5 Erros RIDÍCULOS que o INVESTIDOR INICIANTE Comete (e como EVITÁ-LOS)

Summary

TLDRThis video highlights five common and avoidable investment mistakes, even made by experienced investors. It covers the dangers of falling for 'easy money' promises, investing in things you don’t understand, reacting impulsively to news, trying to predict the market, and putting all your money in one place. Viewers are encouraged to conduct thorough research, diversify their investments, and stick to long-term strategies. The video aims to help investors make smarter, more informed decisions and avoid costly pitfalls in their financial journey.

Takeaways

- 😀 Beware of promises of easy and fast money. These are often signs of scams, especially in volatile markets like cryptocurrency.

- 😀 Investing without understanding the asset is like gambling. Take time to research and understand the risks involved.

- 😀 Don't make impulsive decisions based on breaking news. News can be misleading and cause emotional reactions that lead to bad investment choices.

- 😀 Trying to predict the market is a futile exercise. Market behavior is unpredictable and influenced by countless factors.

- 😀 Diversification is key. Don’t put all your eggs in one basket. Spreading investments reduces overall risk.

- 😀 Consistent, small investments can lead to significant long-term gains. Regularly invest even if it's a small amount.

- 😀 Set clear investment goals and develop a personalized investment plan based on your risk tolerance and financial objectives.

- 😀 Before investing, ensure you have an emergency fund in place. This will protect you from having to sell investments during a financial emergency.

- 😀 Avoid relying on hearsay or social media gurus. Do your own research and make informed decisions based on solid information.

- 😀 Evaluate the fundamentals of a business or asset before investing. Understand its financials, management, market position, and competition.

- 😀 Don't fall for emotional investment stories or fake testimonials. Many schemes are designed to prey on your hopes of getting rich quickly.

Q & A

What is the main risk of falling for promises of easy money in investments?

-The main risk is that these promises often lead to scams, such as pyramid schemes, where the system relies on new investors rather than actual products or services. These schemes often collapse, leaving most participants with significant losses.

Why should you avoid investing in things you don’t fully understand?

-Investing in things you don’t understand is like gambling. Without knowledge of how the asset works, its risks, or its market behavior, you’re more likely to make poor decisions that can result in financial loss.

How do news events impact investment decisions?

-News events can cause emotional reactions in investors, leading to impulsive decisions based on fear or euphoria. However, these short-term reactions can often be misguided, and it’s important to rely on long-term fundamentals rather than the latest headlines.

Why is trying to predict the market a risky strategy?

-Trying to predict the market is risky because it’s influenced by a wide array of unpredictable factors, such as economic crises, technological advancements, and human behavior. Predicting market movements accurately is extremely difficult and often leads to poor investment decisions.

What is the concept of market efficiency, and why does it matter to investors?

-The theory of market efficiency suggests that all available information is already reflected in the price of assets, making it extremely difficult to consistently outperform the market. This implies that beating the market through predictions or 'inside information' is very unlikely.

How can diversifying your investments help mitigate risk?

-Diversification spreads your investments across different assets, reducing the risk of significant losses. By holding a variety of assets, you minimize the impact of a downturn in any single investment, making your portfolio more resilient to market fluctuations.

What is the relationship between risk and return in investments?

-Generally, the higher the risk of an investment, the higher the potential return, but also the greater the potential loss. Understanding this relationship helps investors assess whether the possible rewards justify the risks associated with a particular asset.

Why is it dangerous to base your investment decisions on what others are doing?

-Following the crowd or relying on the advice of non-experts (e.g., friends, family, or internet influencers) can lead to poor decisions, as everyone’s financial goals, risk tolerance, and situations are different. What works for one person might not work for you.

What is the best approach to building a personal investment strategy?

-The best approach involves understanding your financial goals, risk tolerance, and time horizon. Creating a personalized investment plan that aligns with these factors, regularly reviewing it, and sticking to long-term goals can significantly improve investment outcomes.

