1722681018149453

Summary

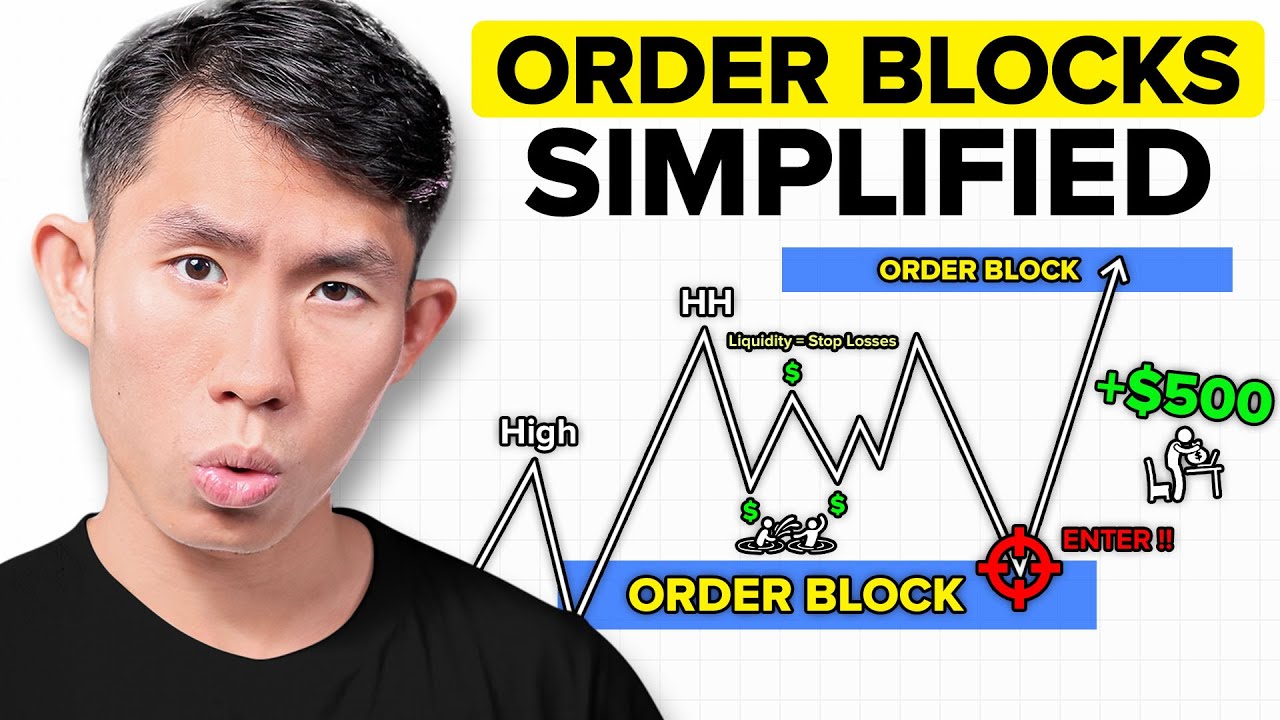

TLDRThis video script delves into the concept of order blocks in trading, explaining how bearish and bullish order blocks form and their significance in continuation trades. It discusses the importance of identifying these blocks after significant price movements and how to use them for entry points in the market. The script provides examples using daily and 15-minute charts, illustrating how to spot liquidation zones and react to price movements, aiming to guide traders in making informed decisions.

Takeaways

- 😀 The video discusses how to identify a bearish order block and bullish order block in trading.

- 📈 A bearish order block forms when the price hits a higher time frame pivot or resistance level and then closes with a last up close candle, indicating a potential continuation of the downtrend.

- 📉 Conversely, a bullish order block is validated when the price hits a lower time frame pivot or support area and closes with a last down close candle, suggesting a potential bullish momentum.

- 🔍 The script emphasizes the importance of using the last manipulation leg to determine entry points based on order blocks.

- 📊 The video provides examples of order block identification using daily and 15-minute time frame charts for better understanding.

- 💡 It explains that a high probability order block is formed when aligned with an important area, such as a pivot or resistance/support level.

- 📌 The concept of 'main thrust hold' or '50% hold' is introduced as a significant area where the price reacts after hitting the order block.

- 🚀 The video illustrates how to use the order block to plan entries and exits, including setting targets and stop losses.

- 🔄 The script mentions the use of continuation trades with order blocks, where the last touch candle before an up move or down move is crucial for entry.

- 🛑 It highlights the importance of proper risk management, such as keeping stop losses below the low of the last down close candles in a bearish order block.

- 🔎 The video concludes with a discussion on how to spot and utilize order blocks in continuation trades, emphasizing the need for the price to sweep through important areas or liquidity zones.

Q & A

What is the main topic of the video script?

-The main topic of the video script is about understanding how to identify and use order blocks in trading, including bearish order blocks and bullish order blocks, and their application in continuation trades.

What is a bearish order block?

-A bearish order block forms when the price hits a higher time frame pivot or resistance level and the last up close candle is a bearish closing. It is validated when the price retraces and closes above the last up close candle, indicating a potential continuation of the downtrend.

What is a bullish order block?

-A bullish order block is validated when the price hits a lower time frame pivot or support area and the last down close candle is a bullish closing with a displacement above the candle that took the area, indicating a potential bullish momentum.

What is the significance of marking order blocks after an important area in the script?

-Order blocks are marked after an important area because a high probability order block forms when aligned with such an area, increasing the chances of a successful trade.

How are order blocks used in continuation trades?

-In continuation trades, order blocks are used to identify potential entry points based on the last close candles and the reaction of the price to certain levels, which can indicate the direction of the trend.

What is a 'min thrust hold' or 'min thrash hold' in the context of the script?

-A 'min thrust hold' or 'min thrash hold' refers to an important area where the price reacts after hitting the level before an order block is formed. It is a key area to watch for potential trades.

How does the script describe the process of identifying entry points based on order blocks?

-The script describes identifying entry points by observing the price's reaction to certain levels after an area is tapped in, looking for liquidation and proper displacement to confirm the order block and plan entries accordingly.

What is the importance of observing the last close candles in the script?

-Observing the last close candles is important because they can indicate the strength of a trend and help in identifying whether the price is likely to continue in that direction or reverse.

How does the script suggest using the 50% area of a range in trading?

-The script suggests marking the 50% area of a range as a 'min thrust hold' or 'min thrash hold' when the last close candles are large or form a series of close candles, which is an important area for potential reactions and trades.

What is the strategy for using order blocks in continuation trades as described in the script?

-The strategy involves using the base of the curve and a side of the curve to identify the last ton close candles that work as the order block, looking for a valid order block formation, and then planning entries and keeping stops below the low to manage risk.

How does the script discuss the importance of liquidation in identifying order blocks?

-The script discusses the importance of liquidation as it can indicate a strong move in the market. A proper displacement with liquidation can validate an order block, confirming the potential for a continuation of the trend.

Outlines

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードMindmap

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードKeywords

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードHighlights

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードTranscripts

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレード5.0 / 5 (0 votes)