ABD'den Karışık Ekonomik Veriler Var

Summary

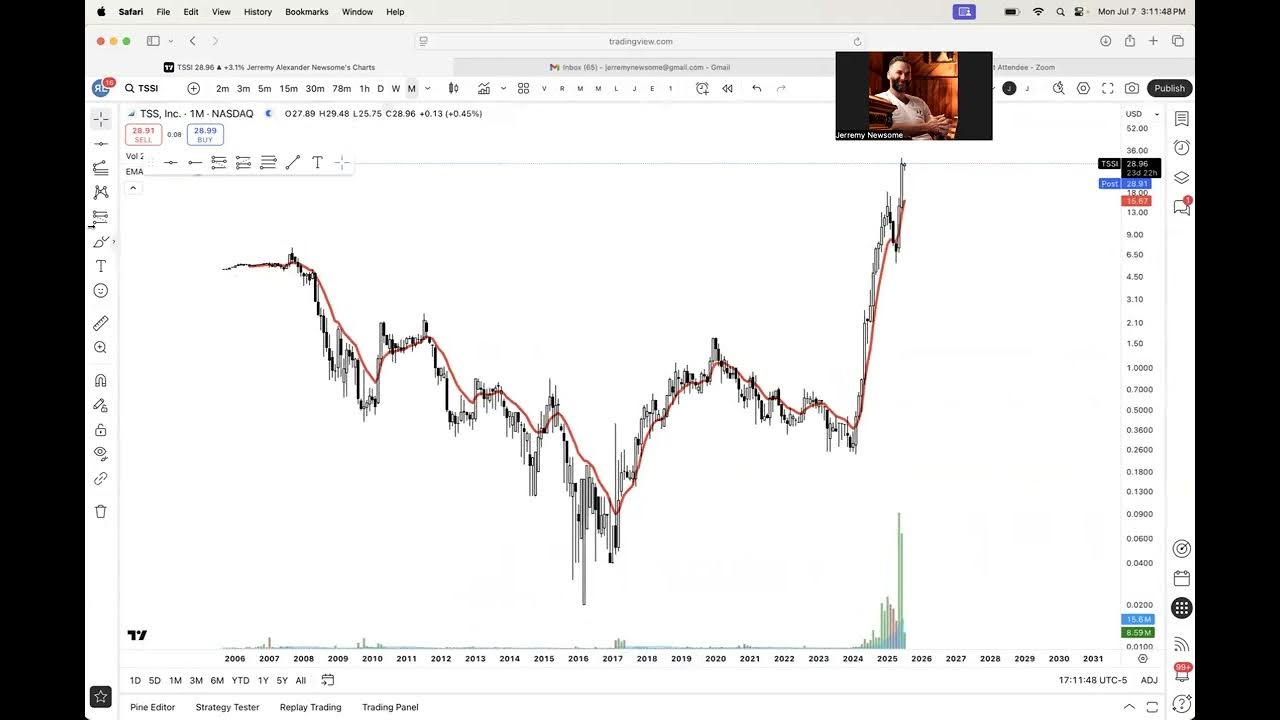

TLDRIn this analysis, Tunç Şatıroğlu discusses the current state of the markets, emphasizing a critical moment for stock trading and highlighting a potential bullish trend. He notes strong employment data from the U.S., raising questions about possible recession risks despite robust growth. The focus shifts to precious metals, particularly gold and silver, with expectations for further price increases. The discussion includes insights on Bitcoin's recent movements, linking market sentiments to upcoming political events. Overall, he asserts a bullish outlook for the market, suggesting that current downturns present buying opportunities.

Takeaways

- 📈 The stock market closed at a critical level, indicating a potential buying opportunity for the first tier of investments.

- ⏳ A wait of two hours was suggested to confirm the suitability for tier-one purchases before making any decisions.

- 🔍 A second tier purchase requires a 4-hour close above 9015, with a focus on daily closing prices.

- 📉 Current market trends are in a downtrend, but a significant reversal is possible if certain thresholds are breached.

- 🇺🇸 Strong U.S. employment data was reported, although growth figures fell below expectations, raising recession concerns.

- 💰 The Federal Reserve is expected to facilitate a 'soft landing' for the economy, with interest rates projected to decline.

- 🔄 Market volatility is anticipated leading up to the elections, with dips viewed as buying opportunities by investors.

- 💎 There has been a dip in gold prices, but silver is expected to rise, targeting $35 in the near future.

- 💻 Bitcoin has formed a cup and handle pattern, with immediate targets set at $71,495 and a long-term target of $88,884.

- 🤔 Despite mixed economic signals, the overall market sentiment remains bullish, with expectations of continued upward momentum in various asset classes.

Q & A

What was Tunç Şatıroğlu's assessment of the stock market's recent performance?

-He noted that the market closed at a critical level, indicating it was a suitable moment for initial buying, but he recommended waiting for further confirmation through additional data.

What key indicators did he mention regarding the U.S. economy?

-He discussed strong ADP employment figures but noted that the growth rate was lower than expected, raising concerns about a potential recession.

How does Şatıroğlu interpret the relationship between employment data and recession fears?

-He believes that the strength in employment data suggests a recession is unlikely at this time, indicating a more stable economic outlook.

What strategies did he suggest for investors in the current market?

-He advised investors to view market dips as buying opportunities and to be cautious of potentially misleading upward corrections.

What is Şatıroğlu's perspective on the future of gold and silver prices?

-He is optimistic about gold's potential to exceed 35 and suggests that silver could see sharp increases if it breaks certain resistance levels.

What trends did he observe in the precious metals market?

-He noted a recent decline in gold and significant drops in palladium and platinum, yet he remains confident about gold's long-term upward trajectory.

How does Şatıroğlu view Bitcoin's recent market behavior?

-He identified a bullish pattern forming in Bitcoin and reiterated a long-term price target of 88,000, suggesting that current price movements are still favorable for buying.

What political factors did Şatıroğlu suggest might influence market trends?

-He mentioned that the upcoming elections could lead to increased market volatility, but he believes that the overall sentiment remains bullish in anticipation of political outcomes.

What does Şatıroğlu mean by a 'soft landing' for the economy?

-He refers to the idea that the economy may experience a gradual adjustment without entering a recession, particularly as interest rates decline.

What overall sentiment does Şatıroğlu express regarding the current financial markets?

-He conveys a bullish sentiment, asserting that the market is viewing all downturns as buying opportunities and that the current volatility reflects underlying strength rather than weakness.

Outlines

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифMindmap

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифKeywords

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифHighlights

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифTranscripts

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифПосмотреть больше похожих видео

Top Tuesday Trade Ideas for July 8th, 2025

ABD'den Güçlü Ekonomik Veriler Geliyor #Altın #Gümüş #Nasdaq #bist

TESLA Stock - Is TSLA Bearish Now?

KEIN CLICKBAIT: Dieses Bitcoin Signal bringt die EXPLOSION [95% Wahrscheinlichkeit]

TESLA Stock - Was This A Bull Trap Or Not?

BTC above 60k, will it hold? Market Check

5.0 / 5 (0 votes)