What role does financial education play in successful investing?

-Financial education is crucial for understanding the basics of investing, such as risk, asset allocation, and market behavior. Knowledge helps investors make informed decisions, avoid common mistakes, and improve their chances of long-term success.

Outlines

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифMindmap

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифKeywords

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифHighlights

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифTranscripts

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифПосмотреть больше похожих видео

2 Kesalahan Investor Saham Pemula

Top 5 Most Avoidable Retirement Mistakes

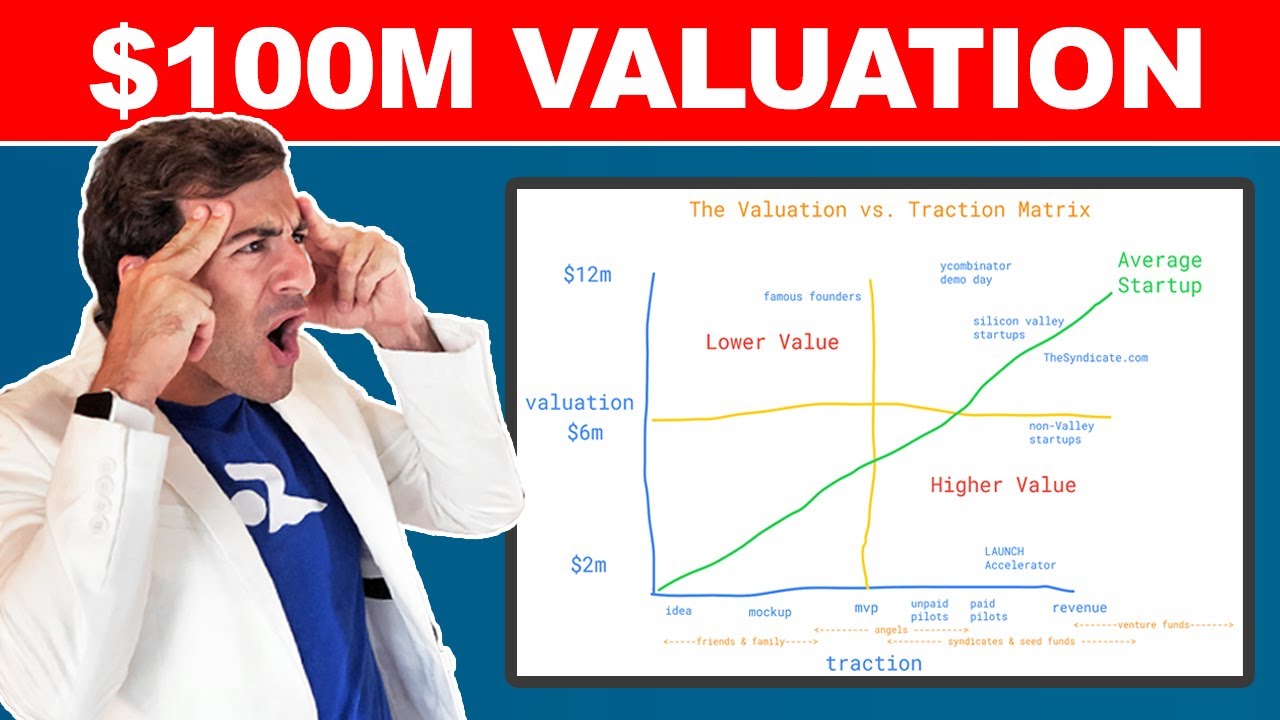

How To Value A Startup Pre-Revenue (Valuation vs. Traction Matrix)

No cometas estos 5 ERRORES mas costosos al invertir en Miami | Bienes Raices en Miami

Step by Step Averaging Down Saham Saat Harganya Lagi Turun yang Bikin Cuan Optimal

These Altcoins Can Make You Rich But You Need To Know Something

5.0 / 5 (0 votes)