No time to die – How will offshore drilling rig values recover facing an energy crisis?

Summary

TLDRThe webinar discusses the offshore rig market and rig valuations, highlighting the oversupply from 2005 to 2014 and the impact of the COVID-19 pandemic on the industry. It explores the energy transition's effect on demand and the potential for value appreciation in the drilling rig market. The speakers also delve into the different types of buyers and sellers in the rig market and the factors influencing rig values, including technical aspects and market conditions. The presentation concludes with an outlook on the recovery of rig values and the challenges and opportunities within the industry.

Takeaways

- 📈 The offshore rig market experienced an oversupply between 2005 and 2014, growing from 600 to over 900 rigs.

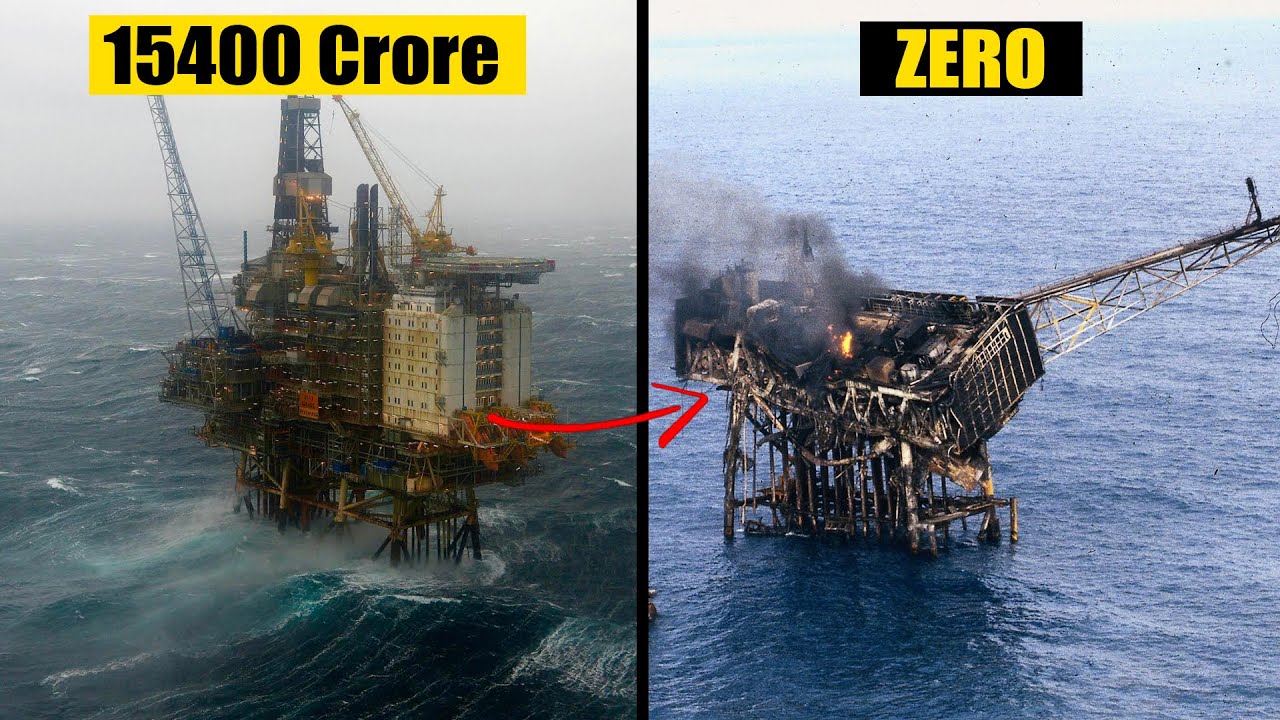

- 📉 The COVID-19 pandemic in early 2020 further weakened the rig market, causing utilization rates to drop and rig values to plummet.

- 🔄 The energy transition is still in its growth phase and cannot yet replace fossil fuels, with oil demand expected to surpass pre-pandemic levels by 2022.

- 💰 Oil prices have been strong, around the $85 level, which is the highest since October 2018.

- 🚀 The competitive rig fleet has been reduced through scrapping and conversion, now standing at 587 rigs, similar to the size in 2005.

- 🛠️ Rig values are determined by market factors such as oil prices, rig supply and demand, utilization rates, and recent sales.

