IND AS 113 (ENGLISH) FAIR VALUE MEASUREMENT | FR SHIELD REVISION MAY / NOV 23

Summary

TLDRThis video explains the core principles of fair value measurement under Ind AS 113, focusing on key aspects like the exit price, market participant perspective, appropriate market, orderly transactions, and the measurement date. It discusses how fair value is determined through various levels of inputs (Level 1, Level 2, and Level 3), with a strong emphasis on observable vs. unobservable data. The video also highlights the calculation of fair value in markets with no principal market and the role of transportation and transaction costs in determining fair value. Practical examples and valuation techniques, including the market, income, and cost approaches, are provided.

Takeaways

- 😀 Fair value measurement in Ind AS 113 is critical and is based on the price received if selling an asset or transferring a liability, known as the exit price.

- 😀 The fair value is market participant specific, meaning the price used is based on what a typical market participant would pay, not the entity's specific needs.

- 😀 The 'appropriate market' for fair value determination is the one where the asset is most actively traded; this can be the principal market or, if none exists, the most advantageous market.

- 😀 The principal market is the one where the highest volume of trading occurs, such as in the case of publicly listed shares on different stock exchanges.

- 😀 If there is no clear principal market, the most advantageous market is chosen, where the highest net proceeds (after considering transportation and transaction costs) can be obtained.

- 😀 Fair value is determined on the measurement date and is not an average price over a period. It must reflect an orderly transaction, not one between related parties or under distress.

- 😀 Transportation costs must be deducted from the available price when calculating fair value, but transaction costs are generally not subtracted unless specified by another standard.

- 😀 The fair value of non-financial assets, like land, should consider the highest and best use from a market participant's perspective, even if the entity has a different intended use.

- 😀 When determining fair value, observable inputs are prioritized over unobservable inputs. Observable inputs come from active markets and are independent of the entity, while unobservable inputs require estimation or forecasts.

- 😀 Ind AS 113 uses a fair value hierarchy, classifying inputs into three levels: Level 1 (identical assets in an active market), Level 2 (similar assets with adjustments), and Level 3 (unobservable inputs like financial forecasts).

- 😀 The golden rule of valuation is to maximize observable inputs and minimize unobservable inputs. If possible, prices from active markets should be used for valuation to ensure objectivity and accuracy.

Q & A

What is the core concept behind IND AS 113 Fair Value Measurement?

-IND AS 113 provides guidance on determining fair value, focusing on what price should be used for measurement. Fair value is defined as the exit price—the price at which an asset would be sold or a liability transferred in an orderly transaction between market participants.

How does fair value differ from entry price?

-Fair value is the price you would get if selling an asset, also known as the exit price, while the entry price is the price you pay when purchasing an asset, often including additional costs like making charges for items such as gold.

What does 'market participant' mean in the context of fair value measurement?

-A market participant refers to any potential buyer or seller who is independent of the entity in question. Fair value measurement is based on how such a participant would value the asset or liability, not based on the entity's specific intentions or circumstances.

What is the difference between the 'principal market' and the 'most advantageous market'?

-The principal market is the market with the highest trading volume, where you would typically sell the asset. If no principal market exists, the most advantageous market is the one where you can obtain the highest net proceeds after considering transportation and transaction costs.

Why is it important to consider 'orderly transactions' when determining fair value?

-An orderly transaction refers to a transaction between independent parties under normal market conditions, without distress or related-party influence. This ensures that the fair value reflects a realistic, market-driven price.

What are the key principles to remember when determining fair value?

-The five key principles are: fair value is an exit price, market-participant specific, determined in the most appropriate market, assessed in an orderly transaction, and measured at the specific date of valuation.

How are transportation and transaction costs treated in fair value measurement?

-When calculating fair value, transportation costs are deducted from the available price, but transaction costs are not unless specifically stated in another standard (e.g., IND AS 41 or 109). Transaction costs are only subtracted if the standard explicitly requires it.

How does IND AS 113 guide the measurement of non-financial assets?

-For non-financial assets like land, IND AS 113 recommends considering the highest and best use from the perspective of a market participant, regardless of the entity’s intended use. This may involve considering alternative uses if they are more valuable in the market.

What is the golden rule of valuation under IND AS 113?

