4/6【米国株投資🇺🇸】雇用統計強すぎる!利下げ期待後退したが株価は戻した❗️今後どうなるの⁉️【バフェット太郎の投資チャンネル】【Dan Takahashi】

Summary

TLDRThe video script discusses the current economic situation, focusing on inflation rates, interest rate cuts, and unemployment statistics in the US. It highlights the strong job market and the Federal Reserve's stance on interest rates, suggesting that the economy can sustain growth even with high interest rates. The speaker also touches on market predictions, investment strategies, and specific stock performances, such as Meta Platforms and Tesla. They emphasize the importance of understanding market volatility and making informed investment decisions, especially in times of economic uncertainty.

Takeaways

- 📉 The speaker discusses the possibility of the U.S. stock market experiencing a downturn, hinting at the recent strong employment statistics and the potential for a soft landing for inflation without interest rate cuts.

- 💼 There is a mention of the significant increase in employment numbers, with over 300,000 jobs added, which is considered good news and indicates a strong labor market.

- 📊 The Federal Reserve's stance on interest rates is highlighted, with some suggesting that the market might have to wait for a rate cut, while others believe it's still too early to consider such a move.

- 📈 The speaker talks about the performance of various stocks and indices, including Meta Platforms, which has seen a significant rise and is noted for its positive technical indicators.

- 🚗 Tesla is mentioned with some concern due to news of price cuts on their popular SUV models, which might affect their stock price negatively.

- 💰 The transcript touches on the volatility in the financial markets, with a particular focus on the potential for profit in the current market conditions.

- 📊 The speaker refers to the 'Fingree Index', which has moved from an extreme reading to a more neutral position, indicating a shift in market sentiment.

- 🤑 The importance of understanding market principles and using them to time investments is emphasized, suggesting that the speaker uses the Elliot Wave theory for market analysis.

- 🌐 There's a mention of the potential impact of geopolitical risks and policy decisions on the market, such as the Federal Reserve's approach to interest rates and its influence on market volatility.

- 💹 The speaker provides personal investment insights and strategies, including a focus on long-term investing and accumulating investments during market downturns.

- 🚀 The potential for certain investments, like 'Leverage Nasdaq' (possibly a leveraged ETF), to significantly outperform the market is highlighted, with a note of caution regarding market volatility.

Q & A

What was the key takeaway from Chairman Powell's statement?

-Chairman Powell's statement suggested that the Federal Reserve might not lower interest rates this year if the inflation rate stabilizes.

How did the market react to Chairman Powell's statement?

-The market reacted negatively, with charts showing a decline following Powell's remarks.

What were the latest figures for new unemployment insurance claims?

-The latest figures for new unemployment insurance claims have decreased, indicating a strong job market.

What was notable about the employment statistics?

-The employment statistics showed over 300,000 new jobs, marking the largest increase in a year, and the unemployment rate dropped.

What did President Harker suggest about the possibility of rate cuts this year?

-President Harker indicated that there might be no rate cuts this year if the economy continues to grow strongly.

How did Tesla's recent news impact its stock?

-Tesla's stock was affected negatively by news of significant discounts on its popular SUV models to clear inventory.

What is the significance of the Fear & Greed Index mentioned in the script?

-The Fear & Greed Index, which was at 61 (neutral), indicated a shift from extreme greed to a more balanced sentiment in the market.

What was the performance of the major stock indices like Dow Jones and NASDAQ?

-The Dow Jones increased by 0.8%, NASDAQ by 1.24%, and the S&P 500 by 1.1%, showing a positive trend in the market.

What concerns were raised about the Nikkei Index?

-The Nikkei Index experienced a significant drop, forming a 'Death Cross,' which signals a potential long-term downturn.

What advice was given regarding the current market situation?

-The advice was to remain patient and look for buying opportunities during market dips, especially with the potential for a long-term upward trend.

What role does the Fear & Greed Index play in market analysis?

-The Fear & Greed Index helps gauge investor sentiment, which can be used to predict market trends and potential turning points.

How did the employment report influence market expectations for rate cuts?

-The strong employment report reduced expectations for immediate rate cuts, as a robust job market suggests a healthy economy that may not need lower rates.

