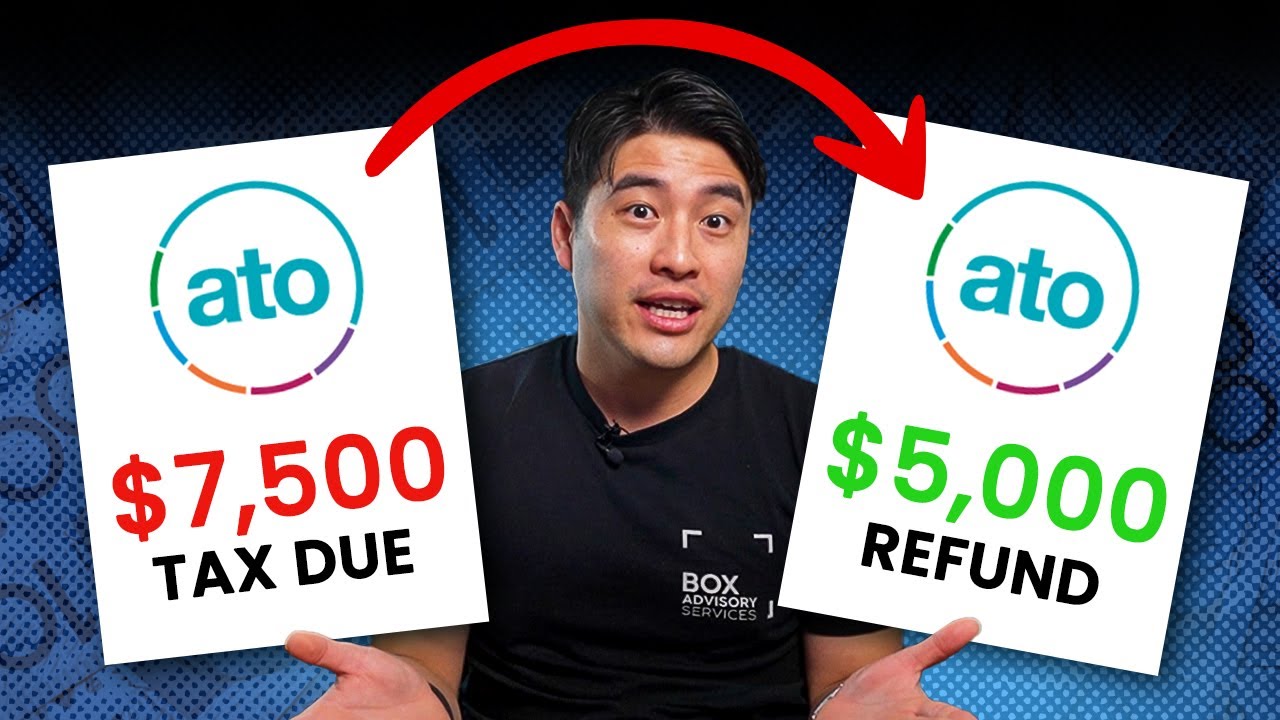

【即やるべき】「こんなに差が付くなんて…」個人事業主必見。確定申告後すぐにやった方が良い節税の事前対策について解説!

Summary

TLDRThis video script discusses the importance of proper tax planning and management for small business owners in Japan. The speaker, Sugawara from Sugawara Tax Office, emphasizes the benefits of monthly financial management to avoid regrets after the annual tax filing. He suggests strategies such as setting aside a certain amount each month for tax deductions, considering family wages for tax benefits, and not overlooking medical expenses and hometown tax contributions. Sugawara also highlights the value of working with a tax accountant to ensure accurate financial records and to maximize tax savings. The script concludes with a reminder to subscribe for more informative content and mentions the instructor's affiliation with SMG Academy.

Takeaways

- 📋 The speaker, Sugawara from Sugawara Tax Office, discusses the importance of understanding tax rules to avoid regrets after filing tax returns.

- 💡 It is suggested to start preparing for the next year's tax declarations now rather than waiting until the last minute to avoid regrets.

- 🏦 The speaker highlights the benefits of personal savings for tax deductions, mentioning that saving 70,000 yen per month can lead to significant tax savings.

