Gr 11 - Accounting - Partnerships - Activity 1

Summary

TLDRThis educational video script by Mrs. Brimakum delves into the intricacies of partnerships in business, contrasting them with sole traders. It covers the unique aspects of partnership accounting, focusing on year-end adjustments, primary and final profit distributions, and the general ledger accounts. The script guides learners through the process of adjusting for partner salaries, bonuses, interest on capital, and the effects on the accounting equation, emphasizing the importance of a written partnership agreement.

Takeaways

- 📚 The focus of Chapter 3 is on partnerships, a different form of ownership compared to the sole trader discussed in Grade 10.

- 💰 Partners in a partnership are entitled to primary distributions (salary, allowance, bonus, interest on capital) and secondary distributions of profits.

- 🤝 There are different types of partners, including active partners and silent partners, which influences the method of profit distribution.

- 📉 Primary distributions are considered an expense to the business and are debited to the partner's current account, affecting the owner's equity.

- 🔄 At the end of the accounting period, expenses such as salary, bonus, and interest on capital are transferred to the appropriation account.

- 📝 The drawings of partners are closed off to the current account, indicating the amount taken from the business by each partner.

- 📉 The remaining profit or loss after primary distributions is shared according to a specific ratio and recorded in the current account.

- 📊 A partnership has unique accounts such as capital accounts, drawings, and current accounts, unlike a sole trader who only has capital and drawings.

- ⚖️ The net profit is transferred to the appropriation account in a partnership, where profit distribution is determined according to the partnership agreement.

- 📋 Year-end adjustments include recording transactions such as partners taking assets for personal use, which are recorded at cost, not selling price.

- 📈 Partners' salaries are subject to adjustments based on changes outlined in the partnership agreement, affecting the calculation of salary allowances.

Q & A

What is the main focus of Chapter 3 in the transcript?

-The main focus of Chapter 3 is on partnerships, specifically discussing the general ledger account and the distribution of profits among partners.

What are primary distributions of profits in a partnership?

-Primary distributions of profits in a partnership include a partner's salary, allowance, bonus, and interest on capital, which are considered an expense to the business and are debited to the partner's current account.

What is the purpose of having different types of partners in a partnership?

-Different types of partners, such as active and silent partners, exist to ensure fair profit distributions, taking into account their varying levels of involvement in the business.

How are the final or remaining distributions of profits calculated in a partnership?

-The final distributions of profits are calculated by taking the net profit from the profit and loss account, subtracting all primary distributions of profits, and then dividing the remaining amount according to a specific ratio to the current account of each partner.

What happens if the remaining profit after primary distributions is a loss in a partnership?

-If the remaining profit is a loss, it is shared among the partners, meaning that the loss figure will appear on the credit side in the appropriation account, reflecting that the partnership owes the partners.

What is the difference between equity accounts in a sole trader and a partnership?

-In a sole trader, there are two equity accounts: capital and drawings. In a partnership, there are capital accounts, drawings accounts, and current accounts for each partner.

How is the net profit transferred in a sole trader versus a partnership?

-In a sole trader, the net profit is transferred from the profit and loss account to the capital account. In a partnership, the net profit goes to the appropriation account to determine profit distribution among partners.

What is the accounting entry for a partner taking trading stock for personal use?

-The accounting entry for a partner taking trading stock for personal use involves debiting the partner's drawings account and crediting the trading stock account at cost, not selling price.

What is the effect on the accounting equation when a partner contributes additional equipment to increase their capital?

-When a partner contributes additional equipment to increase their capital, the accounting equation is affected by debiting the equipment account and crediting the partner's capital account, increasing both assets and owner's equity.

How are partners' salaries adjusted for year-end calculations?

-Partners' salaries are adjusted for year-end calculations by considering any increases that occurred during the accounting period, such as an 8% increase on the first of July, and calculating the total salary allowance accordingly.

What is the process for calculating interest on capital for partners?

-Interest on capital is calculated based on the capital balances of partners, considering any changes in capital during the year, such as increases or decreases, and applying the agreed interest rate per annum.

Outlines

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифMindmap

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифKeywords

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифHighlights

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифTranscripts

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифПосмотреть больше похожих видео

Capitalization Rules for Titles: English Language Arts

Proses melihat dari mata kita. #kelas5 #ipas

STRATEGI PELAKSANAAN (SP) 3 PASIEN HALUSINASI || Praktikum Keperawatan jiwa || STIK Bina Husada.

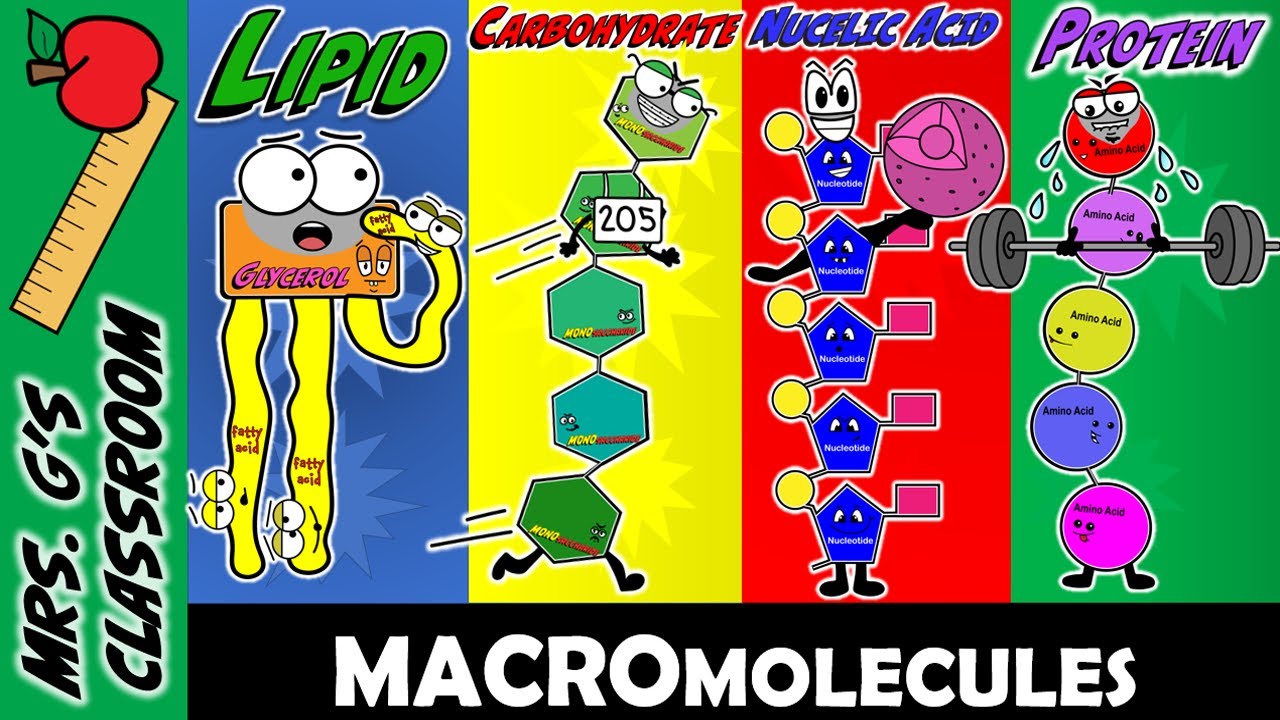

What Are the 4 Major Macromolecules and How Are They Made?

Gr 12 Accounting - Budgets - Activity 1

Video Pembelajaran Kalimat Perintah Kelas 5 Kurikulum Merdeka

5.0 / 5 (0 votes)