Banking’s AI Revolution: A Fireside Chat with BNY Mellon

Summary

TLDRThis video discusses the evolving landscape of AI in the financial sector, highlighting the shift from simple database queries to complex data ecosystems that integrate both structured and unstructured data. The focus is on optimizing data, ensuring security and access, and using AI responsibly to enhance market efficiency, resilience, and security. The conversation emphasizes the importance of data governance, the challenges of data access, and the role of AI in transforming financial markets. The speaker encourages engineers to solve these critical problems and drive AI innovation in real-world applications.

Takeaways

- 😀 Financial data has evolved significantly, from traditional databases to more complex systems like data meshes that link structured and unstructured data.

- 😀 Unstructured data, especially from documents like contracts, presents a significant opportunity to extract valuable insights for financial applications.

- 😀 The key challenge in data management is ensuring proper access control, privacy, and security as systems become more integrated.

- 😀 The hype cycle of AI in the financial sector has shifted from initial overestimations to a more nuanced understanding of its capabilities.

- 😀 AI and machine learning models are becoming standardized across industries, but the critical differentiator is how organizations manage their data.

- 😀 Optimizing data is as important as optimizing algorithms for efficient decision-making and business value generation.

- 😀 The financial sector is focused on making markets more efficient, secure, and resilient through AI-driven data solutions.

- 😀 AI’s potential in the financial sector lies in solving real-world problems related to data governance and integration rather than just algorithmic innovation.

- 😀 There’s a growing need for engineers and experts who want to work on impactful data challenges in the AI space, particularly in finance.

- 😀 The future of AI and data is about creating ecosystems where responsible data access and optimization lead to enhanced efficiency and innovation.

- 😀 Aspiring engineers are encouraged to consider opportunities at companies that are applying AI to create real value, particularly in sectors like finance, rather than just traditional tech giants.

Q & A

How has the financial data industry evolved over the past 20-25 years?