What were the expectations for the Fed's policy based on recent economic data?

-Based on recent economic data, there was an expectation that the Fed might delay rate cuts, focusing instead on maintaining stability in a growing economy.

How did market sentiment shift according to the script?

-Market sentiment shifted from extreme greed to neutral, indicating a more cautious approach by investors.

What were the key factors impacting Tesla's stock performance?

-Key factors impacting Tesla's stock performance included significant price cuts on popular models and overall market conditions.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

「薩姆規則」觸發⚠美國1500萬人將失業😱?|又一「衰退警號」?|聯儲局不減息屬玩火|投資甚麼自保?🙏【施追擊】#股市 #美股 #投資 #crypto

Interest Rate Cuts Are Coming — Investors Need to Position Now

BREAKING: Federal Reserve Cancels 2025 Rate Cuts - Massive Pivot Ahead!

L'INIZIO del CROLLO dei Mercati: è il Colpo di Grazia (FED+Blackout) ?

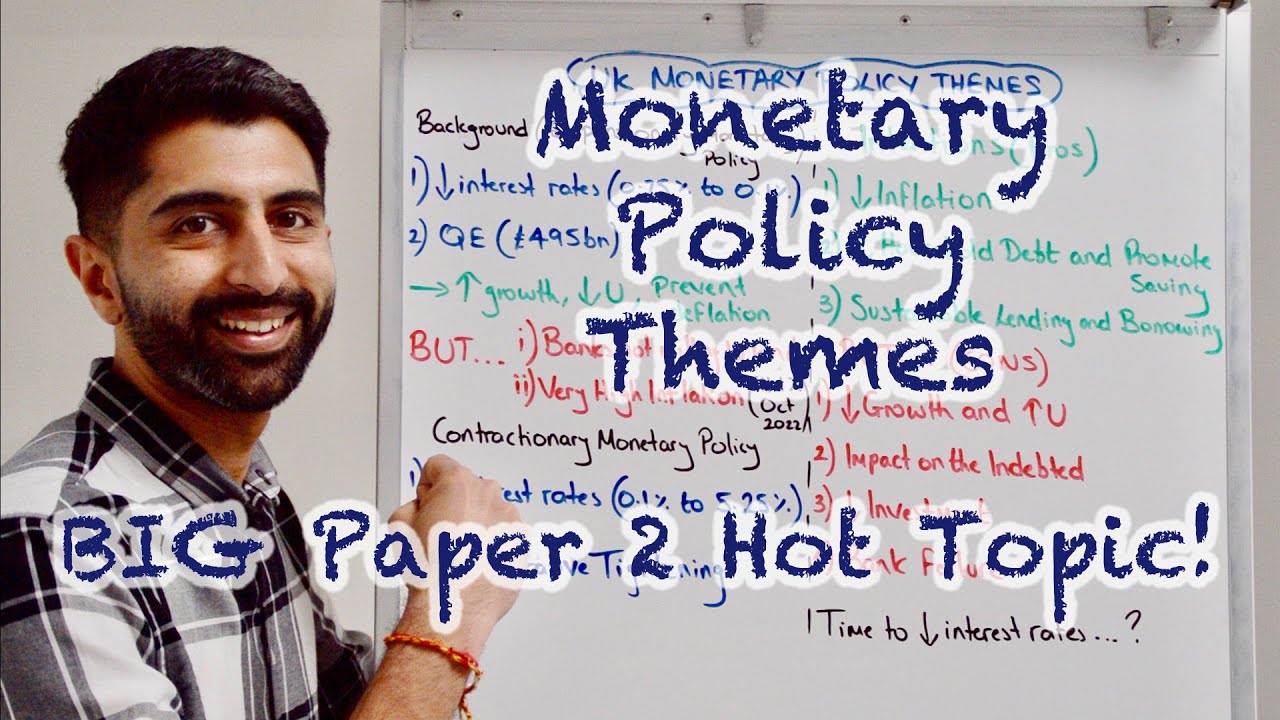

Monetary Policy UK Themes - HOT TOPIC for Paper 2! Must Watch 🔥

OMG!! The Fed Just Made A HUGE Mistake

5.0 / 5 (0 votes)