-The golden rule is to select a valuation technique that maximizes the use of observable inputs (e.g., market prices) and minimizes the use of unobservable inputs (e.g., forecasts or subjective assumptions).

What is the difference between Level 1, Level 2, and Level 3 inputs in the fair value hierarchy?

-Level 1 inputs are quoted prices for identical assets in active markets. Level 2 inputs are prices for similar assets or liabilities, with some adjustments. Level 3 inputs are unobservable and are based on entity-specific assumptions or forecasts, such as present value calculations for future cash flows.

Outlines

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードMindmap

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードKeywords

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードHighlights

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードTranscripts

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレード関連動画をさらに表示

Master these 3 Concepts and you will be Profitable

ICT Mentorship Core Content - Month 1 - Fair Valuation

VídeoAula EaD Premium -Teorias Gerais Da Contabilidade - Trilha 8

Episode 9: Identifying Institutional Order Flow - ICT Concepts

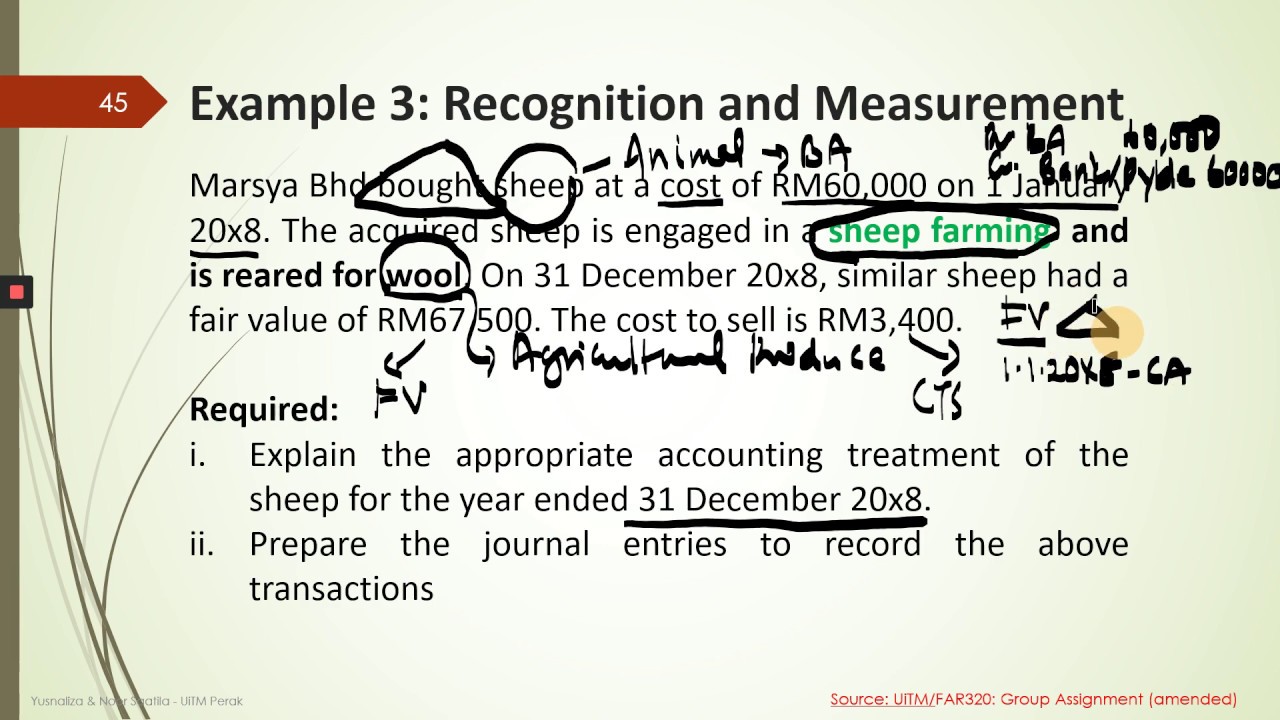

LECTURE 4/4 : MFRS 141/ IAS 41 AGRICULTURE (BIOLOGICAL ASSETS) : FAR320 TOPIC 2-PART 4

IND AS 38 INTANGIBLE ASSETS | CA FINAL REVISION LECTURE | FR & AFM BY BHAVIK CHOKSHI

5.0 / 5 (0 votes)