LaiXinHong (s4042341) BUSM2562 Assessment 3 - Presentation and networking event

Summary

TLDRThis presentation discusses the effects of consumption taxes and tariffs on public health, economic growth, and government revenue. It explains how taxes alter consumer and producer welfare, create deadweight loss, and impact aggregate demand and supply. The potential benefits of a 'fat tax' for long-term economic growth are highlighted, using Directed Acyclic Graphs to illustrate its influence on health outcomes and economic performance.

Takeaways

- 📊 Consumption taxes reduce consumer and producer welfare by shifting the supply curve and decreasing overall market activity.

- 💸 Taxes cause a deadweight loss, which reflects a reduction in economic welfare due to decreased transactions.

- 🏛️ The government collects tax revenue from consumption taxes, which can be used for public services and programs.

- 📉 Tariffs on imports raise import prices, reducing consumer surplus while benefiting domestic producers with higher prices and producer surplus.

- ⚖️ Deadweight loss from tariffs comes from reduced international trade, while for consumption taxes, it stems from decreased domestic transactions.

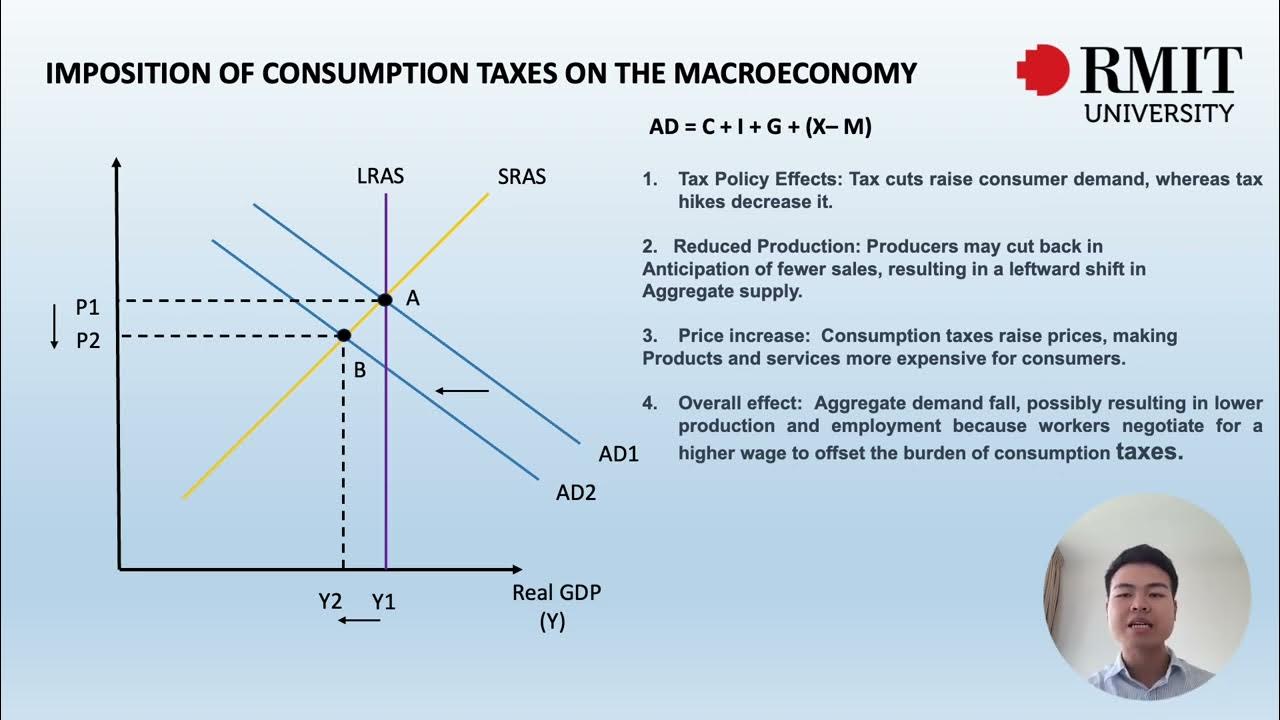

- 🔄 Consumption taxes lower aggregate demand (AD) because consumers have less disposable income, leading to a ripple effect on overall economic activity.

