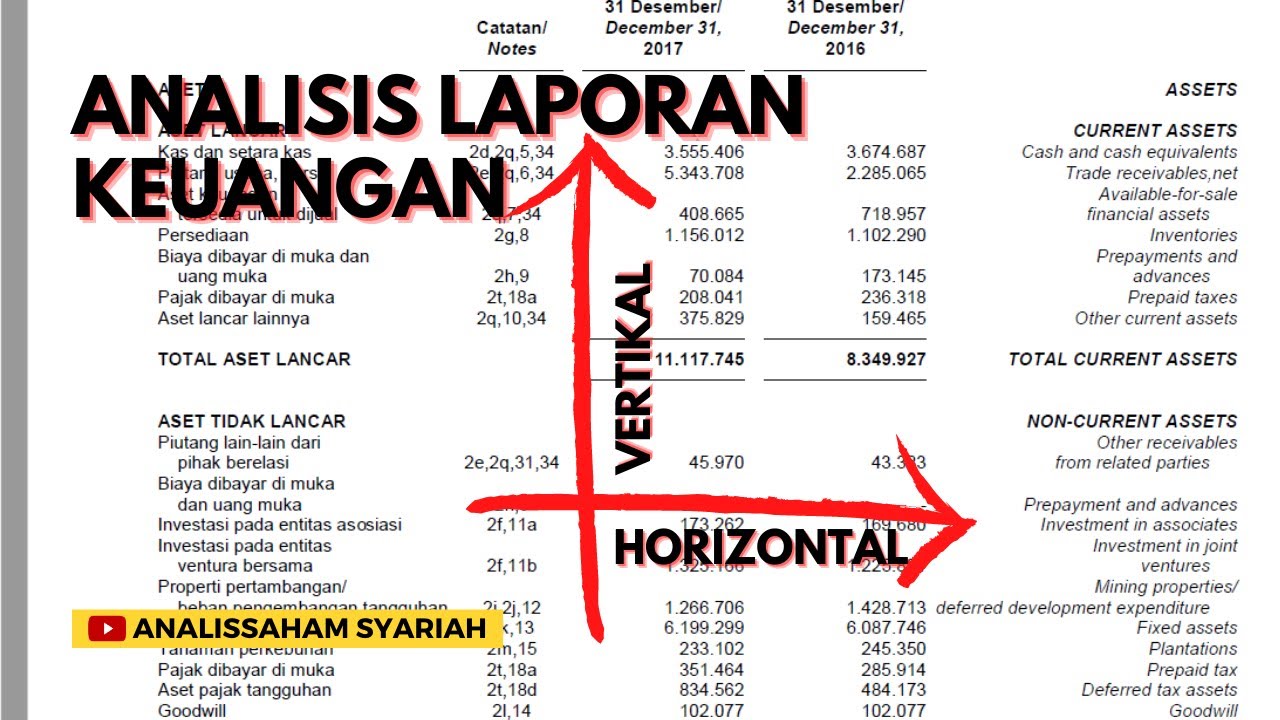

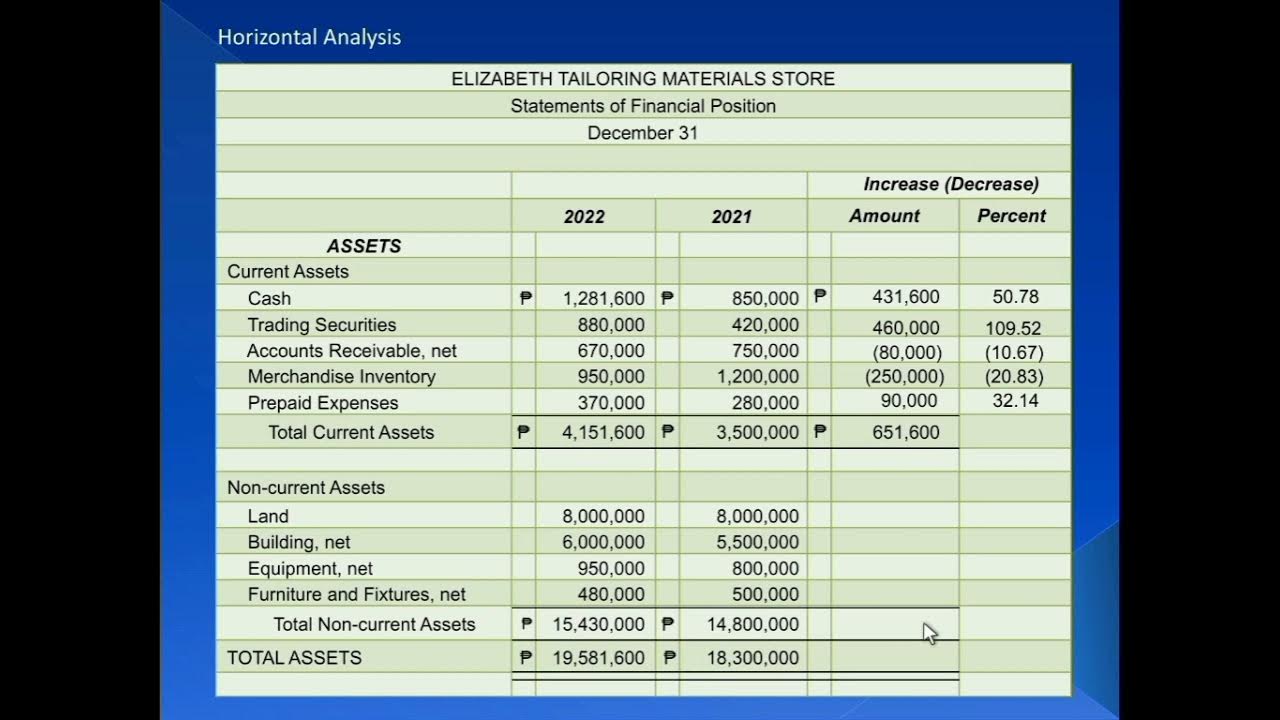

- 🔍 Horizontal analysis compares financial data across multiple periods to identify trends in performance.

- 📉 Vertical analysis expresses each item in the income statement as a percentage of total sales, helping to evaluate cost structures.

- 💰 Profitability analysis is crucial for assessing how well a company generates profit relative to its revenue.

- 🔧 Identifying areas of opportunity within cost structures can enhance financial performance and support strategic improvements.

- 📝 The income statement provides insights into sales, cost of sales, operating expenses, and net income.

- 📅 Analyzing trends over several years enables a clearer understanding of financial health and operational efficiency.

- 📉 A consistent increase in cost of sales can signal potential issues that need addressing to maintain profitability.

- 🤝 Continuous communication with financial professionals can help clarify doubts and improve financial understanding.

Q & A

What are the four main financial statements discussed in the session?

-The four main financial statements discussed are the Balance Sheet, Income Statement, Statement of Changes in Equity, and Cash Flow Statement.

Why is it important to understand financial performance in a company?

-Understanding financial performance is crucial for making informed decisions that can improve the company's financial outcomes.

What does the common-size analysis involve?

-Common-size analysis involves expressing financial figures as a percentage of a base figure, such as sales, to assess the relative size of each component.

What does the term 'gross profit' refer to in the context of the Income Statement?

