Why Ed Yardeni Sees Bitcoin as "Digital Tulips"

Summary

TLDRThe speaker discusses market valuation concerns, forecasting a rapid rise in S&P 500 index levels and comparing the current market exuberance to the late 1990s. They highlight the high valuations in artificial intelligence stocks and the fluctuating performance of major companies like Apple and Tesla. The conversation also touches on Bitcoin's speculative nature, likening it to 'digital tulips,' and explores its impact on other markets. The speaker expresses a traditional investment perspective, valuing earnings and tangible assets over cryptocurrencies.

Takeaways

- 📈 The speaker forecasts a S&P 500 index level of 5400 by year-end and 6000 for the following year, with concerns about reaching these targets too quickly.

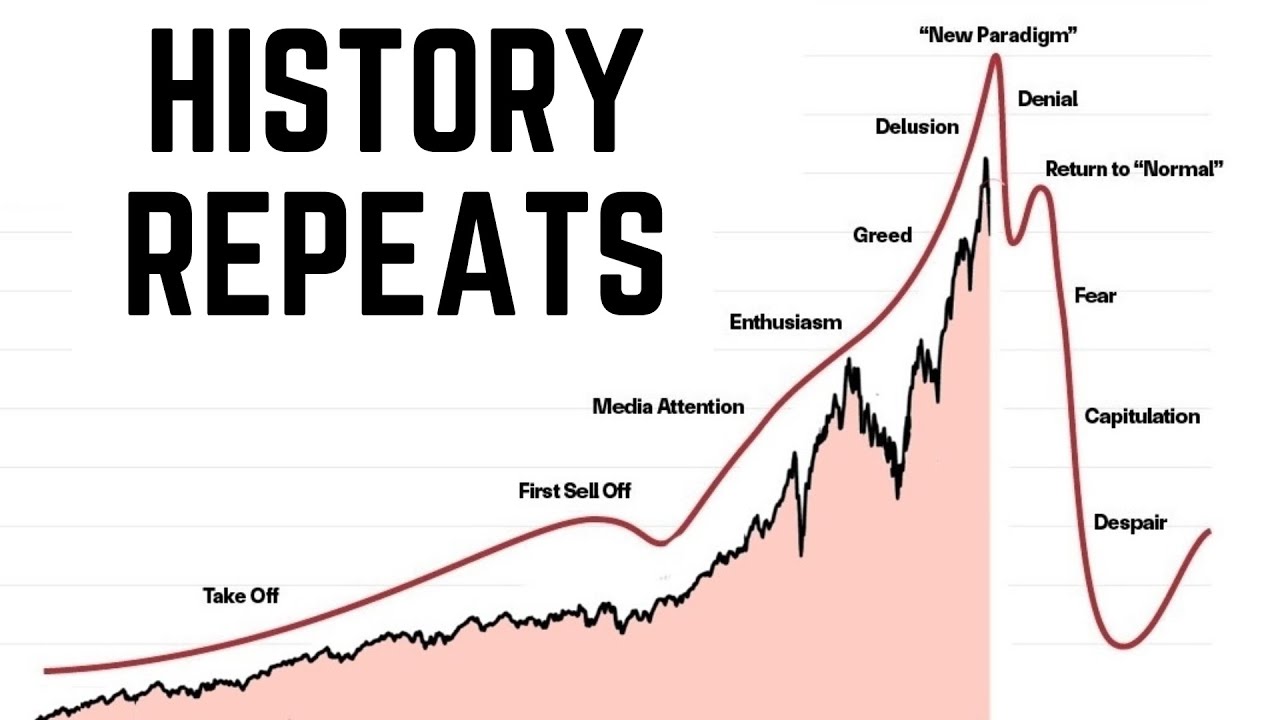

- 🚀 The market's current state is compared to the 1990s, with the speaker suggesting we might be in a similar position to 1996, just before the dot-com bubble.

- 💡 The concept of 'irrational exuberance' is discussed, referencing Alan Greenspan's famous speech and questioning if we are at a similar point of market overvaluation.

- 🤖 The valuation multiple for artificial intelligence-related stocks is considered very high, indicating a potential area of market exuberance.

