MGT201 Short lectures || MGT2021 GUESS PAPER || Mgt201 new syllabus short lectures | Mgt201 lectures

Summary

TLDRThis transcript discusses various aspects of bond valuation, focusing on how interest rates, coupon payments, and market conditions impact bond prices. It explains key financial concepts such as perpetual bonds, the relationship between coupon rates and bond value, and the calculation of intrinsic versus market value. The discussion also includes the importance of discount rates and dividend growth in financial calculations. Additionally, it highlights the priority of payments in case of a company's default, where bondholders are paid before stockholders. The script offers practical insights for understanding and calculating bond values in different scenarios.

Takeaways

- 😀 The formula to calculate interest for a bond involves multiplying the bond's par value by the interest rate.

- 😀 Perpetual bonds have unlimited life, and their present value is calculated using a specific formula involving the coupon rate and discount rate.

- 😀 When a bond matures, its intrinsic value is derived by considering its principal and coupon payments over time.

- 😀 Bonds are often issued at a discount, meaning they are sold for less than their face value, and the present value reflects this discount.

- 😀 Market value and intrinsic value of bonds can differ depending on the discount rate, interest rates, and maturity period.

- 😀 In case of company defaults, bondholders are paid first before preferred and common stockholders.

- 😀 Regular interest payments (coupons) are typically based on the par value and the set interest rate.

- 😀 The calculation of the present value of a bond is influenced by the required rate of return and the discount rate applied.

- 😀 The dividend discount model can be used to calculate the value of a stock or bond by applying the formula: D1 / (1 + growth rate) ^ years.

- 😀 In the context of dividend payments, the valuation can be adjusted based on the expected growth of dividends over a specific period.

Q & A

What is the formula used to calculate interest on bonds?

-The interest on bonds is calculated by multiplying the bond's face value by the interest rate (coupon rate). The formula is: Interest = Face Value * Interest Rate.

What is a perpetual bond and how is its present value calculated?

-A perpetual bond is a type of bond that has no maturity date and pays interest indefinitely. Its present value is calculated using the formula: Present Value = Coupon Payment / Discount Rate, where the discount rate is the required rate of return.

What is the intrinsic value of a bond?

-The intrinsic value of a bond is its present value, which is the discounted value of future cash flows (coupon payments and principal repayment) using the appropriate discount rate.

What does the term 'discount rate' refer to in bond valuation?

-The discount rate is the rate of return required by an investor to invest in a bond, considering its risk and the time value of money. It is used to discount future cash flows to their present value.

What happens to bondholders in case of a company defaulting?

-In the event of a company's default, bondholders are prioritized for payment over preferred and common stockholders. Bondholders receive payments before any dividends or profit distributions are made to stockholders.

How are dividend payments related to stock valuation?

-Dividends are a key factor in stock valuation, especially for dividend-paying stocks. The present value of a stock is calculated by discounting the future dividends at the required rate of return.

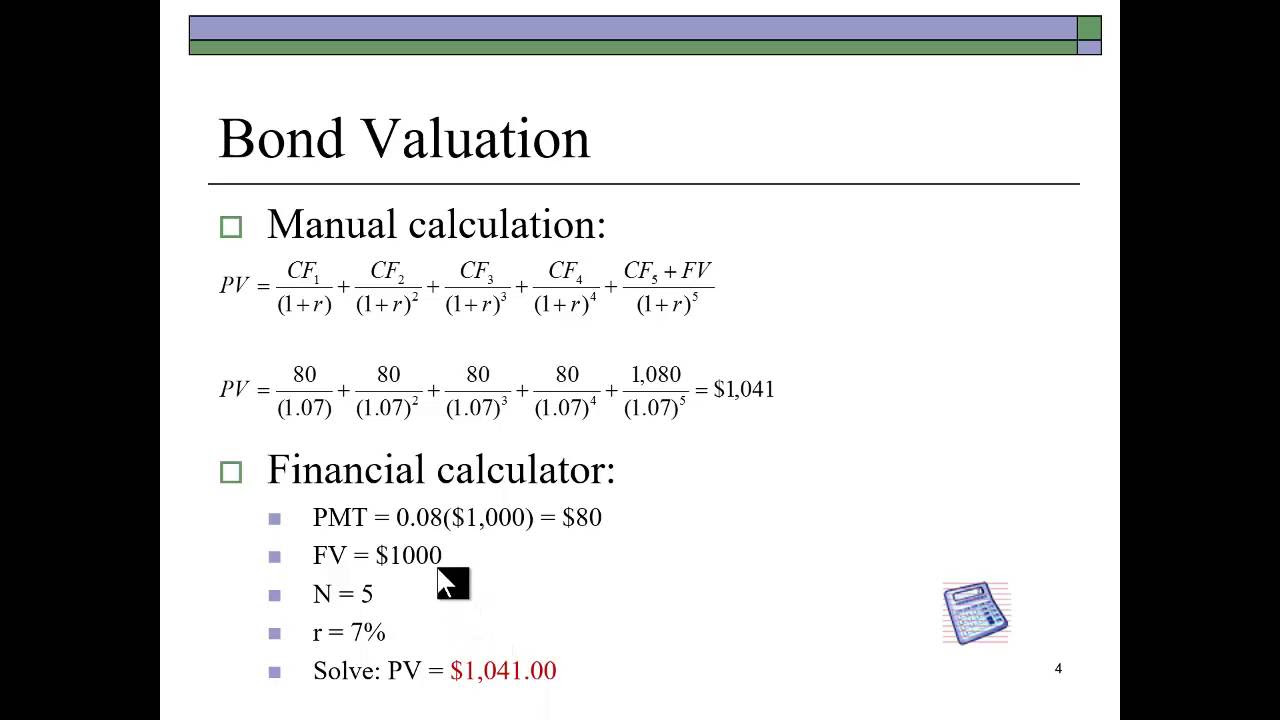

How is the present value of a bond calculated?

-The present value of a bond is calculated by discounting its future cash flows (coupon payments and principal repayment) at the discount rate. The formula is: Present Value = Coupon Payment / (1 + Discount Rate)^n + Face Value / (1 + Discount Rate)^n.

What is the significance of a bond's face value?

-The face value of a bond is the amount that will be repaid to the bondholder at maturity. It is also used to calculate the coupon payments, which are typically a fixed percentage of the face value.

What is the difference between market value and intrinsic value of a bond?

-Market value is the current price at which a bond can be bought or sold in the market, while intrinsic value is the bond's calculated present value based on its future cash flows and discount rate.

How does growth rate impact the calculation of stock value?

-The growth rate impacts stock value by influencing the expected future dividends. A higher growth rate leads to higher future dividends, which increases the stock's present value. The formula for calculating the stock value with growth is: Stock Value = Dividend / (Discount Rate - Growth Rate).

Outlines

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードMindmap

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードKeywords

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードHighlights

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレードTranscripts

このセクションは有料ユーザー限定です。 アクセスするには、アップグレードをお願いします。

今すぐアップグレード5.0 / 5 (0 votes)