- 💰 There is an option to borrow from personal savings for tax purposes, with up to 70-80% or even 90% of the accumulated amount being available for loans.

- 👨👩👧👦 For those with family members, the speaker advises considering family wages for tax deductions, which can help distribute income and reduce taxable income.

- 💊 The script mentions the importance of keeping receipts for medical expenses, including those for common medications purchased at drugstores, as they are eligible for medical deductions.

- 🏠 The concept of 'hometown tax' is discussed, emphasizing the need to understand the limit to avoid underutilizing or exceeding the allowed deductions.

- 📉 The speaker advises against procrastination and suggests monthly financial management to streamline the tax filing process and avoid common pitfalls.

- 🤝 The benefits of working with a tax accountant are highlighted, as they can provide personalized advice and help manage taxes efficiently.

- 📈 The script touches on the potential for growth in businesses that manage their finances well and avoid unnecessary tax payments.

- 📚 Lastly, the speaker promotes his affiliation with SMG Academy and encourages viewers to subscribe for more information and future tax-related themes.

Q & A

What is the main topic discussed by Mr. Sugawara in the video script?

-The main topic discussed by Mr. Sugawara is about the importance of understanding and preparing for tax declarations in Japan, including strategies to avoid regrets post-filing, such as making the most out of tax deductions and managing finances properly.

What does Sugawara-san suggest people should do after completing their annual tax declaration?

-Sugawara-san suggests that after completing their annual tax declaration, people should start preparing for the next year's tax declaration by understanding the rules and taking preemptive actions to avoid regrets and ensure they are not missing out on potential tax savings.

According to the script, why do many people regret after their tax declaration?

-Many people regret after their tax declaration because they realize they could have saved more on taxes if they had known and applied the rules correctly. They often think they should have done more to reduce their tax liability.

What is one of the strategies Sugawara-san mentions to save on taxes?

-One of the strategies Sugawara-san mentions is to accumulate savings monthly, which can later be used to reduce taxable income and thus lower the overall tax burden.

What is the significance of accumulating 70,000 yen per month as mentioned in the script?

-Accumulating 70,000 yen per month is significant because it amounts to 840,000 yen annually, which can be used to reduce taxable income. If the tax rate is 20%, this could result in a tax saving of 168,000 yen.

What is Sugawara-san's advice for those who find it difficult to save 70,000 yen per month?

-Sugawara-san advises that even if one cannot save 70,000 yen per month, they should start with a smaller amount, such as 30,000 yen, and gradually increase their savings.

What is the potential benefit of borrowing from the small-scale wage relief system mentioned in the script?

-The potential benefit of borrowing from the small-scale wage relief system is that it allows individuals to borrow up to 70-80% of their accumulated amount, which can be used to save on taxes.

Why does Sugawara-san recommend involving family members in the tax planning process?

-Sugawara-san recommends involving family members because it allows for the distribution of income, which can lead to tax savings. For example, paying a spouse a salary and then deducting it as an expense can help reduce the overall tax liability.

What is the importance of keeping medical expense receipts mentioned in the script?

-Keeping medical expense receipts is important because they can be used to claim medical expenses as a non-taxable deduction, which can reduce the overall tax burden.

What is the potential downside of not managing finances and receipts properly throughout the year as per the script?

-The potential downside of not managing finances and receipts properly throughout the year is that one might miss out on various tax deductions and savings opportunities, leading to overpayment of taxes and regrets post-filing.

What does Sugawara-san suggest for those who find it challenging to manage their finances monthly?

-Sugawara-san suggests that those who find it challenging to manage their finances monthly should consider contracting a tax accountant to help manage their finances and ensure they are maximizing their tax savings.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

Do this To Legally Pay LESS TAXES in Australia

14 Biggest Tax Write Offs for Small Businesses! [What the Top 1% Write-Off]

Tax Planning Strategies For Canadian Small Business Owners

PPH FINAL UMKM 0 5% BERAKHIR 2024? BEGINI TAX PLANNING DI 2025

Bagaimana Bisnis Online Shop Melapor Pajak???

Dasar - Dasar Manajemen Pajak

5.0 / 5 (0 votes)