Pengantar Perusahaan Pembiayaan Syariah

Summary

TLDRThe speaker discusses key aspects of Sharia-compliant financing in Indonesia, particularly focusing on multifinance companies and the various contracts (akad) they use. He explains the difference between conventional and Sharia financing, highlighting the prohibition of interest (riba) and the importance of using contracts like murabahah (sale with profit), ijarah (leasing), and musharakah (partnership). The speaker emphasizes the role of the National Sharia Council (DSN-MUI) in standardizing these contracts and ensuring compliance with Islamic principles. Additionally, he touches on issues like refinancing, penalties, and the role of Islamic insurance.

Takeaways

- 📜 The financing industry, especially Sharia-based (Islamic) finance, is governed by specific laws such as PJK No. 10 of 2019 and decisions from institutions like Bapepam LK and DSN-MUI.

- 💼 Multifinance companies must follow Islamic principles for business models and contracts (akad), where each type of financing agreement must align with Sharia guidelines.

- 📚 The DSN-MUI has issued numerous fatwas, significantly increasing from around 53 in 2007 to over 125 by 2019, shaping the detailed application of Sharia-based financial contracts.

- 🏦 The primary distinction between conventional and Sharia-based financing lies in the elimination of interest (riba), where Sharia contracts focus on sales, profit margins, and fair pricing rather than loans with interest.

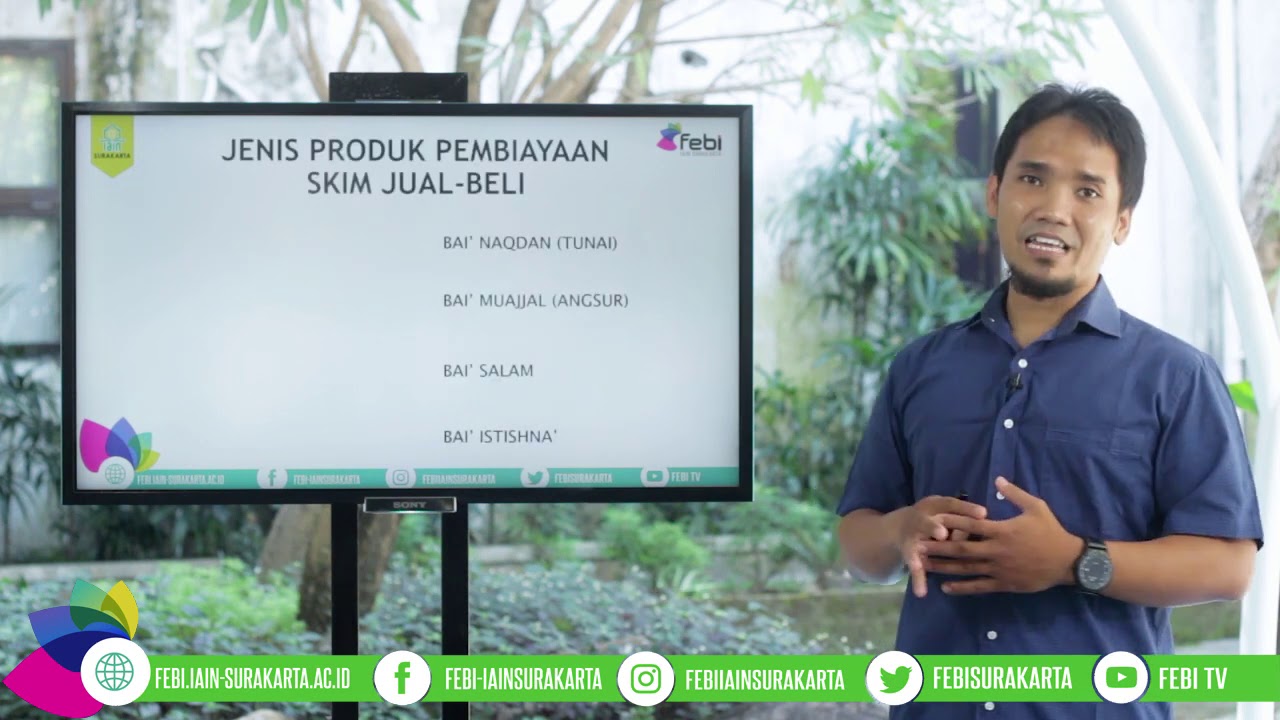

- 🔄 Common Sharia financing models include *Murabahah* (cost-plus sale), *Ijarah* (leasing), and *Musyarakah* (partnership), applied in sectors like automotive, home ownership, umrah, hajj, and other personal and business financing.

