CPP Investments’ John Graham on Rebalancing Its Portfolio

Summary

TLDRIn this interview, John Graham from CPP Investments discusses the firm's global investment strategy, with a focus on emerging markets like China, India, and Brazil. Despite political complexities, CPP Investments remains committed to investing in China, seeing it as a key to understanding the world's second-largest economy. Graham also addresses the importance of diversification, active investment, and the role of ESG considerations in driving value. He acknowledges the challenges of the past decade and anticipates more subdued returns in the coming years, emphasizing the need for alpha generation in a changing investment landscape.

Takeaways

- 🌍 John Ehrlichman, from CPP Investments, emphasizes the importance of investing in emerging markets, particularly China, India, and Brazil, despite political complexities.

- 📈 CPP Investments, a Canadian pension plan, manages around $570 billion in assets and has allocated about 20% of its portfolio to emerging markets.

- 🇨🇳 Despite regulatory changes and other investors pulling out, CPP Investments maintains a 9% allocation to China, recognizing the significance of the world's second-largest economy.

- 🔍 The firm's investment strategy in China is asset-by-asset, focusing on public markets, with some private investments in real estate and equity.

- 💡 Private credit is a significant focus for CPP Investments, with a majority ownership in Antares, a U.S.-based direct lender.

- 📉 The firm is cautious about the current state of private credit, noting that the market is more active when credit becomes more affordable.

- 📊 John Graham, CEO of CPP Investments, expects lower returns over the next decade compared to the past 10-20 years due to the absence of the secular tailwinds that previously boosted markets.

- 🌐 Diversification across asset classes and geographies is a key strategy for CPP Investments, aiming to outperform passive alternatives.

- 🚫 CPP Investments has avoided direct investments in Russia for the past 10 years due to governance concerns, which has proven beneficial in light of recent geopolitical events.

- 💰 The firm has a single fiduciary mandate to maximize returns for the 21 million Canadian contributors and beneficiaries, with political independence and a focus on long-term financial security.

- 🌿 ESG factors are integrated into CPP Investments' decision-making, with a belief that good governance and respect for human rights and the environment drive value.

Q & A

What is John Ehrlichman's perspective on investing in emerging markets, particularly China, India, and Brazil?

-John Ehrlichman sees a future in investments in emerging markets, including China, India, and Brazil. Despite the political issues, he believes it's important to continue investing in these regions as they represent significant growth opportunities and are part of the world's largest economies.

How does CPP Investments approach investing in China?

-CPP Investments has a 9% allocation to China in their portfolio. They believe in understanding the role of the world's second-largest economy and have decided to continue investing in China, focusing on building assets one by one and ensuring comfort with each investment.

What is the size of CPP Investments' portfolio, and how much is allocated to emerging markets?

-CPP Investments manages around 570 billion in assets, with approximately 20% of the portfolio allocated to emerging markets.

How does John Ehrlichman view the current interest in private credit investments?

-John Ehrlichman acknowledges the excitement around private credit investments but cautions that there is a lot of capital in the market, and the historical opportunities in private credit were sponsor opportunities, which have not been as active recently. He anticipates the market will become more active when credit becomes more affordable.

What is CPP Investments' stance on investing in Russia?

-CPP Investments decided about 10 years ago not to invest in Russia due to governance concerns. They prioritize other large countries and do not engage in direct investments in Russia.

How does John Ehrlichman view the role of ESG in investment decisions?

-John Ehrlichman believes that non-financial considerations such as ESG drive value and are integral to investment decision-making. He emphasizes the importance of investing in companies with strong governance and respect for human rights and the environment.

What is the expected return for CPP Investments over the next decade compared to the last decade?

-John Ehrlichman expects returns over the next decade to be subdued compared to the past 10-20 years, as the last decade was above average due to secular tailwinds. He believes in a diversified approach and active investment to outperform passive alternatives.

How does CPP Investments maintain its independence and focus on its fiduciary mandate?

-CPP Investments operates with political independence, free from government involvement in investment decisions, and has a single fiduciary mandate to maximize returns without undue risk, considering factors that impact the plan and contributing to the financial security of its contributors and beneficiaries.

What is John Ehrlichman's view on the current rate situation and its impact on investments?

-John Ehrlichman believes that central banks will get inflation back to target and that rates will be higher for longer. As a long-term institutional investor, CPP Investments is comfortable with the current rate environment, which offers positive real rates and a better place for investment returns.