- 🚶♂️ Health-related taxes, such as a fat tax, may increase long-term aggregate supply (AS) by improving public health and labor productivity.

- 🏥 Healthier populations due to improved dietary habits can lower healthcare costs, boosting economic growth by increasing disposable income and consumer spending.

- 📈 A Directed Acyclic Graph (DAG) shows how a fat tax influences consumption behavior, health outcomes, and ultimately economic growth through indirect effects.

- 🎯 Public health campaigns may act as confounders in the fat tax's impact, as they influence both health outcomes and the tax's implementation.

Q & A

What is the primary focus of the presentation?

-The presentation primarily focuses on the wide-ranging effects of taxes, particularly consumption taxes and tariffs, on public health, economic growth, and government revenue.

How does a consumption tax affect consumer and producer welfare?

-A consumption tax leads to a decrease in consumer surplus due to higher prices and a reduction in the quantity supplied in the market, which impacts producer surplus. It also generates deadweight loss due to transactions that no longer occur because of the higher price.

What is the impact of a consumption tax on the supply curve?

-A consumption tax causes the supply curve to shift to the left because it raises the cost of production for producers, making them willing to supply fewer units at each price level.

How does a tariff on imports differ from a consumption tax?

-A tariff on imports is a tax imposed specifically on imported goods, which shifts the supply curve upward by the amount of the tariff, reducing consumer surplus and increasing producer surplus for domestic producers.

What is the deadweight loss caused by a tariff?

-The deadweight loss caused by a tariff is due to the reduction in the quantity of imports because of higher prices, which directly affects international trade.

How does a consumption tax influence the aggregate demand (AD) and aggregate supply (AS) model?

-A consumption tax can lead to a decrease in consumption expenditure, shifting the AD curve to the left. It typically does not have a direct impact on the AS curve in the short term, as it does not change the economy's productive capabilities.

What is the potential long-term benefit of a tax that improves public health?

-A tax that improves public health can shift the AS curve to the right, indicating an increase in the economy's productive capacity. Healthier individuals tend to be more productive, which can lead to higher levels of output or the same amount of input.

How can a healthier population result in positive externalities?

-A healthier population can lead to reduced disease transmission rates and improved public health, which can decrease healthcare-related costs and potentially increase disposable income for consumers, boosting consumer spending.

What is a Directed Acyclic Graph (DAG) and how is it used in the context of the presentation?

-A Directed Acyclic Graph (DAG) is used to represent the causal relationships between variables. In the presentation, it is used to analyze the impact of a fat tax on consumption behavior, health outcomes, and economic growth, including potential confounders like public health campaigns.

How does the fat tax policy influence consumption behavior according to the DAG?

-The fat tax policy makes unhealthy foods more expensive, potentially reducing their consumption, which is represented by an arrow leading from 'Fat Tax' to changes in 'consumption behavior' in the DAG.

What is the indirect impact of the fat tax on economic growth as presented in the DAG?

-The indirect impact of the fat tax on economic growth is represented by an arrow from 'Health outcome' to 'economic growth' in the DAG, suggesting that changes in dietary patterns can affect healthcare costs, labor force participation, and productivity, influencing overall economic performance.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

RMIT University, Understanding the Business Environment, Assessment 3: Presentation

Kebijakan Makro Ekonomi : Kebijakan Fiskal

Types of Taxes in the United States

How Indian Economy Works? By Adarsh Gupta

[FULL] Nasib Ekonomi Indonesia, Dompet Rakyat dan Negara 'Kering': Harus Bagaimana?

Pajak - Materi Ekonomi SMA dan Ujian Mandiri | Part 2

5.0 / 5 (0 votes)