- 🚗 Companies like Adira apply Sharia contracts, buying assets like cars or motorcycles and reselling them to consumers with a transparent profit margin, differentiating themselves from conventional lenders.

- 📊 Multifinance companies source funding from various avenues, including equity, Sharia-compliant banks, government loans, or subordinated loans, all under strict Sharia principles.

- 💰 DSN-MUI allows fines for late payments, but these funds must be allocated to social causes, ensuring that fines aren't used as revenue sources for companies.

- 🔍 In complex contracts like refinancing and securitization, companies face additional challenges to remain compliant with both Islamic laws and financial regulations, ensuring transparency and adherence to Sharia.

- 📝 Islamic insurance (takaful) is viewed as a means of risk management, with its framework grounded in DSN-MUI Fatwa No. 21, enabling individuals to cover liabilities in unforeseen circumstances.

Q & A

What is the main regulatory framework for Sharia financing companies mentioned in the transcript?

-The main regulatory framework mentioned is OJK Regulation No. 10 of 2019, which governs the operations of Sharia financing companies and their Sharia business units in Indonesia.

What is the key difference between conventional and Sharia-based financing according to the speaker?

-The key difference is that conventional financing involves providing credit with interest, while Sharia-based financing is structured around transactions such as buying and selling, where the company buys the asset first and sells it to the customer with a transparent margin, avoiding interest (riba).

How does Sharia law view the output of contracts with similar outcomes but different processes, such as conventional credit vs Sharia sales?

-Sharia law emphasizes the process rather than just the outcome. Even if the final outcome appears similar (e.g., owning a car), a contract involving interest is considered haram, while a sale with transparent terms is halal. The process of following Sharia principles is crucial.

What is the significance of the DSN-MUI fatwas in Sharia financing?

-DSN-MUI fatwas serve as the main reference for Sharia contracts in Indonesia. They ensure that all transactions and financing operations comply with Islamic principles, providing standardized guidelines for Sharia-compliant practices.

What are some of the permissible business models for Sharia financing companies?

-Sharia financing companies can engage in various business models, including sale and purchase (murabaha), leasing (ijarah), and partnership-based financing (musharakah and mudarabah). These models must adhere to Sharia principles and ensure transparency and fairness.

Why is interest (riba) prohibited in Sharia financing?

-Interest is prohibited in Sharia financing because it leads to unfair wealth accumulation without any real economic activity or risk-sharing. Sharia encourages risk-sharing and trade-based transactions, where profits and losses are distributed fairly among the involved parties.

What challenges do Sharia financing companies face in terms of product development?

-The speaker mentions that while there are many Sharia-compliant financing products available, regulatory constraints and the cautious approach of regulators can limit the implementation of new products. This creates challenges for innovation in the Sharia financing sector.

What is the importance of the standardization of Sharia contracts in Indonesia?

-Standardization through DSN-MUI fatwas is crucial to ensure consistency across different Sharia financing institutions in Indonesia. Without standardization, different interpretations could lead to confusion and inconsistency in the application of Sharia principles.

How does the speaker address the criticism that Sharia financing lacks product innovation?

-The speaker refutes this criticism by explaining that many innovative Sharia-compliant products exist, but regulatory prudence limits their widespread implementation. He highlights the variety of available contracts and products, such as murabaha, ijarah, and musharakah, which cater to different financing needs.

How is the issue of late payment penalties (denda) handled in Sharia financing?

-Late payment penalties are allowed under certain conditions, but the penalties must go towards social funds, not the company’s profits. The penalties are only imposed on customers who intentionally delay payments without valid reasons.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Akad-akad dalam Bank Syariah • Perbankan Syariah #5

Manajemen Pembiayaan Bank Syariah Bagian 1 | Rais Sani Muharrami, M.E.I

Pengertian Leasing Syariah

Tugas Perbankan Syariah

290 Hukum Investasi di Reksadana - Dr. Muhammad Arifin Badri, M.A. حَفِظَهُ اللهُ

BAB 6 Lembaga Jasa Keuangan (Part 4 - Perasuransian, Dana Pensiun, Lembaga Pembiayaan dan Pegadaian)

5.0 / 5 (0 votes)