The best time to trade gold (XAUUSD) | Part 1 | Gold trading strategy

Summary

TLDRThis video presents an extensive analysis of gold price volatility over a 17-year period, featuring over 13,000 data observations. It highlights key trading opportunities based on different market sessions, focusing on the U.S. and European overlap periods as the most volatile and profitable for momentum traders. The analysis emphasizes that trading gold during the European afternoon and U.S. market early hours yields better opportunities, backed by data-driven insights. The video encourages viewers to leverage this knowledge for improved trading success.

Takeaways

- 📊 The study analyzed 17 years of gold price data with over 13,000 observations, focusing on gold volatility.

- ⏰ Gold can be traded 24 hours a day, from Sunday 11 PM to Friday 9 PM GMT, across Asian, European, and U.S. sessions.

- 🔄 There are two major overlap periods with high trading activity: the European-Asian overlap (7 AM - 9 AM GMT) and the U.S.-European overlap (1 PM - 5 PM GMT).

- 💹 The European-U.S. overlap is the most active trading period, offering higher liquidity, volatility, and price movements.

- 💼 During these overlap periods, multi-national corporations, hedge funds, investment funds, and banks are actively trading for hedging and speculative purposes.

- 📈 Data shows that gold tends to move more significantly during the European afternoon and early U.S. session compared to the Asian-European overlap.

- 💵 Analyzing 8-hour price candles, the study found that gold's average move is about $11, with the maximum move being $108.

- ⚖️ About 62.5% of the time, gold moves $11 or less, but during the U.S.-European overlap, it moves more than $11 almost 40% of the time.

- 📊 Out of 13,247 observations, only 11 times did the Asian session show significant price movements, while nearly 2,900 times the European-U.S. overlap showed large movements.

- 📉 The most volatile and active sessions for gold trading are the European and U.S. sessions, making them ideal for traders seeking high price movements.

Q & A

What is the duration of the gold trading day according to the transcript?

-Gold can be traded 24 hours a day from Sunday 11 PM to Friday 9 PM GMT.

How many observations were included in the study mentioned in the transcript?

-The study included 17 years of data with over 13,000 observations.

What are the two special overlap periods in the gold trading sessions?

-The two special overlap periods are the European and Asian overlap from 7 AM to 9 AM GMT, and the U.S and European overlap from 1 PM to about 5 PM GMT.

Why are the overlap periods significant for trading gold?

-Overlap periods are significant because they have high liquidity, more volatility, and more price action due to multinational corporations, hedge funds, and banks transacting during these times.

Which session overlap is suggested for momentum traders according to the transcript?

-The European U.S overlap is suggested for momentum traders as it offers more volatility and trading opportunities.

What was the average eight-hour price candle range in gold found in the study?

-The average eight-hour price candle range in gold was about 11 dollars.

How often did gold move more than 11 dollars during the Asian session according to the study?

-Gold moved more than 11 dollars only 11 times out of 13,247 observations during the Asian session.

What is the percentage of time gold moved 11 dollars or less according to the study?

-Gold moved 11 dollars or less 62.5% of the time.

What is the maximum eight-hour price move in gold that was observed in the study?

-The maximum eight-hour price move in gold observed was 108 dollars.

Why is volatility important for traders as mentioned in the transcript?

-Volatility is important for traders because more volatility means more trading opportunities.

What is the conclusion about the best times to trade gold according to the transcript?

-The best times to trade gold are during the European and U.S sessions, as these sessions are the most volatile and have the most trading opportunities.

Outlines

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифMindmap

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифKeywords

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифHighlights

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифTranscripts

Этот раздел доступен только подписчикам платных тарифов. Пожалуйста, перейдите на платный тариф для доступа.

Перейти на платный тарифПосмотреть больше похожих видео

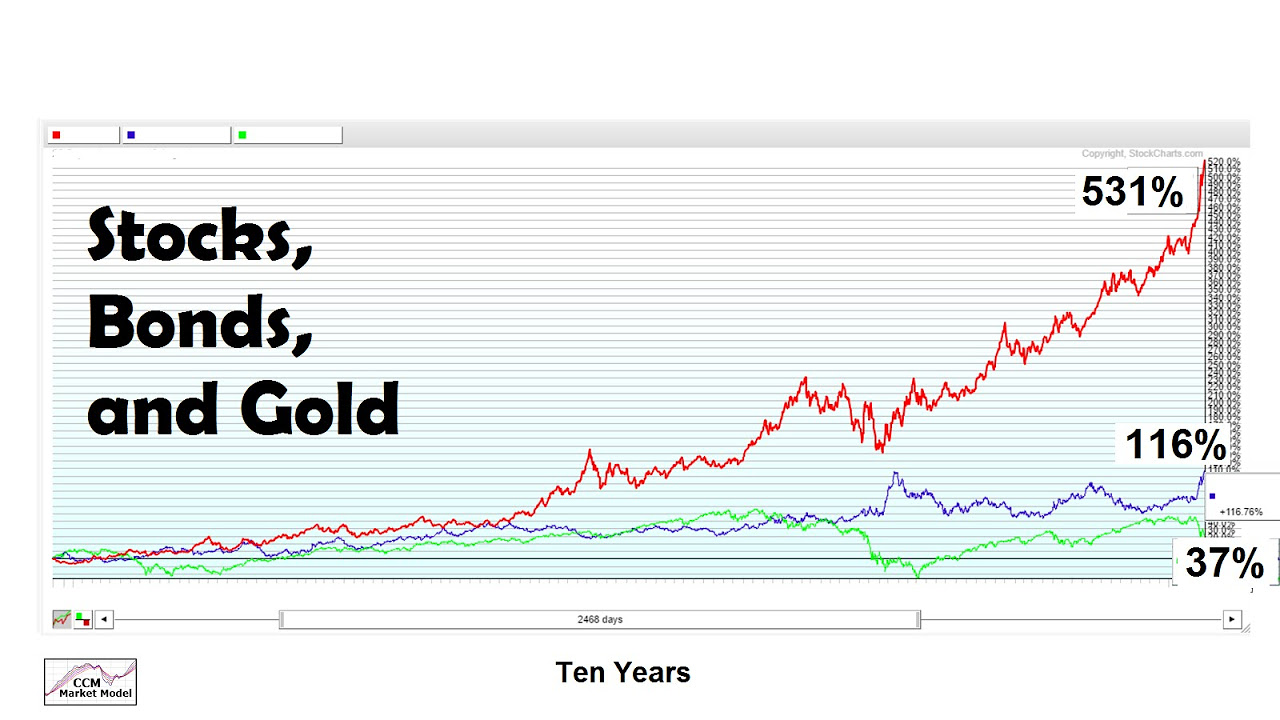

Gold Can Add Value To A Stock/Bond Portfolio

Kelompok 2 ST13 | Presentasi Project Statistika STA-1111

Could this company predict the next terror attack?

احذ رفخ الانهيار القادم للذهب ! الدولار ينهار تخلص منه فورا ،شراء الذهب الان، الذهب هينخفض لكام؟

XRP - HOLY SH*T, IT’S OFFICIALLY OVER IN 24 HOURS! (HOW TO RETIRE ON XRP IN 2025?!)

Meta Was Fined a Record-Breaking $1.3 Billion by E.U. Regulators

5.0 / 5 (0 votes)