- 🔄 The buyer landscape consists of strategic buyers, opportunistic buyers, and those interested in conversion or scrap, each with different motivations and resources.

- 🔄 The seller landscape includes strategic sellers, distressed sellers, and stranded sellers, with deals varying based on the seller's situation.

- 🌐 SGN provides a digital platform for rig values and analytics, covering the status of all rigs and offering forecasts, as well as a product for individual CO2 emissions from the rig fleet.

- 📈 Looking ahead, the forecast for rig values suggests a potential for substantial appreciation, especially for modern drill ships and premium jack-ups, as utilization rates increase.

Q & A

What was the impact of the COVID-19 pandemic on the offshore rig market in early 2020?

-The COVID-19 pandemic led to a significant downturn in the offshore rig market in early 2020. Rig utilization rates dropped from 78% to 64% between February and June, and the number of big contract rigs fell from 460 to 378. This resulted in a substantial devaluation of rig assets, with many becoming worth only their scrap value, leading to offshore drillers filing for bankruptcy under Chapter 11.

How has the offshore rig fleet changed in size between 2005 and 2014?

-Between 2005 and 2014, the offshore rig fleet grew from approximately 600 rigs to just over 900 rigs. This expansion led to an oversupply in the market.

What is the role of the energy transition in the current state of the offshore rig market?

-The energy transition is still in a growth phase and is not yet ready to replace fossil fuels to meet additional demand as economies grow. Despite the transition, the demand for oil is expected to surpass pre-pandemic levels by 2022 and grow beyond 100 million barrels per day by 2023.

How does the SGN Rig Values platform function?

-SGN Rig Values is a digital platform that provides rig values 24/7. The values are updated twice weekly or as market events demand. The platform's basis is SGN Rig Analytics, which covers the status of all rigs in the world fleet and provides rig demand and rig supply forecasts.

What factors are considered when establishing rig values?

-Rig values are established by considering macro-level factors such as oil prices and oil company spending, the rig market itself including rig supply size and the competitive fleet, utilization fixtures, day rates, and recent sales. Technical aspects like rig design and operating areas are also considered.

What has been the trend in rig values since the market peak in 2014?

-Since the market peak in 2014, there has been a catastrophic reduction in rig values. Modern rigs such as seventh-generation drillships and premium jack-ups have lost about 75% of their value. The harsh environment sector has fared the best, with values dropping about 50% due to limited supply.

Who are the typical buyers in the current offshore rig market?

-Typical buyers in the current market are drillers with less inventory of idle rigs and higher fleet utilization. These drillers are likely to acquire more modern rigs to take advantage of the increase in day rates and bid on new tenders.

What are the three types of sellers in the offshore rig market?

-The three types of sellers are strategic sellers, which include drillers looking to right-size their fleet or exit non-core segments; distressed sellers, which occur when creditors take over companies and need to exit quickly; and stranded sellers, which are new builds controlled by yards that have become unwilling owners due to cancelled orders.

How does the retirement of older rigs affect the market dynamics?

-The retirement of older rigs, particularly those that have been stacked for a long period or are pre-2005 models, reduces the supply of available rigs. This can lead to higher utilization rates and potentially higher day rates and rig values as the market adjusts to a smaller fleet size.

What are the climate risks associated with offshore drilling activities?

-Climate risks in offshore drilling activities include the costs associated with reducing emissions from drilling rigs. As the world moves towards a low-carbon future, there will be increasing pressure to limit greenhouse gas emissions, which could affect the economics of offshore drilling operations.

What are the expectations for rig values and utilization rates in the coming years?

-The expectations are for rig values and utilization rates to increase significantly. With a forecasted increase in demand for oil and gas, and a reduction in the competitive fleet size to levels not seen since 2005, utilization rates for all rig classes are expected to move above 80%, which historically has led to higher day rates and rig values.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Navigating 2024: A Global Q1 Review and Year Ahead Forecast.

Aramco's Rig Suspensions: Shaping the future of the global jackup market?

Why American Farmers Are Dumping Milk

Offshore oil driller Noble will get 'ever pickier' on M&A after Diamond deal, CEO says

This Wave Killed All 84 Men

The Secret of Piper Alpha Oil Rig Disaster lies at the Bottom of the Sea

5.0 / 5 (0 votes)