3w FinEcon 2024fall v2

Summary

TLDRThis script discusses the intricacies of futures trading, focusing on daily settlements and the simplicity of closing positions through offsetting trades. It explains how investors can manage their exposure by entering into opposite transactions to mitigate risk. The script also delves into the role of the exchange clearing house, detailing the margin requirements for brokers and the importance of daily settlement to prevent defaults. Additionally, it contrasts the centralized clearing of futures with the bilateral agreements common in the OTC market, highlighting the shift towards central counterparties (CCPs) for standardized OTC derivatives to reduce systemic risk post-financial crisis.

Takeaways

- 📈 Futures are settled daily, allowing investors to close out their positions without waiting until maturity.

- 🔄 To offset a future position, one can enter into an offsetting trade, which is a fundamental concept in both futures and forward contracts.

- 💵 The example of Caleb illustrates how a short position in FX forward can be offset by buying a similar contract from a counterparty.

- 🏦 The exchange clearing house plays a crucial role in the futures market, ensuring daily settlement and managing margin requirements.

- 💼 Brokers and clearing house members are responsible for providing initial and variation margins to manage credit risk.

- 📉 The daily settlement process involves transferring funds between the margin accounts of long and short traders based on price movements.

- 🚫 Margin requirements are essential to prevent defaults and protect against significant losses in the futures market.

- 🌐 The OTC market operates differently from the exchange market, with transactions governed by agreements like ISDA Master Agreements.

- 🔄 The 2007-2009 financial crisis led to a push for central clearing of standardized OTC derivatives through CCPs to reduce systemic risk.

- 📊 Open interest, settlement price, and trading volume are key metrics in the futures market, reflecting market activity and contract obligations.

Q & A

What is the main difference between futures and forwards?

-Futures are standardized contracts traded on an exchange and settled daily, while forwards are customized contracts traded over-the-counter (OTC) and settled at maturity.

How can an investor close a futures position before maturity?

-An investor can close a futures position by entering into an offsetting trade, which means taking the opposite position of the original contract.

What is the role of the exchange clearing house in futures trading?

-The exchange clearing house acts as an intermediary between buyers and sellers, ensuring that trades are settled and margins are collected.

What are the two types of margins required by the exchange clearing house?

-The two types of margins required are initial margin, which is a percentage of the contract value, and variation margin, which is adjusted daily based on gains or losses.

How does the margin flow work when the futures price increases?

-When the futures price increases, the short trader's margin account funds are transferred to the long trader's margin account to cover the gain made by the long trader.

What is the purpose of daily settlement in futures markets?

-Daily settlement helps to manage credit risk by ensuring that gains and losses are realized and settled daily, preventing the accumulation of large losses that could lead to default.

What is the main difference between bilateral clearing and central clearing?

-Bilateral clearing involves direct agreements between two counterparties, while central clearing involves a central counterparty (CCP) that becomes the counterparty to each member, reducing the number of direct relationships.

Why was the requirement for central clearing introduced for standardized OTC derivatives after the 2007-2009 financial crisis?

-Central clearing was introduced to reduce systemic risk and avoid default by ensuring that all parties post initial and variation margins, which helps to mitigate potential losses from counterparty failures.

What is the ISDA Master Agreement and why is it important in OTC markets?

-The ISDA Master Agreement is a standardized contract that governs the terms of transactions between two parties in the OTC market. It is important because it provides a legal framework for managing credit risk and collateral.

What is open interest in the context of futures trading?

-Open interest refers to the total number of outstanding futures contracts that have not been settled or closed by an offsetting trade.

How does the trading volume differ from open interest?

-Trading volume refers to the number of contracts traded on a given day, while open interest represents the total number of contracts that are still open and have not been settled.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

2022 ICT Mentorship [No Rant] ep. 11 - Reinforcing Past Lessons & Trading Executions

I make a living trading Price Action, here’s how.

How to create a Binance futures demo account | trade crypto on a Binance demo account

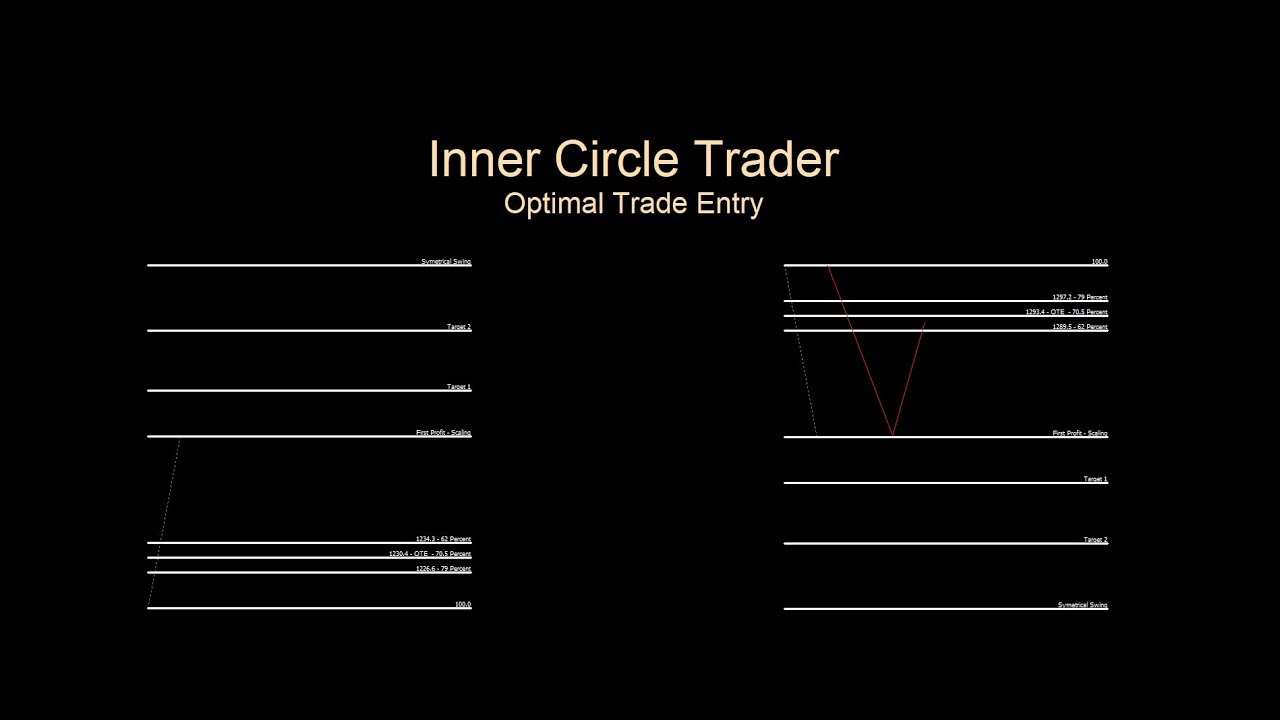

OTE Primer - Intro To ICT Optimal Trade Entry

Trading the 15 minute ORB the MAX way!

Entry - 20 Jun - BTST in Equity | Trade Swings | Trade Swings Academy | Live Trade

5.0 / 5 (0 votes)