15 Assets That Are Making People Rich

Summary

TLDRThis video script from alux explores 15 assets that contribute to wealth accumulation, including cash reserves, real estate, bonds, stocks, and intellectual property like patents and trademarks. It emphasizes the importance of understanding assets versus liabilities and the potential of assets like equipment, brand goodwill, and unique rights to generate income. The script also introduces the concept of 'time money time arbitrage,' encouraging viewers to leverage their time to create opportunities for wealth growth.

Takeaways

- 💰 Assets are investments that generate income, while liabilities cost you money. The more assets you have, the wealthier you become.

- 🏦 Cash is still considered an asset, despite low bank interest rates, because it provides liquidity and opportunities for higher returns through peer-to-peer lending.

- 🏠 Real estate is a significant asset due to rental income and property appreciation, but a personal residence is a liability, not an asset.

- 📈 Stocks allow you to own a percentage of a business and can be a gateway to wealth, especially when investing in index funds like the S&P 500 for diversification and historical high returns.

- 📊 Bonds are a safe investment, typically backed by the government, offering a steady, though low, return compared to other investments.

- 🔧 Equipment is an asset if it directly helps in generating income or increasing efficiency in money-making processes.

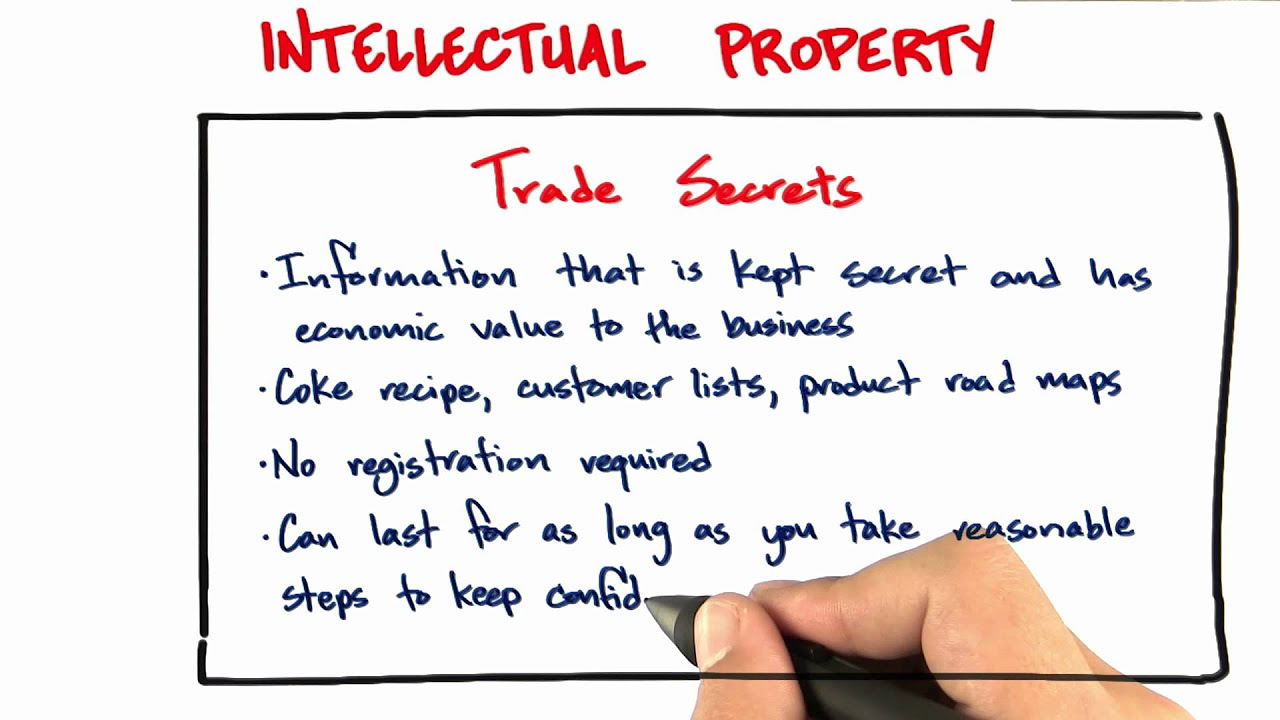

- 📄 Patents protect inventions and can be a significant source of income if others want to use your invention, making them a valuable business asset.

- ™ Trademarks protect brand identity and can be licensed for commercial use, generating income and contributing to a company's asset base.