-Gross profit refers to the difference between sales and the cost of goods sold, indicating how efficiently a company produces its goods.

What trend was observed in the cost of sales from 2013 to 2015?

-The cost of sales increased from 60% in 2013 to 70% in 2015, indicating rising costs relative to sales.

How did operating expenses change during the years analyzed?

-Operating expenses showed a slight decline from 25% in 2013 to 24% in 2014 and remained at 24% in 2015, suggesting effective cost management in this area.

What are the components of cost of sales mentioned in the session?

-The components of cost of sales include raw materials, direct labor, and manufacturing overhead.

What is the significance of the 30% tax rate used in the example?

-The 30% tax rate is used to illustrate how taxes impact net income calculations and overall profitability.

What is the main takeaway regarding profitability from the analysis of the Income Statement?

-The main takeaway is that declining net income percentages can signal potential operational inefficiencies or rising costs that need to be addressed.

How can the tools of horizontal and vertical analysis benefit a company?

-Horizontal and vertical analysis can help identify trends and areas for improvement, enabling companies to make informed decisions to enhance profitability.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Contoh Cara Menghitung Analisis Vertikal / Horizontal Laporan Keuangan

ANALISIS LAPORAN KEUANGAN UNTUK SMK KELAS XII SEMESTER GENAP

Part 1: Financial Statements Analysis (Intro, Horizontal Analysis and Vertical Analysis)

Contabilidade Geral Básica | Aula 01 | Parte 01 | Loberto Sasaki

BAB V Gerak Parabola

Types of Financial Analysis

5.0 / 5 (0 votes)