How does CPP Investments approach the investment in public and private markets?

-CPP Investments' portfolio is predominantly in public markets, with some exposure to private markets, including real estate and private equity. They continue to look for opportunities in both sectors, ensuring they are compensated for the risks they take.

What is John Ehrlichman's outlook on the future of the private credit market?

-John Ehrlichman anticipates that the private credit market will become more active when credit becomes more affordable and when the broadly syndicated loan market and high yield market return. He sees room for both public and private credit markets to function effectively.

Outlines

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowMindmap

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowKeywords

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowHighlights

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowTranscripts

This section is available to paid users only. Please upgrade to access this part.

Upgrade NowBrowse More Related Video

CPP Investments F2023 Results

Vad är en tillväxtmarknadsfond? | Nordnet Academy

Vad är en globalfond? | Nordnet Academy

What is an emerging market? | CNBC Explains

Vou INVESTIR em ETFs de MERCADOS EMERGENTES 🚀 Qual o MELHOR ETF❓ NOVA SÉRIE MENSAL de Investimentos💸

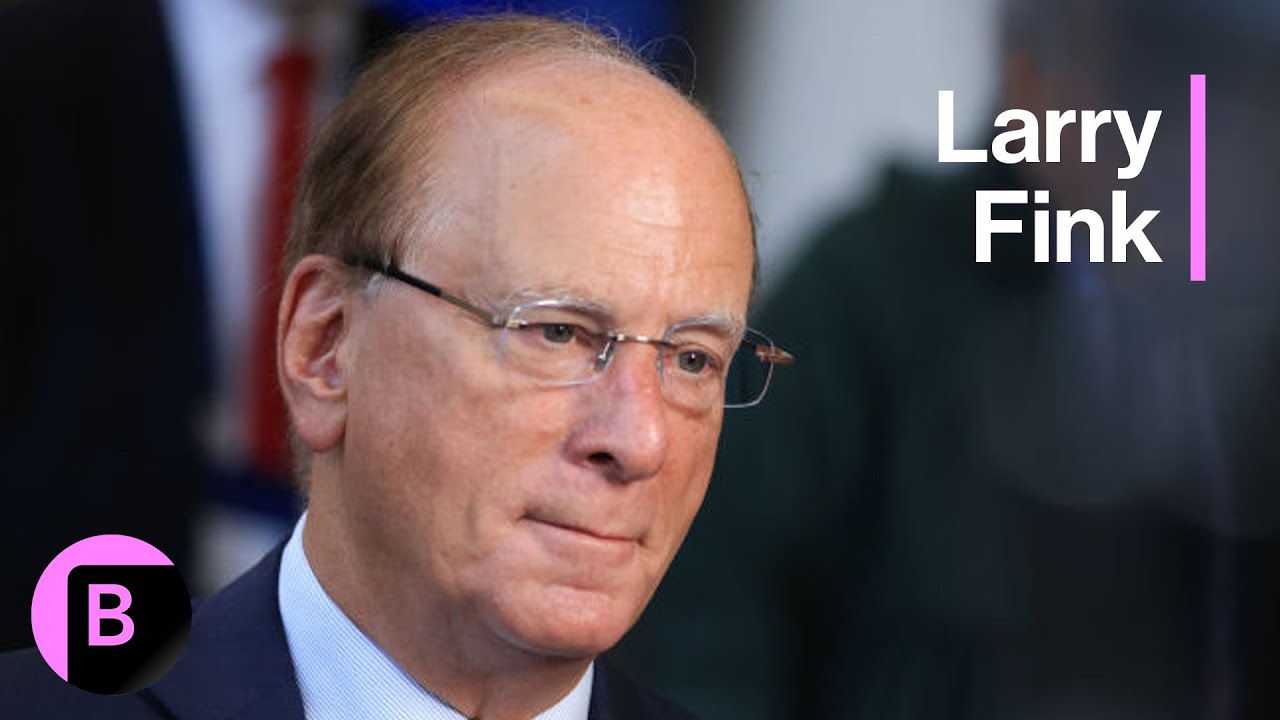

BlackRock CEO Larry Fink on US Economy, Trump Vs. Harris, Geopolitical Risks (Full Interview)

5.0 / 5 (0 votes)