Solana, What’s Right And What’s Wrong

Summary

TLDRIn this engaging conversation, Eugene Chin, co-founder at Ellipsis Labs and known as zerox on Twitter, shares his insights on the crypto space, particularly focusing on high-performance DeFi products like Phoenix on Solana. With a background in high-frequency trading and product engineering, Eugene discusses the evolution of his thoughts on DeFi, the challenges faced by liquidity providers, and the potential of Solana's performance to revolutionize the trading experience on-chain. He also addresses the importance of balancing technological innovation with core values in the blockchain community.

Takeaways

- 🌐 Eugene Chin is a co-founder at Ellipsis Labs, focusing on high-performance DeFi products like Phoenix on Solana.

- 🤖 Eugene's background includes high-frequency trading and product engineering, with a foundation in mathematics.

- 💡 Eugene's transition to crypto was driven by a desire to improve upon the inefficiencies he observed in traditional DeFi liquidity provision models.

- 📈 His perspective on AMMs has evolved over time, recognizing their value as a liquidity bootstrapping mechanism, especially for new tokens.

- 🔄 Eugene sees a future where AMMs serve as a liquidity backbone, complementing more sophisticated order book systems.

- 🚀 Phoenix is a proof of concept for demonstrating that active liquidity can outperform passive liquidity in an environment like Solana.

- 🛠️ The Solana ecosystem has room for improvement, especially regarding its fee model and network layer issues.

- 🔧 Solana's priority has been on performance and user experience, sometimes at the expense of incentive compatibility.

- 📊 The success of Solana's token (SOL) is tied to the platform's ability to support a robust DeFi ecosystem, rather than its market cap ranking.

- 🌟 In the long term, Eugene envisions a future where Solana can facilitate the trading of non-crypto assets, integrating with traditional financial systems.

Q & A

What is Eugene Chin's background and how did he get involved in the crypto space?

-Eugene Chin is a co-founder at Ellipsis Labs, where they build high-performance DeFi products like Phoenix on Solana. He has a background in high-frequency trading and product engineering, with a focus on math during his studies. He entered the crypto space during the pandemic, initially spending time looking at DeFi and its developments.

What were the main issues Eugene saw in the current DeFi market that led him to start his company?

-Eugene was not satisfied with the state of DeFi, particularly with the XY=K model and its replacement with Uniswap V3's concentrated liquidity. He felt that these models did not make sense from a trading background and seemed inefficient compared to traditional market-making practices.

How does Eugene view the role of AMMs in the DeFi space?

-Eugene sees AMMs as a liquidity bootstrapping mechanism suitable for new coins, but believes they are not designed to be the ultimate solution for liquidity provision. He thinks AMMs serve a purpose but are not as efficient as traditional market-making models, especially for more liquid, large market cap assets.

What is the main goal of Phoenix on Solana according to Eugene?

-The main goal of Phoenix on Solana is to prove that active liquidity can be competitive with passive liquidity in an environment like Solana. It aims to provide better liquidity than centralized exchanges by building a product that market makers can use to provide really good liquidity to end users.

What are some of the challenges that Eugene sees with running a high-performance trading platform on a blockchain like Solana?

-Some challenges include the need to pay gas fees for every on-chain order placement or cancellation, which can add up quickly for active market makers. Additionally, the environment is significantly different from centralized venues, requiring a new primitive for on-chain liquidity provision.

How does Eugene view the future of Solana and its ability to support high-performance applications?

-Eugene believes that Solana has been ambitious and successful in its mission, offering high throughput and credible decentralization. However, he acknowledges that there are long-term issues that need to be addressed, particularly on the engineering and research sides, to ensure the platform's continued growth and success.

What is Eugene's take on the Solana fee model and its impact on user experience?

-Eugene criticizes the Solana fee model, stating it does not make much sense as it does not effectively throttle demand or provide a good user experience. He advocates for a model that offers better UX, such as one with a maximum escalation limit and a clear transaction fee structure.

What are Eugene's thoughts on the recent changes to Solana's MEV (Miner Extractable Value) situation with the removal of the mempool by Jto?

-Eugene views the removal of the mempool by Jto as a positive step towards prioritizing user experience over incentive compatibility. However, he believes this is not a permanent fix and that a better long-term solution is needed to support the on-chain trading economy.

How does Eugene see the role of blockchain in the future of finance and beyond?