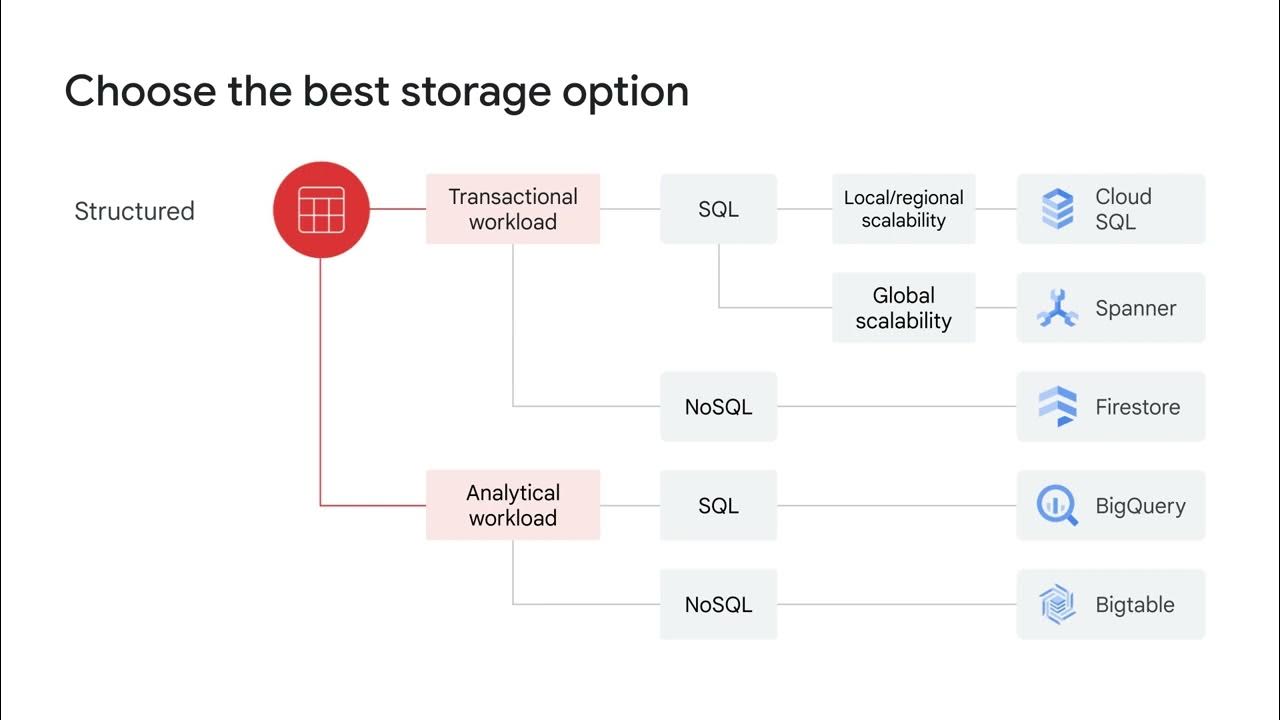

-The financial data industry started with simple databases and basic queries. Over time, it shifted towards data warehouses and business intelligence tools to standardize data. Now, the focus has moved towards a decentralized approach known as data mesh, but with a continued emphasis on structured data.

What role does unstructured data play in the financial industry, and how is it being integrated with structured data?

-Unstructured data, like contracts and legal documents, contains critical information. The challenge is to extract meaningful elements from this unstructured data and link it with structured data. This integration is seen as a significant opportunity for advancing financial data processing.

What is the data mesh concept, and how does it impact financial data management?

-Data mesh is a decentralized approach to data management where data is not strictly standardized or centralized. It allows data to remain in its original source system, while still being accessible and usable. The financial industry is looking to connect unstructured data with the structured data mesh to enhance the overall ecosystem.

What are the key challenges related to data access in AI and finance, and how are these being addressed?

-The primary challenges with data access are ensuring privacy, security, and the correct governance of sensitive financial data. The approach being taken is incremental, focusing on developing robust systems that ensure secure and responsible access to data.

How has the AI and machine learning landscape changed in terms of model standardization across industries?

-AI and machine learning models have become more standardized across various industries, which was once considered unlikely. Now, many sectors are using similar algorithms and model architectures, which streamlines development and reduces the need for highly specialized models for each vertical.

Why is optimizing data considered as important as optimizing algorithms in AI development?

-Optimizing data is crucial because AI systems are only as good as the data they are trained on. The quality, accessibility, and optimization of data play a central role in the effectiveness of AI models, often making data optimization just as important as optimizing the algorithms themselves.

What is the future of AI in the financial industry, according to the speaker?

-The future of AI in the financial industry is focused on making markets more efficient, safe, resilient, and secure. The speaker believes that AI will continue to play a transformative role, particularly in enhancing the effectiveness of financial institutions like Bank of New York Mellon.

What is meant by 'fall in love with your data,' and why is it emphasized?

-The phrase 'fall in love with your data' refers to the importance of deeply understanding and appreciating the role that data plays in AI development. It's emphasized because the real power of AI comes from how well the data is managed, optimized, and applied, not just from the algorithms themselves.

What advice does the speaker give to students and engineers looking to make an impact in AI?

-The speaker advises students and engineers to look beyond traditional tech companies like Google and instead explore opportunities in industries where AI is having a direct, transformative impact. This includes companies like Bank of New York Mellon, where AI is driving real-world value and efficiency.

How does the speaker view the current state of AI in terms of model development and infrastructure?

-The speaker views the current state of AI as one of standardization, where many industries are using the same models and architectures. While infrastructure and algorithms continue to evolve, the real challenge lies in the optimization and management of data to fully leverage these tools.

Outlines

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードMindmap

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードKeywords

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードHighlights

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードTranscripts

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレード関連動画をさらに表示

2. What is data? Different types of data? Structured | Semi-structured | Unstructured data

Structured and unstructured data storage

SQL vs NoSQL in 2024 Make the Right Choice (Difference Explained)

What Is GenAI? | Intel

January 16, 2025

Pengantar Data Mining - #1 Intuisi Kenapa Harus Menggunakan Data Mining

5.0 / 5 (0 votes)