The ONLY Elliott Wave Theory Trading Guide You’ll Ever Need

Summary

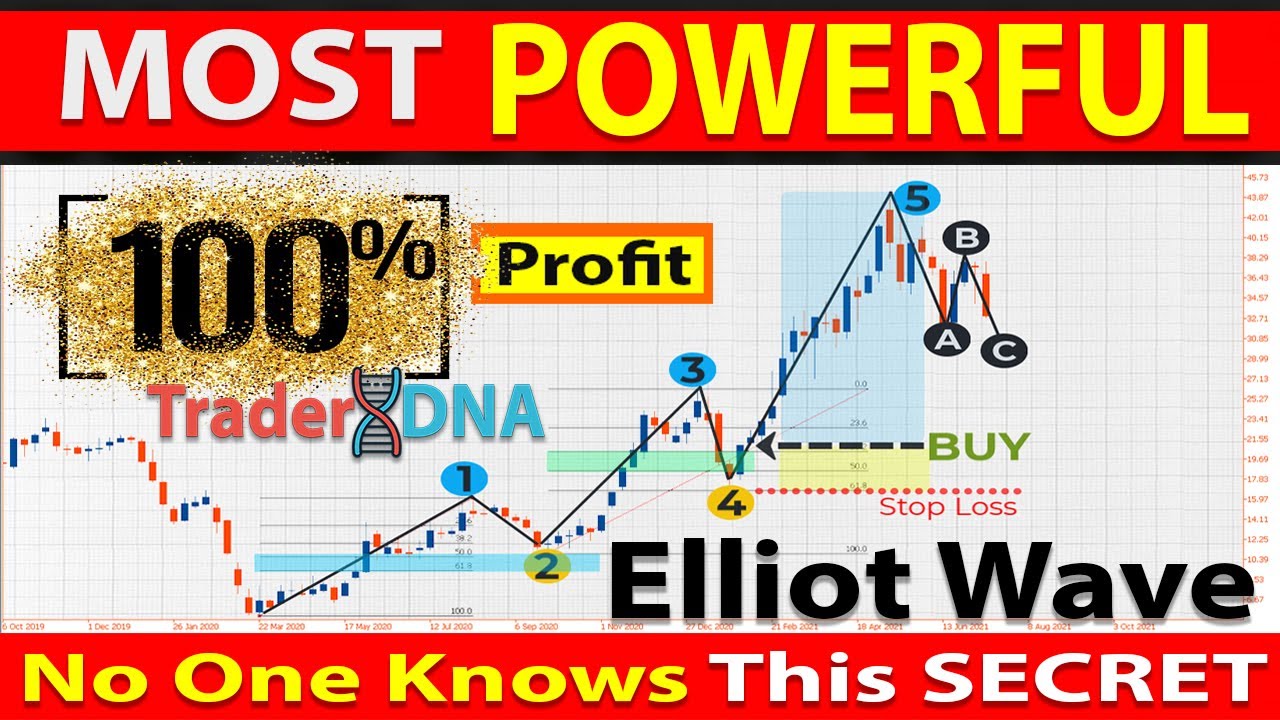

TLDRElliot Wave Theory helps traders understand market trends through price movements that follow a rhythmic pattern called waves. These waves are driven by investor psychology and are divided into impulsive and corrective types. Impulsive waves drive major price shifts, while corrective waves present retracements. The typical five-wave pattern (1, 2, 3, 4, 5) in uptrends offers insights into market cycles, with Fibonacci ratios providing key turning points. By understanding wave relationships and size, traders can identify high-probability entry points. Although subjective, Elliot Wave Theory has been successfully incorporated into many traders' strategies for enhanced market analysis.

Takeaways

- 😀 Waves in financial markets follow rhythmic patterns driven by investor psychology, forming the basis of Elliott Wave Theory.

- 😀 Elliott Wave Theory helps traders understand market cycles by recognizing impulsive and corrective waves, essential for analyzing trends.

- 😀 Impulsive waves are associated with strong price shifts and trends, while corrective waves provide brief retracements that offer trading opportunities.

- 😀 Trading in the direction of impulsive waves is recommended as they provide greater profit potential compared to corrective waves.

- 😀 A typical five-wave pattern in an uptrend consists of three upward impulsive waves and two corrective waves, labeled as 1 to 5 and A, B, C respectively.

- 😀 In a downtrend, after the five-wave uptrend, there are three downward waves, with wave A being an impulse down, followed by corrections (B) and a final impulse (C).