-Eugene believes that blockchain, particularly through DeFi, is well-suited for disrupting the traditional financial system by offering permissionless innovation and access. He sees a future where blockchain technology can onboard a significant portion of non-digital assets and provide better financial outcomes for users.

What are Eugene's thoughts on the economic security of L1 tokens and their role in the ecosystem?

-Eugene thinks that the economic security of L1 tokens is overrated. He believes that as long as there is an honest minority that can fork out malicious actors, the economic security argument does not hold much weight. He also suggests that the focus should be more on building a platform that optimizes for applications rather than token price.

How does Eugene view the competition between Solana and other high-performance chains?

-Eugene believes that Solana has an incumbency advantage due to its early adoption and network effects. He thinks that while other high-performance chains are making valuable contributions to the space, Solana's head start and continued innovation give it an edge. However, he also acknowledges that no blockchain is in a finished state and that ongoing innovation is necessary for the growth of the entire crypto industry.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Kamino 2.0: Brand new Borrow / Lend market on Solana

Mein 800.000€ Krypto Wallet für 2025😳🚀

Vultisig, Thorchain & 2025 Cycle Top

Transformation in Oil and Gas: DocStudio's CTO Perspective | EUGENE SOLOVIOV, ENERGIZE, Episode 6

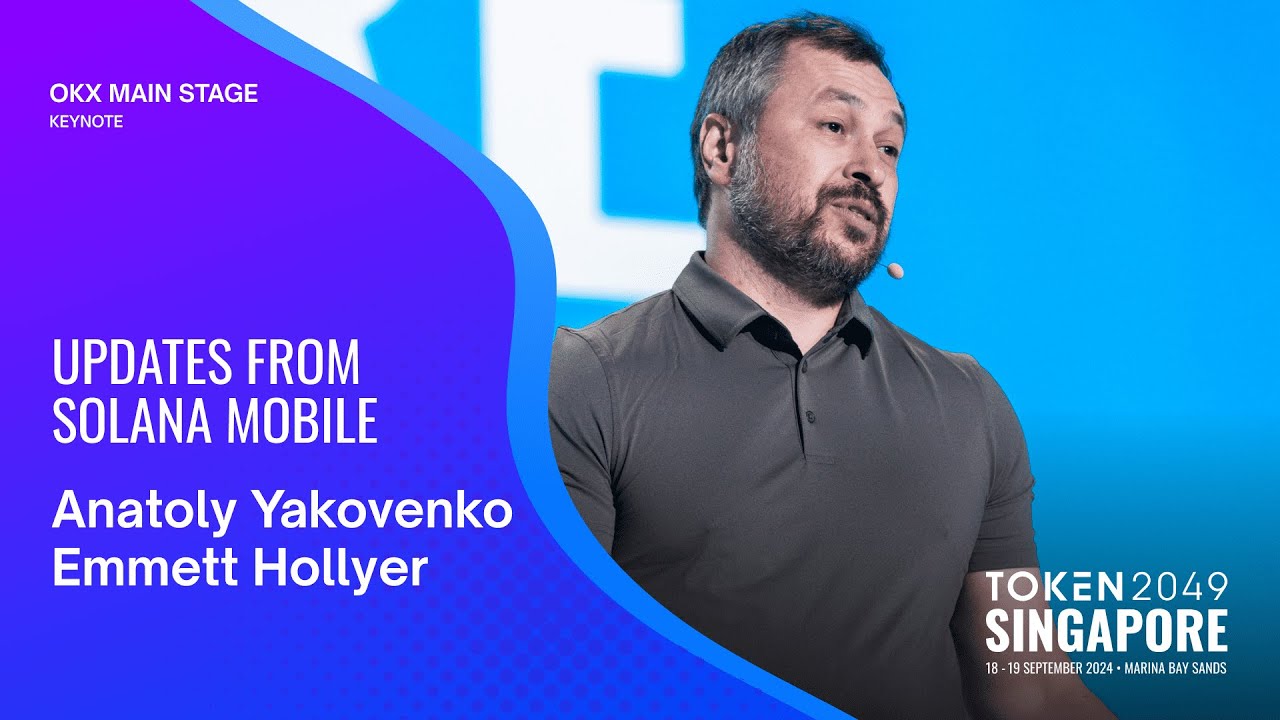

Updates from Solana Mobile - TOKEN2049 Singapore 2024

Layer N: Hyper Performant and Hyper Composable Execution. An Interview with Co-Founder David Cao

5.0 / 5 (0 votes)