- 📉 The 'Magnificent Seven' tech stocks have seen some underperformance, which the speaker views as a healthy market adjustment.

- 🪙 Bitcoin's significant price movements are discussed, with the speaker expressing skepticism, likening it to 'digital tulips' due to its speculative nature.

- 🌐 The global nature of Bitcoin and its 24/7 market are highlighted as factors that could lead to higher price movements, but also increased unpredictability.

- 💸 The speaker emphasizes the importance of earnings and tangible investments, expressing discomfort with the lack of these elements in Bitcoin.

- 📊 The impact of Bitcoin's price on other markets, such as gold, is noted, with gold benefiting from a shift in investor interest.

- 📈 The speaker shares a long-term earnings forecast for the S&P 500, predicting increases that would support index levels of 6100 by 2026.

- 🤔 FOMO (Fear of Missing Out) is acknowledged as a common sentiment among investors, especially with the rapid rise of Bitcoin's value.

Q & A

What is the speaker's forecast for the S&P 500 index by the end of the year?

-The speaker forecasts 5400 for the S&P 500 index by the end of the year.

What concern does the speaker express about reaching the forecasted S&P 500 index level?

-The speaker is concerned that the S&P 500 might reach the forecasted level of 5400 by midyear or even earlier, which could indicate an overheated market.

What is the speaker's forecast for the S&P 500 index for the next year?

-The speaker forecasts 6000 for the S&P 500 index for the next year but is concerned that this level might be reached by the end of the current year.

Who is the individual mentioned from Yale, and what concept is he known for discussing?

-The individual from Yale mentioned is Shiller, who is known for discussing the concept of 'irrational exuberance' in the market.

How does the speaker compare the current market environment to the 1990s?

-The speaker compares the current market environment to the 1990s, suggesting that if we are in a similar situation, the question is whether we are at the stage of 1999 or somewhere earlier, like 1996.

What does the speaker refer to when mentioning the 'Magnificent Seven'?

-The 'Magnificent Seven' refers to a group of high-performing tech stocks that have been experiencing high valuation multiples, although some are becoming more rational as they are not performing as expected.

How does the speaker view Bitcoin in comparison to traditional investments?

-The speaker views Bitcoin as 'digital tulips,' comparing it to the Dutch tulip mania, but acknowledges the global market and 24/7 trading as factors that could lead to a much higher upside than traditional investments.

What is the speaker's stance on Bitcoin as an investment?

-The speaker is skeptical about Bitcoin as an investment, stating a preference for traditional investments with tangible earnings and value, such as stocks and bonds.

How does the speaker describe the impact of Bitcoin's popularity on other markets?

-The speaker suggests that Bitcoin's enthusiasm has spilled over into other markets like gold, with gold prices rising as Bitcoin enthusiasts diversify their investments due to high Bitcoin prices.

What is the speaker's long-term forecast for the S&P 500 index earnings?

-The speaker forecasts that the underlying earnings per share for the S&P 500 will increase to $250 this year, $270 in 2025, and $300 by 2026, which would support an S&P 500 index of 6100 by 2026.

How does the speaker address the concept of 'irrational exuberance' in the current market?

-The speaker acknowledges the widespread discussion of 'irrational exuberance' in the market, comparing the current sentiment to the period before Alan Greenspan's famous speech in 1996 about market irrationality.

What is the speaker's opinion on the recent market behavior of cryptocurrencies like Polkadot and Dogecoin?

-The speaker finds the serious discussions around cryptocurrencies like Polkadot and Dogecoin to be 'nuts,' indicating skepticism and a belief that these may be signs of speculative excesses in the market.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

☢ The GENERATIONAL CRASH Is Coming (No Clickbait!)

Please Don’t Be Dumb Money…

We are at the Precipice of a Major Turning Point for US Stocks…

WARNING: Brace for a Flood of Stock Market Crash Videos

This Market Crash is Flashing a Warning Not Seen for 3 Years (what it means for BTC & SP500)

"US Market recovered !! Indian Market? " Nifty and Bank Nifty, Pre Market Report , 07 Aug 2024 Range

5.0 / 5 (0 votes)