08.12. Aula de Ativos biológicos e produtos agrícolas (Contabilidade Geral)

Summary

TLDRThis lecture on CPC 29, presented by Professor Ricardo Reis, focuses on accounting for biological assets and agricultural products. It covers essential definitions, such as biological assets (living animals or plants) and agricultural products, while emphasizing key topics like the recognition of fair value, measurement rules, and the differentiation between temporary and permanent crops. The lecture highlights the specific treatment of biological assets in agricultural settings, providing examples of how certain items should be classified and valued. The professor also explains practical applications of CPC 29 in accounting and how it differs from traditional commercial accounting practices.

Takeaways

- 😀 CPC 29 focuses on accounting for biological assets and agricultural products, especially in rural accounting, which differs from commercial accounting.

- 😀 The primary objective of CPC 29 is to establish accounting treatments and disclosures related to biological assets and agricultural products.

- 😀 Agricultural activity involves managing the transformation of biological assets into agricultural products for sale or conversion into additional biological assets.

- 😀 Biological assets must be living animals or plants to be classified as such under CPC 29, with 'living' being a key distinction.

- 😀 The CPC 29 applies to biological assets, agricultural products, and government grants, but plants that are used for more than one production cycle are excluded and treated under CPC 27.

- 😀 Plants considered 'biological assets' are those that produce goods, like fruit-bearing trees, whereas plants like bamboo and sugarcane are examples of 'bearing' plants under CPC 27.

- 😀 Temporary crops are those that need replanting after each harvest, like corn or soybeans, while permanent crops last for many years, like coffee or fruit trees.

- 😀 For accounting, temporary crops are classified as inventory under CPC 16, while permanent crops are classified as fixed assets under CPC 27.

- 😀 Biological assets and agricultural products are generally recognized at fair value, with any variations in fair value reflected directly in the income statement.

- 😀 If fair value cannot be measured reliably, biological assets are measured at cost minus depreciation and impairment losses until fair value becomes available.

Q & A

What is the primary objective of CPC 29?

-The primary objective of CPC 29 is to establish the accounting treatment and disclosures related to biological assets and agricultural products, focusing on the management, transformation, and harvesting of biological assets into agricultural products.

What does 'biological asset' refer to under CPC 29?

-A biological asset refers to any living animal or plant. The key factor in this definition is that the asset must be alive, as only living animals or plants qualify as biological assets under CPC 29.

What is the meaning of 'agricultural product' in CPC 29?

-An agricultural product is the harvested output of biological assets, such as fruits, vegetables, or livestock that are harvested for sale, further processing, or transformation into other products.

What is a biological asset 'additional'?

-A biological asset 'additional' refers to an asset that generates additional biological assets. For example, a livestock operation where cattle produce offspring, which in turn become new biological assets.

How is the end of the fiscal year defined under CPC 29?

-The end of the fiscal year for agricultural entities is defined as the point after the harvest. Once the harvest is complete, the fiscal year ends and accounting entries are made accordingly.

What is the difference between a biological asset and a bearer plant under CPC 29?

-A bearer plant is a plant that is used in the production or supply of agricultural products, typically cultivated for producing fruits over multiple periods. Examples include fruit trees like oranges or mangoes. These are not classified as biological assets under CPC 29 but are covered under CPC 27 (property, plant, and equipment).

Can you provide examples of bearer plants?

-Examples of bearer plants include bamboo, sugarcane, and fruit-bearing trees such as orange, lemon, and passion fruit trees.

What is the correct treatment for annual crops like corn and wheat?

-Annual crops such as corn and wheat are classified as agricultural products rather than biological assets under CPC 29. These are considered temporary crops and are harvested and sold within the same year.

What accounting treatment is applied to temporary and permanent crops under CPC 29?

-Temporary crops, such as annual crops, are classified as inventory (CPC 16) and are recognized as current assets. Permanent crops, like coffee trees, are classified as fixed assets (CPC 27) because they have a longer life cycle and produce crops over multiple years.

