Exponentially Weighted Moving Average or Exponential Weighted Average | Deep Learning

Summary

TLDRThe video explains the concept of Exponential Weighted Moving Average (EWMA) and its applications in time series forecasting, stock trends, temperature records, and deep learning. The host breaks down the mathematical formula behind EWMA and discusses how newer data points are weighted more heavily than older ones. Through practical examples and Python code, the video demonstrates how to calculate EWMA and how changing the 'beta' value impacts the data's behavior. Viewers are encouraged to experiment with different parameters and better understand time series trend analysis.

Takeaways

- 📈 The video introduces the concept of Exponential Weighted Moving Average (EWMA), a technique used to find trends in time-series data.

- 📊 EWMA is widely applied in time-series forecasting, especially in industries like stock market analysis and climate data monitoring.

- 🔍 In EWMA, recent data points are given more weight compared to older data, making it more sensitive to recent changes.

- 🧮 The formula for calculating EWMA involves multiplying the previous moving average with a weight (beta) and adding it to a new data point.

- ⏳ As time progresses, the weight of older points decreases, ensuring that recent trends have a greater influence on the moving average.

- 🔗 EWMA is extensively used in deep learning for optimizing algorithms and understanding time-based patterns.

- 📉 Changing the beta value alters the behavior of EWMA; higher beta values give more importance to older data points, while lower values emphasize recent data.

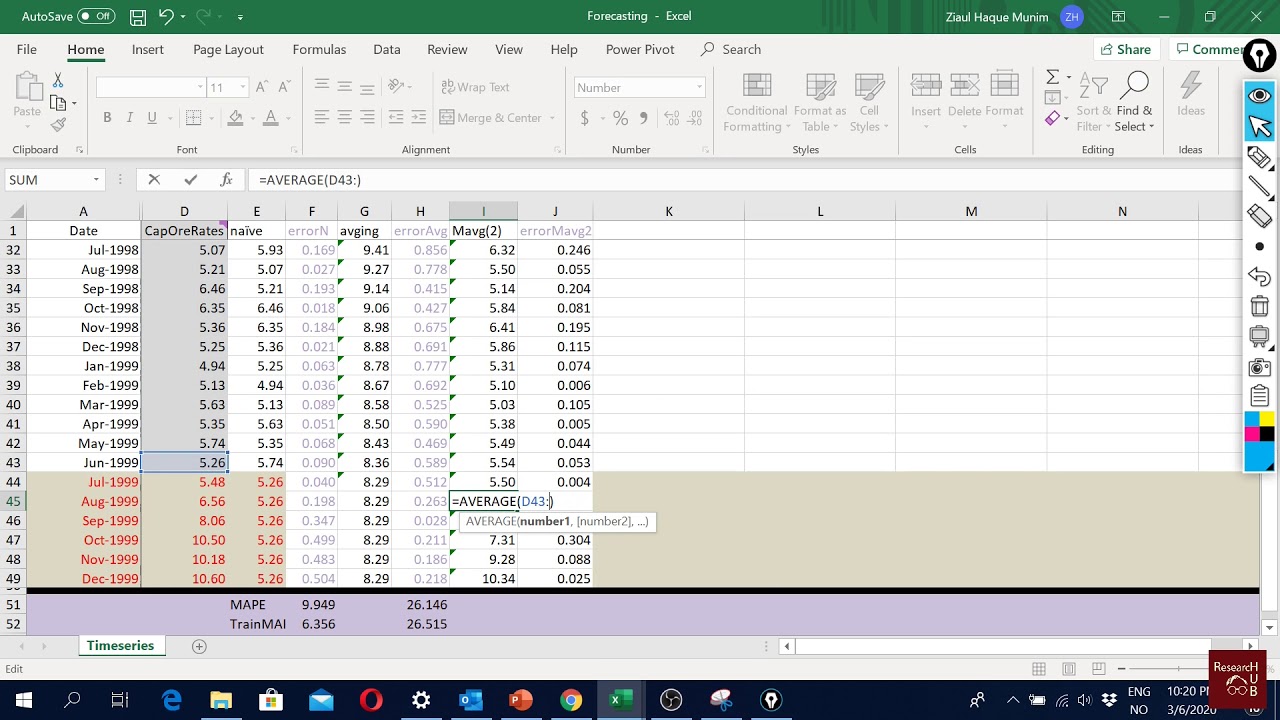

- 📐 The speaker demonstrates how EWMA can be computed mathematically using Python, showcasing both the formula and code implementation.

- 🖥️ The video explains the role of Python's libraries like Pandas and Matplotlib in calculating and visualizing EWMA trends with actual climate data.

- 📘 The next video will focus on Momentum-based optimization techniques, continuing the series on optimization algorithms in deep learning.

Q & A

What is the main focus of the video?

-The main focus of the video is to explain the concept of Exponential Weighted Moving Average (EWMA) and how it is used in time series data, particularly in trend analysis and forecasting.

What is Exponential Weighted Moving Average (EWMA)?

-EWMA is a technique used to identify trends in time series data by giving more weight to recent data points and gradually reducing the weight of older data points.

How does the weighting mechanism work in EWMA?

-In EWMA, recent data points are given higher weight compared to older data points. As time progresses, the weight of older data points decreases exponentially, while the weight of newer data points remains higher.

What are the common applications of EWMA?

-EWMA is used in a variety of fields including stock market analysis, temperature forecasting, signal processing, and deep learning algorithms for trend analysis.

What does the 'beta' parameter represent in EWMA?

-The 'beta' parameter in EWMA controls how much weight is given to recent data points. A higher beta gives more weight to newer data points, while a lower beta gives more importance to older data points.

How is the EWMA formula structured?

-The EWMA formula is: EWMA_t = beta * EWMA_(t-1) + (1 - beta) * Data_t, where 'beta' controls the weighting of the current and past data points.

What is the impact of changing the beta value in EWMA?

-Changing the beta value alters the behavior of EWMA. A higher beta makes the moving average more responsive to recent changes, while a lower beta smoothens the average, making it less sensitive to fluctuations.

How is EWMA different from Simple Moving Average (SMA)?

-Unlike SMA, where all data points are given equal weight, EWMA assigns exponentially decreasing weights to older data points, making it more sensitive to recent trends.

Why is EWMA preferred in certain forecasting applications?

-EWMA is preferred because it captures trends more effectively by emphasizing recent data, which is particularly useful in dynamic environments like stock trading or real-time temperature monitoring.

What is the significance of the alpha parameter in Python's EWMA implementation?

-In Python’s EWMA implementation, the 'alpha' parameter is used instead of 'beta', and alpha is calculated as 1 - beta. It controls how quickly the moving average reacts to recent changes in the data.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Analisis Deret Berkala - Pengantar Statistika Ekonomi dan Bisnis (Statistik 1) | E-Learning STA

Peramalan Permintaan Part 1 (Moving Average and Weighted Moving Average)

What is Time Series Analysis?

Forecasting (10): Moving average forecast

Forecasting (12): Simple exponential smoothing forecast

Peramalan Kuantitatif 1

5.0 / 5 (0 votes)