- 😀 Understanding the size of corrections is critical for trading Elliott Waves, with typical retracements of 60% for Wave 2 and 30-40% for Wave 4.

- 😀 The Elliott Wave rules include: Wave 3 must be the longest impulsive wave, Wave 2 must not exceed Wave 1, and Wave 4 must not overlap with Wave 1's price.

- 😀 There are additional guidelines in Elliott Wave analysis, such as Wave 5 typically approximating the length of Wave 1, and alternating correction types between Wave 2 and Wave 4.

- 😀 Integrating Fibonacci ratios with Elliott Wave structures helps traders identify high-probability turning points, with common relationships like Wave 2 retracing 50-61.8% of Wave 1 and Wave 3 extending to 161.8%.

Q & A

What is Elliott Wave Theory and why is it important for traders?

-Elliott Wave Theory is a technical analysis approach that suggests financial market price movements follow repetitive, predictable patterns known as 'waves.' These waves are driven by investor psychology, and understanding them helps traders anticipate market cycles and trends, making it an essential tool for market analysis and trading strategies.

What are the two main types of waves in Elliott Wave Theory?

-The two main types of waves in Elliott Wave Theory are 'impulsive waves' and 'corrective waves.' Impulsive waves are large, strong price movements that follow the main trend, while corrective waves represent brief retracements within the trend, providing entry opportunities for traders.

What is the significance of impulsive waves in Elliott Wave Theory?

-Impulsive waves are critical in Elliott Wave Theory because they represent the significant price shifts that align with the primary market trend. They are the strongest waves and offer traders the greatest profit potential as they drive the market in the direction of the prevailing trend.

What role do corrective waves play in Elliott Wave analysis?

-Corrective waves are short-term retracements within the larger market trend. They are important because they present opportunities for traders to enter the market in anticipation of the next major price move in the direction of the prevailing trend, whether the market is in an uptrend or downtrend.

Can you explain the typical five-wave pattern in Elliott Wave Theory during an uptrend?

-In an uptrend, Elliott Wave Theory identifies a typical five-wave pattern, consisting of three upward impulsive waves (Waves 1, 3, and 5) and two corrective waves (Waves 2 and 4). Wave 1 is the initial price movement, Wave 2 is a corrective pullback, Wave 3 is the longest and strongest impulsive wave, Wave 4 is another corrective pullback, and Wave 5 is the final upward impulsive wave.

What happens after the five-wave uptrend in Elliott Wave Theory?

-After the five-wave uptrend, the market typically enters a three-wave corrective phase labeled A, B, and C. This correction usually retraces part of the earlier uptrend before the market resumes its primary trend.

What are the three golden rules of Elliott Wave labeling?

-The three golden rules of Elliott Wave labeling are: (1) Wave 3 must be the longest or strongest impulsive wave and never the shortest; (2) Wave 2 cannot surpass the beginning of Wave 1; and (3) Wave 4 cannot overlap with the price of Wave 1. Violating these rules invalidates the Elliott Wave count.

How can Fibonacci ratios enhance Elliott Wave analysis?

-Fibonacci ratios are commonly used in Elliott Wave analysis to identify key levels for potential turning points in the market. These ratios help traders predict where corrective waves may end and where the trend might resume, offering a more accurate forecast of price movements.

What are the typical Fibonacci relationships in Elliott Waves?

-In Elliott Wave Theory, typical Fibonacci relationships include: Wave 2 typically retracing 50% to 61.8% of Wave 1, Wave 3 often extending to 161.8% of Wave 1, and Wave 5 commonly equaling 100% of Wave 1 or extending to 161.8%. These ratios help traders anticipate the size of each wave.

Is Elliott Wave Theory a foolproof trading technique?

-While Elliott Wave Theory is a valuable tool for traders, it is not foolproof. Its subjective nature means that wave counts can sometimes differ depending on interpretation. However, many traders successfully incorporate Elliott Wave patterns into their strategies, often in combination with other technical analysis tools for greater accuracy.

Outlines

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифMindmap

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифKeywords

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифHighlights

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифTranscripts

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифПосмотреть больше похожих видео

The Simplest Way to Use & Trade Elliott Waves (Changes Everything...)

Arbitrum (ARB) Price Prediction 2025 - How High Will It Go?

Every Trading Strategy Explained in 12 Minutes

🔴 Most Effective "ELLIOT WAVE and FIBONACCI" Price Action Trading Strategy (Wave Trading Explained)

Bitcoin [BTC]: The final stage is here!

ICT Mentorship Core Content - Month 04 - Mitigation Blocks

5.0 / 5 (0 votes)