How to Pitch a Stock – and Find An "Angle" at the Last Minute [Tutorial]

Summary

TLDRThis tutorial video offers a comprehensive guide on crafting a stock pitch, detailing the structure, idea generation, and research process. It emphasizes starting with a clear recommendation, providing company background, and explaining investment thesis. The video also advises on selecting a company with a simple business model and upcoming catalysts. It suggests using resources like Finviz for screening and conducting real-life research to refine the pitch, ensuring it's concise and compelling.

Takeaways

- 📈 Start a stock pitch with a clear recommendation (long or short) and an investment thesis explaining why the market's evaluation is incorrect.

- 🏭 Match your pitch to the firm's strategy and industry focus, and choose an industry you're familiar with to increase the pitch's relevance.

- 🔍 Use screening tools like Finviz to find mid-sized companies with a market cap between 1 to 10 billion dollars that have shown divergence from industry trends.

- 📊 Focus on companies with simple financials and a few key drivers to simplify the research and valuation process.

- 🔑 Look for companies with upcoming catalysts within 6 to 12 months, such as product launches or strategic changes, to provide a clear timeline for potential stock price movement.

- 📚 Conduct research using annual reports, investor presentations, and press releases to understand the company's operations and industry position.

- 💼 Build a simple Discounted Cash Flow (DCF) model with projections based on units sold, average selling price, or market share to estimate the company's value.

- 🤝 Engage in real-life research by speaking with industry insiders, suppliers, or customers to gain insights that can strengthen your pitch.

- 📉 Address risk factors and propose mitigants, such as using options or stop-loss orders, to show how potential losses can be managed.

- ⏱ When time is limited, prioritize research that can be completed quickly, focusing on key financials and industry trends, to prepare a compelling pitch.

Q & A

What is the main focus of the tutorial video?

-The main focus of the tutorial video is to discuss how to pitch a stock, covering the stock pitch guide, company selection, and research process.

Where can viewers find templates and the full guide mentioned in the video?

-Viewers can find templates and the full guide on the M&I blog post located at mergersandacquisitions.com/stock-pitch-guide.

What is the basic structure of a stock pitch as outlined in the video?

-The basic structure of a stock pitch includes a recommendation, investment thesis, company background, investment thesis explanation, catalysts, valuation and past performance analysis, risk factors and mitigants, and a summary of recommendations.

Why is it important to match the industry to the hedge fund strategy when preparing a stock pitch?

-Matching the industry to the hedge fund strategy is important because it ensures that the pitch aligns with the firm's investment preferences, increasing the likelihood of a successful pitch.

What is the recommended market cap range for mid-sized companies when screening for stock pitches?

-The recommended market cap range for mid-sized companies when screening for stock pitches is between 1 to 10 billion dollars.

How does the video suggest narrowing down a list of potential companies for a stock pitch?

-The video suggests narrowing down a list of potential companies by focusing on those with a clear divergence from stock price trends, mid-sized market caps, a few key drivers, relatively pure-play businesses, clean and simple financial statements, and clear catalysts in the next six to twelve months.

What are some methods to research a company and its industry as suggested in the video?

-Some methods to research a company and its industry include reviewing annual and interim reports, investor presentations, recent press releases, and conducting real-life research by speaking with people in the industry.

What is the recommended approach for building a DCF analysis in a stock pitch?

-The recommended approach for building a DCF analysis in a stock pitch is to project revenue and expenses beyond simple percentage growth rates and margins, aiming for around 100 to 300 rows in Excel, and to include cases like the base case, upside case, and downside case.

Why is it beneficial to speak with people in real life for a stock pitch?

-Speaking with people in real life is beneficial for a stock pitch because it provides insights from industry professionals, suppliers, customers, and others who can offer unique perspectives and information that may not be available through public financial statements or reports.

What is the significance of catalysts in a stock pitch and how are they identified?

-Catalysts are significant in a stock pitch because they are events or developments that can cause the market to reevaluate a stock's value. They are identified by looking for upcoming events such as product launches, acquisitions, earnings announcements, or strategic changes that could impact the stock price.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Full Print On-Demand Tutorial For Beginners (2024 Version)

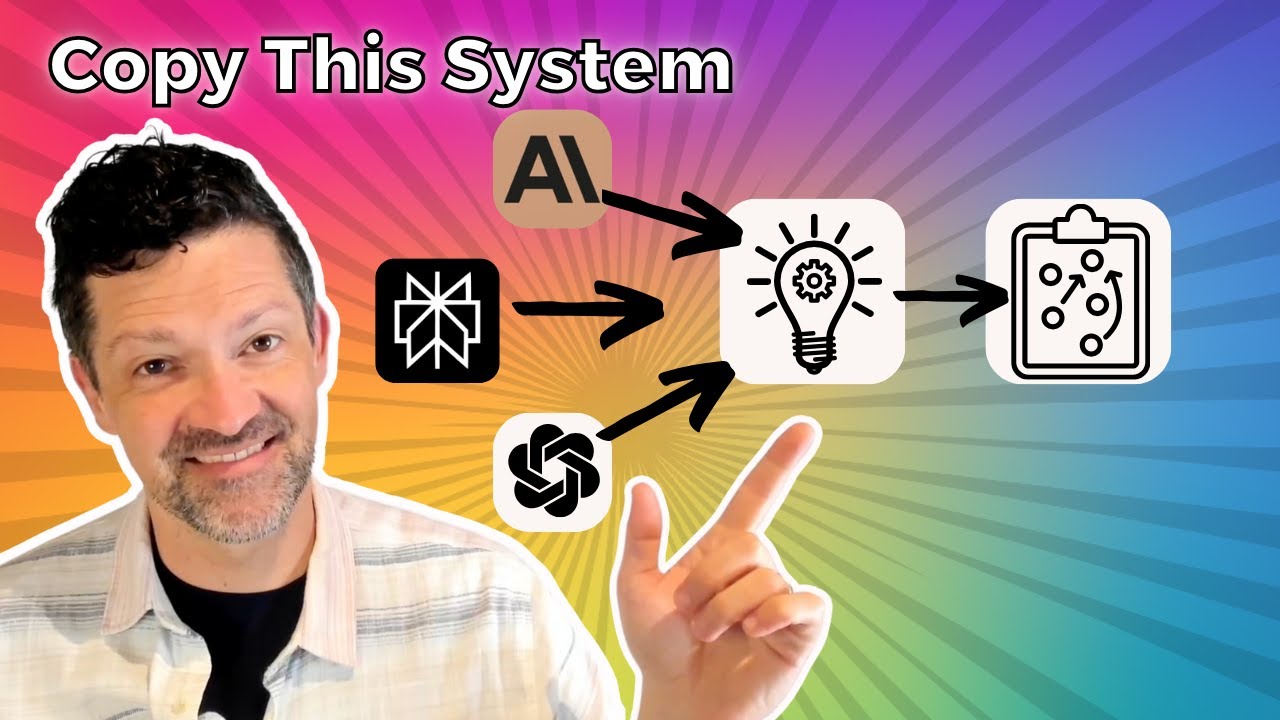

This AI System Builds Data-Driven Marketing Strategies

How to Develop an Interview Guide for Qualitative Research (Real Examples) 🎤📄

Cara Membuat Skripsi dengan AI Auto Lulus Cepet | Braintext AI

CÓMO REDACTAR LOS OBJETIVOS DE INVESTIGACIÓN PASO A PASO CON EJEMPLO (PROYECTO DE INVESTIGACIÓN).

Game Design Process: Designing Your Video Game

5.0 / 5 (0 votes)