- 🏷 Brand and Goodwill are intangible assets that represent a company's reputation and customer loyalty, which can significantly impact a company's value.

- 👥 People are assets to a company due to their ideas and contributions; their value increases with their irreplaceability and impact on the business.

- ⌛ Time is an asset that can be exchanged for money, and by using the money to buy others' time, you can scale your business and grow wealth exponentially.

Q & A

What is the fundamental rule of getting rich according to the video?

-The fundamental rule of getting rich is having more assets that put money in your pocket and fewer liabilities that cost you money.

Why is cash considered an asset even though bank interest rates may not keep up with inflation?

-Cash is still considered an asset because it provides liquidity, allowing individuals to access opportunities as they arise and potentially earn higher returns through peer-to-peer lending.

What are the two main reasons rich people keep a significant portion of their wealth in cash reserves?

-The two main reasons are to be able to access any opportunity that presents itself and to get higher returns from straight cash deals, such as peer-to-peer lending.

How does real estate generate income for its owners?

-Real estate generates income through rent payments from residential, office, and commercial buildings, as well as through land appreciation.

Why is the house you live in considered a liability and not an asset?

-The house you live in is considered a liability because it costs you money to maintain and live in it, rather than generating income for you.

What is a bond and how does it provide a return to investors?

-A bond is a financial instrument issued by governments or businesses to raise funds, promising to pay the bondholder a certain amount of money regularly until the bond's maturity date, at which point the principal is returned.

What is the average yearly return range for bonds?

-Bonds usually offer a 3% yearly return, which is better than most banks but not high enough to excite beginner investors.

How do stocks allow individuals to own a part of a business?

-Stocks represent ownership in a company, allowing individuals to buy a percentage of a publicly traded business by purchasing shares.

What is the main advantage of investing in mutual and index funds over individual stocks?

-The main advantage is diversification, which reduces risk. Index funds, in particular, provide exposure to a basket of companies, ensuring that you're invested in the overall market performance rather than relying on the performance of individual stocks.

Why are patents valuable assets in the business world?

-Patents are valuable because they protect an inventor's rights to their invention, allowing them to license it to others for use, which can generate significant income.

What is the significance of trademarks in business and how can they generate income?

-Trademarks protect symbols, words, or phrases associated with a brand, and owning a valuable trademark can allow for licensing it to others for commercial use, generating income in return.

How does brand and goodwill contribute to a business's value and success?

-Brand represents the company's image and what it stands for in the minds of consumers, while goodwill is the emotional connection people have with the brand. Both contribute to customer loyalty and can significantly impact a company's success.

Why are people considered valuable assets in a company?

-People are valuable assets because they generate ideas and innovation that drive a company's success. Key individuals can significantly impact a company's direction and performance.

What is the concept of time money time arbitrage and how can it be used to grow a business?

-Time money time arbitrage is the process of using time to generate money, then using that money to buy other people's time, thereby growing the business exponentially. It involves identifying opportunities to convert time into money and then leveraging that money to create more value by employing others.

Why is it important to invest in assets that you understand?

-Investing in assets you understand is crucial because it allows you to make informed decisions and manage risks effectively, avoiding potential losses due to lack of knowledge or misinformation.

How can information or content products like books, digital courses, and songs be considered assets?

-Information or content products are assets because they can be created once and then sold multiple times, providing scalable income with minimal additional effort after the initial creation.

What is the potential of royalties in generating income from intellectual property?

-Royalties can generate significant income by allowing creators to receive a portion of the earnings from the use of their intellectual property, such as books, music, or movies, in various formats and media.

Why is having a first-mover advantage or a proprietary business model considered valuable?

-A first-mover advantage or a proprietary business model is valuable because it provides a competitive edge in the market, allowing a company to capture market share and establish a strong presence before competitors catch up.

Outlines

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードMindmap

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードKeywords

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードHighlights

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードTranscripts

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレード関連動画をさらに表示

10 Assets That Are Making People RICH

“10 Things You MUST Sell Before 2026 (Or LOSE EVERYTHING)RAY DALIO

21 ASSETS that make you financially free | How to get rich hindi | 11 FREE ASSETS | SeeKen

8 Assets That Make People Rich and Never Work Again - Financial Freedom, Passive Income, Cash Flow

Intellectual Property Detailed - How to Build a Startup

Intellectual Property Law | Patents & Trademarks

5.0 / 5 (0 votes)