What is the primary method of valuing biological assets under CPC 29?

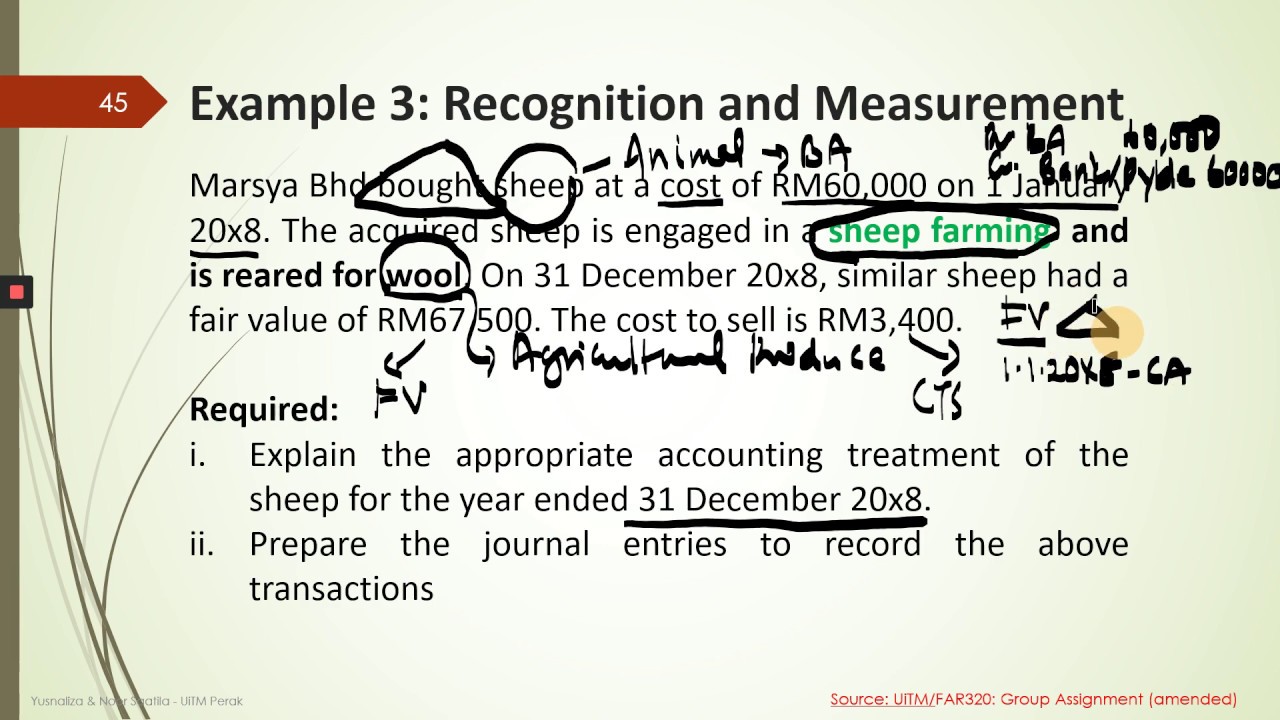

-Biological assets are recognized at fair value, less the costs to sell. If fair value cannot be reliably measured, the biological asset is recognized at cost less any depreciation and impairment losses.

Outlines

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードMindmap

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードKeywords

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードHighlights

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードTranscripts

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレード関連動画をさらに表示

LECTURE 1/4 : MFRS 141/ IAS 41 AGRICULTURE (BIOLOGICAL ASSETS) : FAR320 TOPIC 2 - PART 1

LECTURE 4/4 : MFRS 141/ IAS 41 AGRICULTURE (BIOLOGICAL ASSETS) : FAR320 TOPIC 2-PART 4

Procedimentos Contábeis Básicos

IAS 41 Agriculture summary - applies in 2024

01.09. Aula de Atos e Fatos Contábeis (Contabilidade Geral)

Bioquímica - Aula 05 - Enzimas

5.0 / 5 (0 votes)